- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Use of TurboTax for 2019 as a resident on H1B Visa

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Use of TurboTax for 2019 as a resident on H1B Visa

Hello,

I came in Aug 2014 as F1-Student visa and worked on OPT till Sept30 2019. My H1B started on 1st Oct 2019. Now for Year 2014-2018 I filed 1040NR for the purpose of taxes using mail. For Year 2019 as I pass 5year in the USA, can I consider myself as resident alien and use TurboTax for the efiling?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Use of TurboTax for 2019 as a resident on H1B Visa

Yes, you should be able to file as a resident and use TurboTax since you met the Substantial Presence Test in 2019.

Please see Alien Residency Examples for additional information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Use of TurboTax for 2019 as a resident on H1B Visa

Thank you for the help. Now I have one more question. As I was on OPT from 1st Jan 2019- 30th Sept 2019, my employer was not deducting FICA (Social+Medicare) taxes. It started getting deducted from 1st Oct 2019. For tax purpose, I will be going for the Resident Alien and as it states, Resident alien suppose to pay FICA tax for complete year. In that case, I will owe Social and Medicare for Jan to Sept 2019???

I have gone though IRS site and got below information

"Also, the Internal Revenue Code provides one exemption from social security/Medicare taxes for foreign students and another exemption from social security/Medicare taxes for all students, American and foreign. This is the so-called "student FICA exemption", and it may operate to exempt a foreign student from social security/Medicare taxes even though the foreign student has already become a RESIDENT ALIEN. For employment which occurs after April 1, 2005, Revenue Procedure 2005-11 provides instructions for determining who is eligible for the "student FICA exemption"."

From the above, does it mean I am still exempt for the JAN-SEPT(F1-OPT) period even though I will file as Resident Alien?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Use of TurboTax for 2019 as a resident on H1B Visa

You will need to review the requirements for the Student Exception to FICA Tax to see if you qualify.

FICA (Social Security and Medicare) taxes do not apply to service performed by students employed by a school, college or university where the student is pursuing a course of study. Whether the organization is a school, college or university depends on the organization’s primary function. In addition, whether employees are students for this purpose requires examining the individual’s employment relationship with the employer to determine if employment or education is predominant in the relationship.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Use of TurboTax for 2019 as a resident on H1B Visa

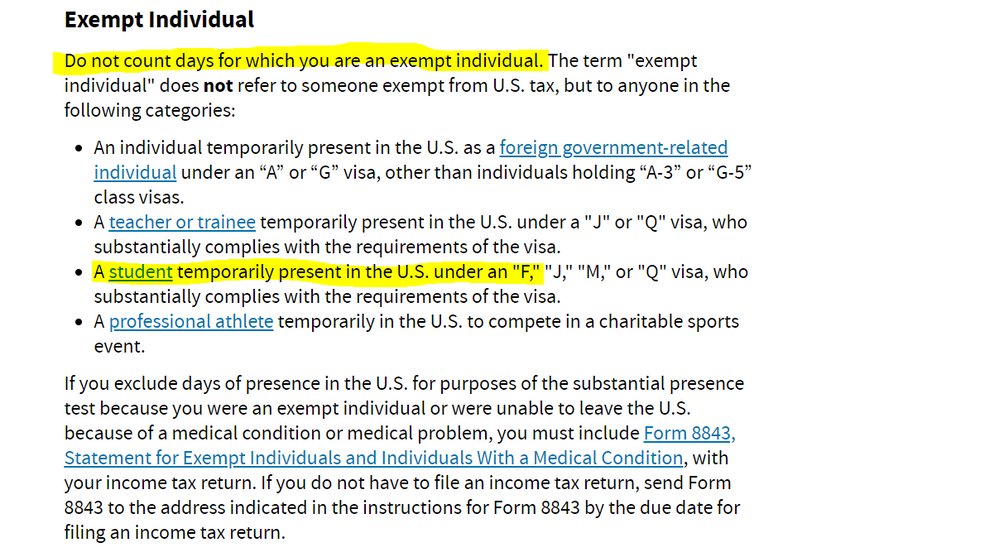

Per IRS, as shown in the image above the days in "F" visa cannot be counted, then how would one pass the substantial presence test? Reference

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Use of TurboTax for 2019 as a resident on H1B Visa

Because you came into the United States in 2014 on a F-1 Visa, you completed the five-year exempt period on 12/31/2018.

If you were present in the United States in 2019 for 183 days you are considered a resident alien for tax purposes. You are eligible to file a Form 1040 using TurboTax for your 2019 return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dc20222023

Level 3

ajm2281

Level 1

rodiy2k21

Returning Member

marcmwall

New Member

dpa500

Level 2