- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Upgrading to Live

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Upgrading to Live

hi,

So I've done almost everything on my taxes except one of my K-1's is really stressing me out. I asked a question and got an answer but I still don't understand what to do and I'm having a mini meltdown. I want to pay to upgrade to Live to just get through this one form but I have the download/CD version...is there any way to upgrade to Live with the download/CD version?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Upgrading to Live

No, TurboTax Live is available for TurboTax Online customers only. Use the Contact us page at this link to get connected with an expert for your specific question.

If you ask your question in Community, someone may be able to help you.

To start your K-1 entry, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to begin entry of the Schedule K-1 you received.

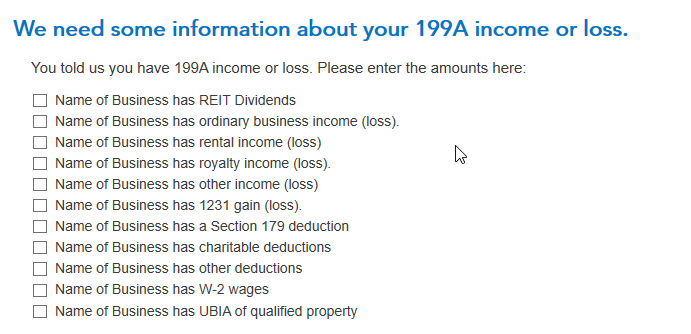

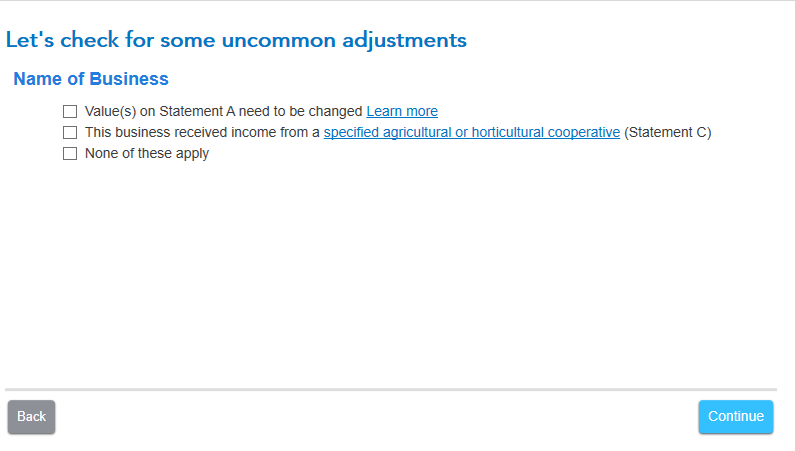

One of the common issues with a K-1 is Section 199A information being reported on a K-1. You'll need to put the 199A information that came with your K-1 into the categories shown in the "We need some information about your 199A income or loss" and "Let's check for some uncommon adjustments" screens (see two screenshots later in this post).

For a partnership Form 1065 Schedule K-1, the 199A QBI entry starts by entering code Z on the box 20 screen.

For an S-corp Form 1120S Schedule K-1, the 199A QBI entry starts by entering code V on the box 17 screen.

Form a trust Form 1041 Schedule K-1, the 199A QBI entry starts by entering code I (as in India) on the box 14 screen.

Enter the code Z or V or I when you enter the K-1 box 20 or 17 or 14 screen, but you don't need to enter an amount on that "box" screen. Continue on, and after two more screens asking about QBI, you'll find the two screens you need. When you check the box next to a category, a place will open up to enter your amounts. These screens (if applicable to the amount(s) on your statement) must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

Note that any Unadjusted Basis of Assets amount goes on the "....has UBIA of qualified property" line.

To get back to the K-1 summary screen and and enter your K-1 (or find a Schedule K-1 to edit), click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here are the "We need some information about your 199A income or loss" and "Let's check for some uncommon adjustments" screens where you enter the information from your K-1:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rodiy2k21

Returning Member

mboyd1298

New Member

rgrahovec55

New Member

user17538342114

Returning Member

TEAMBERA

New Member