- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS on ADR Dividends

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

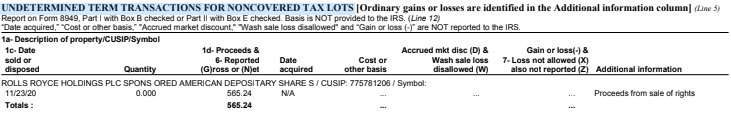

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS on ADR Dividends

Hello,

How do I report my listing on UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS as shown below?

I have determined that the listed item is actually a dividend I received.

My final Dividend was $550.74 after a "Sponsored ADR: Agency Processing Fee" of $14.5

TurboTax is saying that this is incorrect as there is no cost basis that is reported.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS on ADR Dividends

This is a dividend and there is no cost basis reported. On TurboTax enter zero for the cost basis.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS on ADR Dividends

This is a dividend and there is no cost basis reported. On TurboTax enter zero for the cost basis.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS on ADR Dividends

Hey did you figure this out!? I’m having the exact same issue with this RYCEY special dividend. Nobody can tell me how to report it correctly. one Turbo Tax agent who i spoke with just told me NOT to report it!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS on ADR Dividends

Hi Mary,

Are you absolutely sure? This was a special one time dividend. The stock price fell by the exact same amount as the dividend itself, so there was really no “profit” from receiving this income in any way. It feels wrong to be paying taxes on it as a regular dividend. Are you sure this is the correct way to report it? By stating zero cost basis?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS on ADR Dividends

I ended up reporting a $0 cost basis on this since it is a dividend and that was the best answer I could get. Mine was also because of the RYCEY special dividend. My return ended up being accepted federally as well as in NC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS on ADR Dividends

Thanks for the quick reply. That may be what i do as well. Although i noticed the box that i could check that states cost basis is either missing or incorrect. Just don’t want to pay too much in taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS on ADR Dividends

I found this article here: https://www.investmentnews.com/the-tax-implications-of-special-dividends-46982. It seems to address a similar situation. This is basically a return of capital. I’m worried that Turbo tax is going to be treating this as 100% short term profit and tax it at the higher rate.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

b_benson1

New Member

icefyre123

Returning Member

fuelnow

Level 2

DIY_HarryWhodini

Level 2

Semper0

Returning Member