- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Assuming you are entering Schedule K-1s from a business and are trying to entering them in your individual tax return, you will need to follow these steps. Code Z is available for selection in both the desktop and online versions of TurboTax.

To get to the input, please log back into your TurboTax program.

- Select the Personal Income tab and scroll down to Business Investment and Estate/Trust Income.

- Select start/update to the right of Schedule K-1.

- Select the start/update to the right of the applicable Schedule K-1 on the screen titled "tell us about your Schedules K-1."

- Select edit the right of applicable entity.

- Continue through the screens until you see the screen titled "Check boxes that has an amount or are checked on the form." Check box 20.

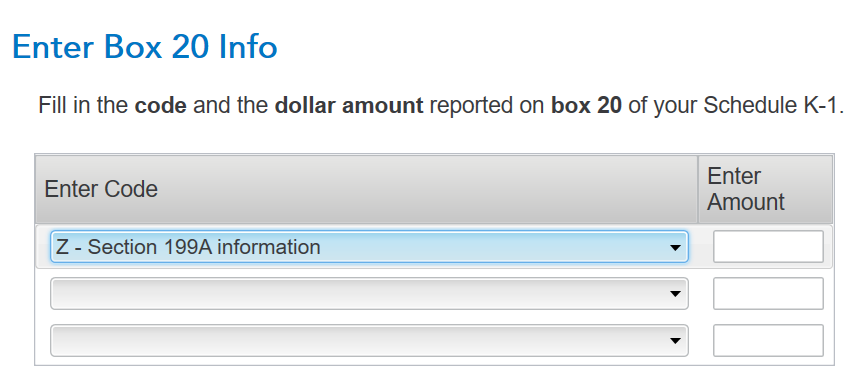

- When you see the screen titled "Enter Box 20 info," select the arrow to scroll down to code Z. Enter the applicable amount.

Also, be sure to confirm you are entering your Schedule K-1 in the correct entity type. Only a partnership Schedule K-1 will have the option to check box 20.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 8, 2024

7:56 AM