- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- turbotax is not taking my dependent SSN as it takes as ITIN

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

turbotax is not taking my dependent SSN as it takes as ITIN

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

turbotax is not taking my dependent SSN as it takes as ITIN

Please clarify your question.

- Are you posting this in the My Info section of your return?

- Is it a 9 digit number?

- How is it being identified as a ITIN and not a SSN?

Please contact us again to provide some additional details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

turbotax is not taking my dependent SSN as it takes as ITIN

During the time of submission, its calculating $500 as child credit for all 3 my dependents( 2 are having ITIN and 1 is having SSN) saying as all of them having ITIN not SSN

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

turbotax is not taking my dependent SSN as it takes as ITIN

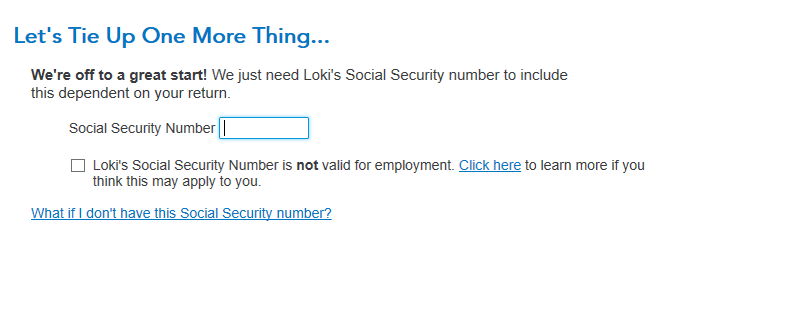

Did you put a checkmark in the box that says Social Security number NOT valid for employment? If you did put a check mark in that box, and their numbers are valid for employment, you can go back and remove the checkmark. You can do this by selecting edit in the personal info section next to their name.

If so, then the dependents would be not be eligible for the Child Tax Credit, just the Other Dependent Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Idealsol

New Member

anonymouse1

Level 5

in Education

anil

New Member

bgoodreau01

Returning Member

iqayyum68

New Member