- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- What box do I check on "Tell Us About Your Farm or Farm Rental" if the income I have is from the CREP program?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What box do I check on "Tell Us About Your Farm or Farm Rental" if the income I have is from the CREP program?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What box do I check on "Tell Us About Your Farm or Farm Rental" if the income I have is from the CREP program?

Do you mean CRP (Conservation Reserve Program) from the Department of Agriculture? If so, you would check the box "I have income from operating a farm". CRP payments are reported on schedule F. Please note; Your 1099-G is entered on schedule F but you must also review the Ag Program interview to determine the taxable amount and whether self employment (SE) tax applies.

This is from IRS publication 225, page 11;

Conservation Reserve Program (CRP)

Under the Conservation Reserve Program (CRP), if you own or operate highly erodible or other specified cropland, you may enter into a longterm contract with the USDA, agreeing to convert to a less intensive use of that cropland. You must include the annual rental payments and any onetime incentive payment you receive under the program on Schedule F, lines 4a and 4b. Costshare payments you receive may qualify for the costsharing exclusion. See Cost-Sharing Exclusion (Improvements), later. CRP payments are reported to you on Form 1099G.

Individuals who are receiving Social Security retirement or disability benefits may exclude CRP payments when calculating self-employment tax. See the instructions for Schedule SE (Form 1040).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What box do I check on "Tell Us About Your Farm or Farm Rental" if the income I have is from the CREP program?

Do you mean CRP (Conservation Reserve Program) from the Department of Agriculture? If so, you would check the box "I have income from operating a farm". CRP payments are reported on schedule F. Please note; Your 1099-G is entered on schedule F but you must also review the Ag Program interview to determine the taxable amount and whether self employment (SE) tax applies.

This is from IRS publication 225, page 11;

Conservation Reserve Program (CRP)

Under the Conservation Reserve Program (CRP), if you own or operate highly erodible or other specified cropland, you may enter into a longterm contract with the USDA, agreeing to convert to a less intensive use of that cropland. You must include the annual rental payments and any onetime incentive payment you receive under the program on Schedule F, lines 4a and 4b. Costshare payments you receive may qualify for the costsharing exclusion. See Cost-Sharing Exclusion (Improvements), later. CRP payments are reported to you on Form 1099G.

Individuals who are receiving Social Security retirement or disability benefits may exclude CRP payments when calculating self-employment tax. See the instructions for Schedule SE (Form 1040).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What box do I check on "Tell Us About Your Farm or Farm Rental" if the income I have is from the CREP program?

My Problem is when filling out 1099 Income section the program asks to enter 1099-G income in that section.

However, I also enter it in Business Income section .? So I get tax 2X for same income?

The program will not let me delete this either?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What box do I check on "Tell Us About Your Farm or Farm Rental" if the income I have is from the CREP program?

Are you actually operating the farm or are you renting it out?

- If you are running the farm as a business, the income and expenses go on Schedule F.

- If you are renting out your farm the income and expenses go on Schedule E or Form 4835, depending on whether you are receiving cash or part of the production as payment.

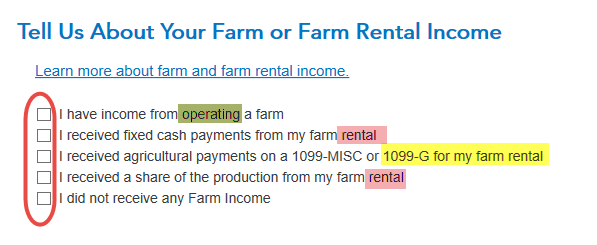

On the screen, Tell us about your Farm or Farm Rental, make sure you check the appropriate boxes, including the box for receiving a 1099-G. [See Screenshot below.]

Only enter the 1099-G in the Farm section of TurboTax. Do not enter it in the Wages & Income section.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Ninaya1

New Member

RCarlos

New Member

in Education

gavronm

New Member

jmallard

New Member

dcgelectriccorp

New Member