- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- VA 529 Plan Carryover

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

VA 529 Plan Carryover

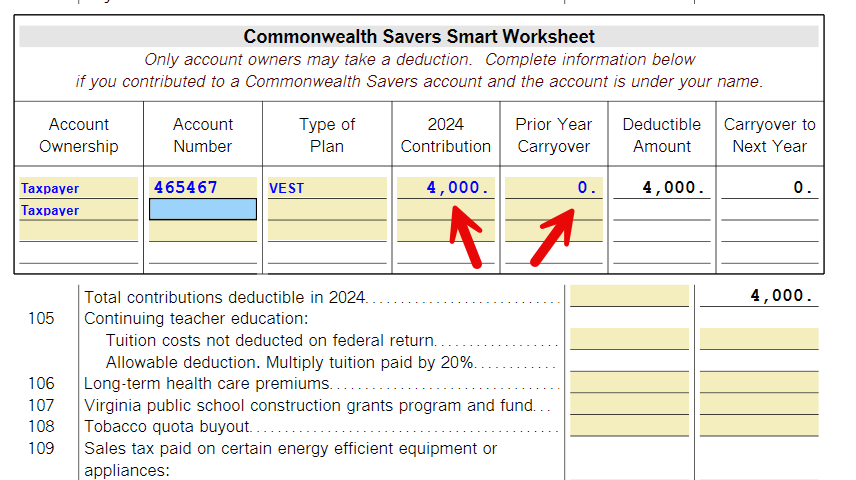

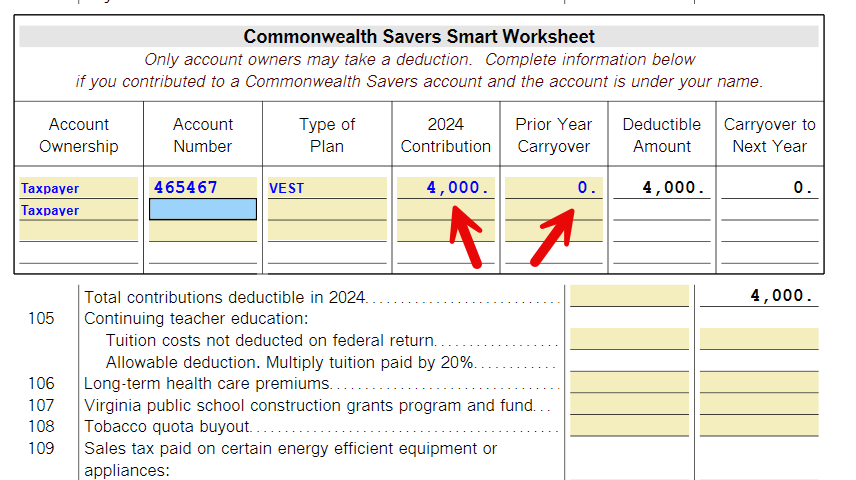

The TurboTax VA State FY24 tax is stating that I have to carry-over funds to next tax year. However, I have not met the $4000 limit on all the accounts listed. I have 6 accounts with contributions totaling $13k. The VA 529 Plan allows a deductible limit of $24k (6 accounts x $4k). Clearly, I have not met the limit, and TurboTax should not be carrying-over any funds.

Is there a bug/glitch in the software or am I missing something?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

VA 529 Plan Carryover

Your tax forms need to be correct. It is an odd number. I am sure you have reviewed your tax forms for a checked box or oddity that is out of place. The $4k is per account, it sounds like you know to add the many accounts. You may want to file an extension and /or contact support. I can't take a look at your return today or tomorrow but the phone lines can.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

VA 529 Plan Carryover

Something is wrong. A full or corrupted cache can cause problems in TurboTax, sometimes you need to clear your cache (that is, remove these temporary files).

Online version:

- Delete the contributions

- Log out of your return and try one or more of the following:

- Log back into your return.

- Enter the information again.

Desktop version:

- Delete the contributions

- Save your return while closing the program.

- Update the program

- Open

- Enter the information again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

VA 529 Plan Carryover

Your solution did not resolve the issue. A carry-over is still stated, and what's weird is it's only for $602. This must be a bug. My concern is if I file, will this be corrected with next year's software? This is unlikely.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

VA 529 Plan Carryover

Your tax forms need to be correct. It is an odd number. I am sure you have reviewed your tax forms for a checked box or oddity that is out of place. The $4k is per account, it sounds like you know to add the many accounts. You may want to file an extension and /or contact support. I can't take a look at your return today or tomorrow but the phone lines can.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

VA 529 Plan Carryover

Thanks, Amy. After reviewing the worksheet, I realized the contribution was over 4k, hence the carryover. My apologies; it was my error.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

blange7712

New Member

daryll-bohrer

New Member

in Education

jamdeuce

Level 1

Jana10

New Member

puggyman92

New Member