- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- TurboTax Business K-1box 20

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business K-1box 20

I have received K-1s with an amount ib Box 20 for code Z. That code is missing in this years software. I only see a code ZZ. Is there a fix or work around?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business K-1box 20

Assuming you are entering Schedule K-1s from a business and are trying to entering them in your individual tax return, you will need to follow these steps. Code Z is available for selection in both the desktop and online versions of TurboTax.

To get to the input, please log back into your TurboTax program.

- Select the Personal Income tab and scroll down to Business Investment and Estate/Trust Income.

- Select start/update to the right of Schedule K-1.

- Select the start/update to the right of the applicable Schedule K-1 on the screen titled "tell us about your Schedules K-1."

- Select edit the right of applicable entity.

- Continue through the screens until you see the screen titled "Check boxes that has an amount or are checked on the form." Check box 20.

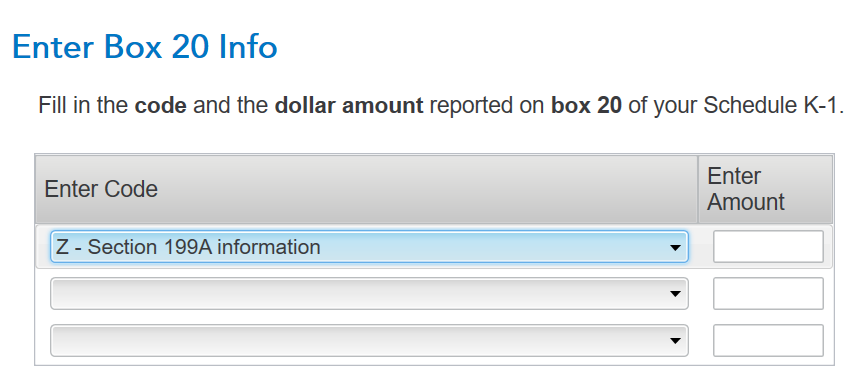

- When you see the screen titled "Enter Box 20 info," select the arrow to scroll down to code Z. Enter the applicable amount.

Also, be sure to confirm you are entering your Schedule K-1 in the correct entity type. Only a partnership Schedule K-1 will have the option to check box 20.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business K-1box 20

I am using a the business software. I ended up going to the "forms" mode and entering on Section A for the QBI. Thank you for responding.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business K-1box 20

In TurboTax Business, check the box for Section B1 (Qualified Business Income Deduction) rather than Box 20. A subform will appear that allows you to enter the QBI information under Section A.

These entries may be easier using Forms Mode.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business K-1box 20

Yes, that seemed to work good.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bk1999

Level 1

user26879

Level 1

deborahhuff753

New Member

joel_black_sr1

New Member

tucow

Returning Member