- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Usertesting.com Self-Employment and Income Taxes

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Usertesting.com Self-Employment and Income Taxes

@kpatino24 You would best report that income as self-employment income in TurboTax. When you go to enter the income, you will see an option to indicate that it was General Income

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Usertesting.com Self-Employment and Income Taxes

Hi ThomasM125,

The solution provided above did NOT work for me. I have "TurboTax Basic" and did NOT receive any 1099-NEC/MISC related to my "usertesting.com" payments.

Can you please advise me what should I do?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Usertesting.com Self-Employment and Income Taxes

If you are using the downloaded Basic program then in the Wages & Income tab choose the self employed section and skip the 1099 entry option ... just use the other income option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Usertesting.com Self-Employment and Income Taxes

Hi @Critter-3

Thanks for your response.

Sorry, it looks like I have the "Deluxe" version and there is no Self-Employment exists.

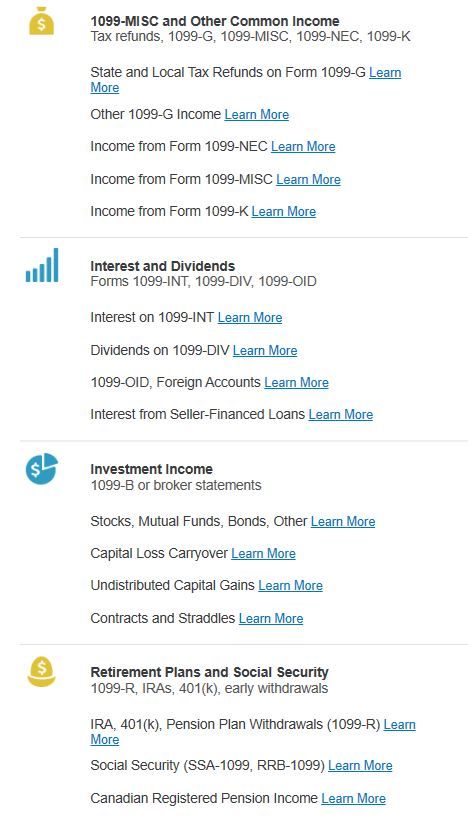

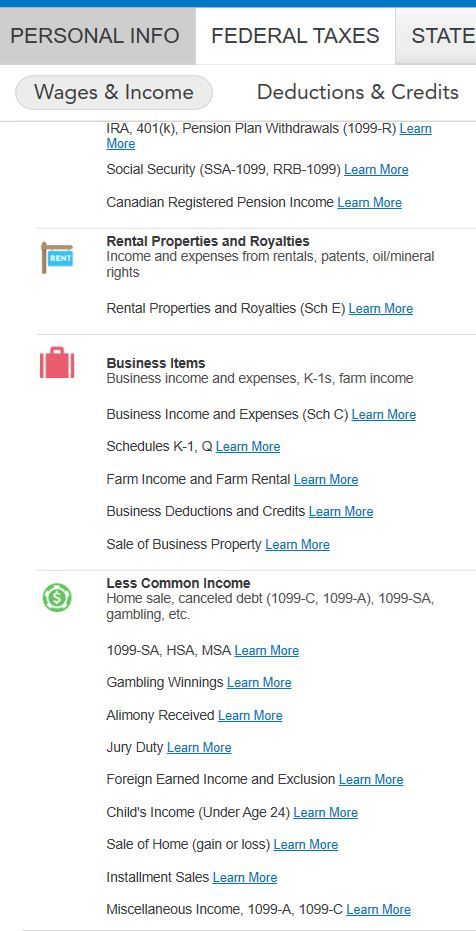

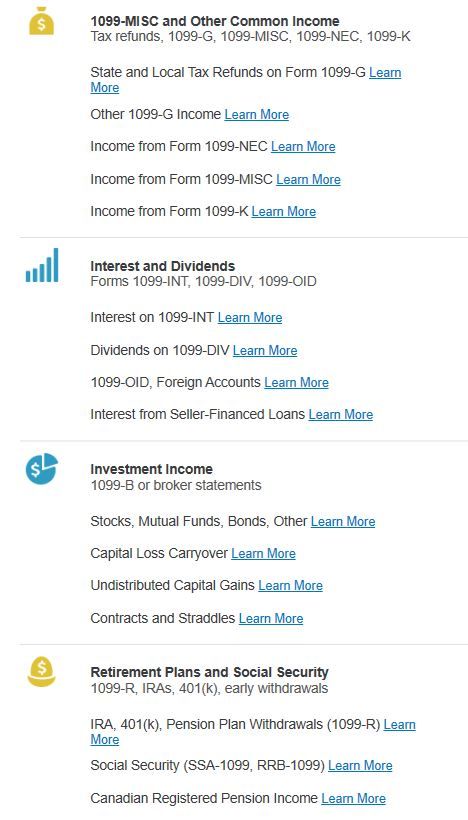

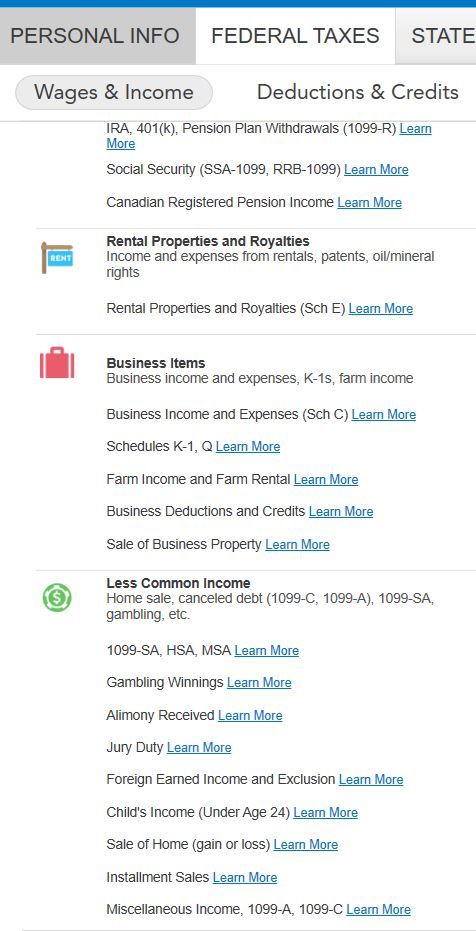

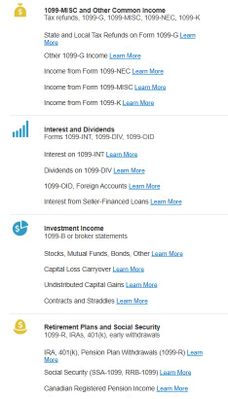

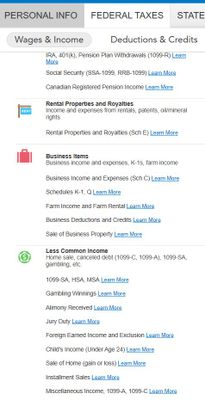

Please see the screenshots.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Usertesting.com Self-Employment and Income Taxes

Hi @Critter-3 ,

Thanks for your response.

Sorry, it looks like I have the "Deluxe" version and there is no "Self-Employment" exists.

Please see the below screenshots.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Usertesting.com Self-Employment and Income Taxes

Hi @Critter-3 ,

Thanks for your response.

Sorry, it looks like I have the "Deluxe" version and there is no "Self-Employment" exists.

I tried to upload/insert screenshots, but after posting it - the post disappears.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Usertesting.com Self-Employment and Income Taxes

Screenshots from my Deluxe version:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Usertesting.com Self-Employment and Income Taxes

If you are using TurboTax Deluxe Desktop (from a disc or download), you can enter self-employment income here:

- Open your return and select the Federal Taxes tab.

- Select Wages and Income on the second tier of tabs.

- Select I'll choose what I work on, on the right.

- Scroll down to Business Items near the bottom of the list.

- Find Business Income and Expenses (Sch C), click Start to the right.

- Answer the first question Yes.

- You will be asked to upgrade, but you can select Continue in TurboTax Deluxe.

- Enter your business income and any relevant expenses on the screens that follow.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Usertesting.com Self-Employment and Income Taxes

Hi @JulieS,

Thank you for your response.

I tried to use the "Schedule C" as well, but got confused.

Can you please help to understand the below? This is only related to "usertesting.com".

1. "Describe Your Business" => should I say "Freelancer"?

2. "Tell Us About Your Business" => Should I choose the below or just skip them?

2.1. "I use my name as the name of my business"

2.2. "My business address is the same as my home address"

3. "Enter Business Information":

3.1. Should I name the business as "usertesting.com" or what do you think?

3.2. What address should I use? "usertesting.com" HQ address?

4. "Do you have an Employer ID Number (EIN)" => I chose "NO".

5. "Which Accounting Method?" => I received to my Paypal account - what should I choose? Cash, Accrual or Other Method?

6. "Business Code" => I typed "999999".

7. "Did you play an Active Role in This Business?" => I chose "Yes" since it comes under " Perform all the work, even if you work fewer than 100 hours". Correct?

8. "Enter Business Income That's Not on a 1099-NEC or a 1099-MISC" - I typed the amount received from usertesting.com in the "Income and Sales" box only.

9. "Is this Qualified Business Income" => I chose "Yes". Correct?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Usertesting.com Self-Employment and Income Taxes

Description of business is asking what you do, so freelancer is fine.

For business name and address use your own name and address, you don't need to enter anything about specific about UserTesting.

EIN should be No.

Accounting method should be cash

999999 is fine for the business code.

Active role is Yes.

Questions 8 and 9 are fine as you answered them.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Usertesting.com Self-Employment and Income Taxes

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

april.supple

New Member

LynK

New Member

cramanitax

Level 3

stafford2019

Level 2

Sarmis

New Member