- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- TurboTax will not allow me to enter a value on Schedule A, line G4

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

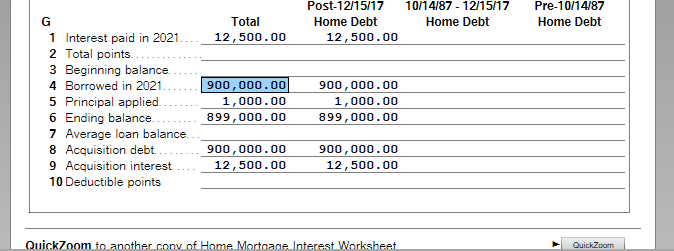

TurboTax will not allow me to enter a value on Schedule A, line G4

TurboTax is not allowing mew to enter a value in schedule A, line G 4 - the 'Borrowed in 2021' value os a HELOC.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax will not allow me to enter a value on Schedule A, line G4

Schedule A does not have a line G4 but does report deductible mortgage interest.

Interest paid on a HELOC loan may or may not be deductible depending on what was done with the funds.

If the funds were redirected to the home, such as used to remodel or otherwise improve the original home, the interest is deductible.

If the funds were used for any purpose not related to increasing the value of the property, the interest may not be deducted and is not added to Schedule A.

This was a tax change enacted in 2017.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax will not allow me to enter a value on Schedule A, line G4

Its schedule A worksheet. I understand what's deductible for home mortgage & HELOC and what is not.

I believe this is a Turbotax software flaw that needs to be fixed immediately. The software tags this non entry as an error and will not allow me to submit my taxes electronically without it, however the software will not allow me to enter the value.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax will not allow me to enter a value on Schedule A, line G4

For HELOCs, after entering Form 1098:

- Answer No to Is this the original loan

- Answer Yes to Is this loan a HELOC or a refinance?

- Answer Yes to Did you take cash out?

Answering in this manner will populate the home mortgage interest worksheet correctly. For HELOCs, you must answer in that manner, even if all the money you took out was used to substantially improve the home. If that is the case, you may answer the next question Have you used the money from this loan exclusively on this home? with Yes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax will not allow me to enter a value on Schedule A, line G4

I do see them in the step-by step, where I already have answered these question exactly as you indicated, except for the "Have you used the money from this loan exclusively on this home? with Yes. " The answer is here is no for us.

I still have the same results, where the federal review shows result "Home mortgage interest worksheet (CU name): Amount borrowed this year must be entered."

I realize that because I am not claiming a deduction, this year, for this 1098, I can delete the 1098 information. However, I think your software should be able to handle and store this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax will not allow me to enter a value on Schedule A, line G4

I followed all the directions and it still won't let me enter the amount NOR submit my taxes !!!!!!!!!!!!!!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax will not allow me to enter a value on Schedule A, line G4

If you are referring to the Home Mortgage Interest Worksheet, Line G4, Borrowed in 2021, the amount is entered in the 1098 interview questions.

Type '1098' in the Search area, then click on 'Jump to 1098' to get back to this section.

Edit the entry you need to enter a 2021 amount for. If the 'Mortgage Origination' or 'Mortgage Acquisition' dates are in 2021, the Outstanding Mortgage Principal amount in Box 2 of your 1098 will show on Line G4 as 'Borrowed in 2021'.

If this doesn't resolve your issue, please provide clarification and we'll try to help.

@AndyHollinger1

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

techonecommunication

New Member

ekudamlev

New Member

swaairforce

New Member

swaairforce

New Member

alex_garzab

New Member