- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Are you actually operating the farm or are you renting it out?

- If you are running the farm as a business, the income and expenses go on Schedule F.

- If you are renting out your farm the income and expenses go on Schedule E or Form 4835, depending on whether you are receiving cash or part of the production as payment.

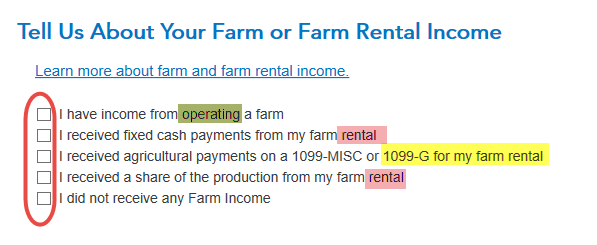

On the screen, Tell us about your Farm or Farm Rental, make sure you check the appropriate boxes, including the box for receiving a 1099-G. [See Screenshot below.]

Only enter the 1099-G in the Farm section of TurboTax. Do not enter it in the Wages & Income section.

March 4, 2021

6:46 AM