- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Underpayment Penalty for Overpayment?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Underpayment Penalty for Overpayment?

I'm trying to determine if this is a mistake in TurboTax or just another weird tax law I don't understand. Hopefully this is the right place to ask.

Looking at my Form 2210 worksheet, there's a $5 penalty for a partial amount paid in September (considered late) when "first installment" showed a larger amount due in July that I didn't entirely pay. I paid most of it. But that installment was from my own self-chosen estimates when I did my tax return last year. I'm self-employed.

In September I paid a lot more than my estimated installment. Then in December (instead of January) also paid a high amount because my running calculations showed my estimates were too low. I didn't want underpayment penalty.

Now after doing my tax return for 2020, I had actually OVERpaid my estimates because, among other things, I decided to max out my retirement contribution. So I'm getting a refund (which I've elected to apply to next year). All seems good. I don't care if the US Treasury doesn't pay me interest on the extra money I give them.

But I'm still facing an underpayment penalty of $5 ?!?

Is this something just within TurboTax that's carried year over year?

If not, if it's some weird tax law, I might as well just pick super low estimates every year to avoid such penalties! Is this what everybody else is doing that newbie me is only now learning?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Underpayment Penalty for Overpayment?

I agree. Thanks. I didn't fully review the AI section before but did so just now. I simply don't qualify.

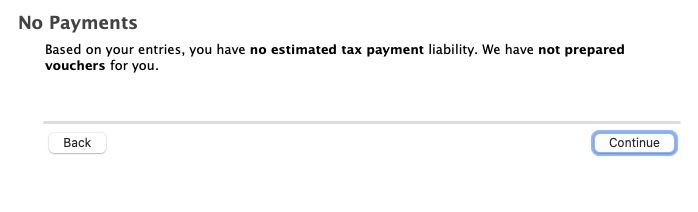

However, remember that I'm self-employed. And there's the Estimated Taxes worksheet for next year. I've now reviewed it without entering any value in any of the fields. It defaults to zero for the entire worksheet.

And thus, my estimated payments for next year is zero. Viola. No more underpayment penalty. What's wrong with doing this every year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Underpayment Penalty for Overpayment?

I can't be sure from your description, but it sounds like you ran afoul of the option in the 2210 to annualize your income to see if you can avoid an underpayment penalty.

As you can imagine, you can't wait until the 4th quarter to pay the 90% of your tax, because US taxes are a "pay-as-you-go" system.

Instead, the 2210 processing allows you to enter how much income you had per quarter and then it annualizes the income to see if you paid an appropriate amount of tax for the quarter, based on your income up to that point.

So it can happen that you have an estimated tax underpayment for one quarter even if you ended up paying more than the amount due by the end of the year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Underpayment Penalty for Overpayment?

OK, thanks. I'll look into how my business type can qualify for "annualize income" something or other. The TurboTax wording in EasyStep makes it seem I don't qualify. My profession/ industry/ type of service is not seasonal. It merely fluctuates like most small businesses do.

But bottom line for estimated tax is still the basic concept of estimated.

Why penalize somebody for undershooting their own guess!? Might as well guess lower and lower each year until it's impossible to undershoot!

Maybe I'm just super late in the tax game discovering this obvious silly solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Underpayment Penalty for Overpayment?

If your penalty is only $5, i would not advise trying to use the AI method to avoid it especially if you had taxable income in the first two quarters. anyone can use the AI method but then you have to use it for every quarter. which means you have to compute your income and tax liability for jan - mar, jan - may - jan - aug and then the whole year (the easy part because that's what's on the return). if you have a tax liability for the early quarters but didn't pay in your taxes until later quarters, you will not likely reduce your penalties. just so it's clear the AI method is not a pro-rata portion of the tax for the whole year but requires the computation of the actual tax liability for the period. you can have a higher tax liability under this method for the first 3 months than you do for the whole year.

the rules for avoiding penalties (i assuming you have no withholding - only pay estimated taxes and ignoring the AI method) ).

no penalty if

timely estimates equal 90% of the current year tax. which means 1/4 must be paid in by 4/15 and an additional 1/4 by each of the following dates 6/15, 9/15/ and 1/15 of the following year (the next business day if the payment date falls on a Saturday, Sunday, Federal holiday

or

timely estimates - same payment dates - equal 100% of the previous year's taxes (110% if the previous year's adjusted gross income over $150,000)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Underpayment Penalty for Overpayment?

I agree. Thanks. I didn't fully review the AI section before but did so just now. I simply don't qualify.

However, remember that I'm self-employed. And there's the Estimated Taxes worksheet for next year. I've now reviewed it without entering any value in any of the fields. It defaults to zero for the entire worksheet.

And thus, my estimated payments for next year is zero. Viola. No more underpayment penalty. What's wrong with doing this every year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Underpayment Penalty for Overpayment?

Hello All: I think I may be in the same boat here...a few days ago, I received a notice from the IRS stating that my 2020 form 1040 had been changed due to a "miscalculation on your 2020 form 1040, which affects the following area of your return: Recovery Rebate Credit. We changed your return to correct this error. As a result, you owe $9.74." In the "billing summary" section of the letter, it's clear that "payments you made" was $6.26 *more* than "tax you owed," yet I'm being assessed a $16 failure to pay proper estimated tax penalty. Less the $6.26 I *overpaid* and I now owe $9.74 (16 minus 6.26). Is this right? My total taxes paid was MORE than what I owed, but I'm still being penalized?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ma6878

Level 2

disilvios1

Level 1

ChacChan

Level 2

reand53

New Member

triolo2

New Member