- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Turbotax Business adding prior depreciation for asset placed in service in current year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Business adding prior depreciation for asset placed in service in current year

Background:

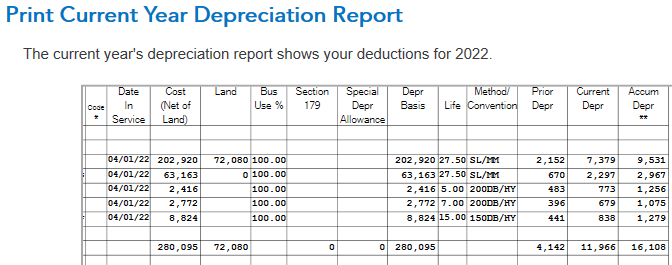

I'm preparing an estate tax return for 2022. The decedent passed in August 2021 and left house to 2 beneficiaries. The estate is still open as of 12/31/22. In April 2022, the house was placed in service as rental property for 100% business use for the remainder of the year.

In the Assets section, I've used the Date In Service as 4/1/22. However, TT is reflecting depreciation for the prior year which makes no sense bc the asset was not PIS until 2022, so there could not be any depreciation in 2021 as it was not used for business purposes. Also, its showing a full year of depreciation in the "Current Depr" which also doesn't make sense bc it wasn't in service for the entire year.

Questions:

-How do I get TT to show $0 for prior year (2021) depreciation?

-How do I get TT to show the proper depreciation, prorated for the current year (2022)

-Is there a way to change the depreciation method? I'd prefer to just use SL for all assets. The property is already showing a taxable loss with SL depreciation, so no need to speed up depreciation and take more this year.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Business adding prior depreciation for asset placed in service in current year

This is a data entry error on your part ... you must make the date placed in service AND the date the property was purchased/inherited be the SAME 2022 date.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Business adding prior depreciation for asset placed in service in current year

The inherited date would have been in 2021, but there was no rental activity until April 2022 (when we started marketing the property as rentable) which is why I did the 2 separate dates. Will that cause issues if the inherited date is technically wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Business adding prior depreciation for asset placed in service in current year

I gave you the way to fix the depreciation in the program ... inherited date is immaterial.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Business adding prior depreciation for asset placed in service in current year

So, I updated the "Decedents Date of Death" to match the PIS date and it definitely works. Depreciation is in line with what I'm calculating now.

However, are you saying it wont be an issue that the "Decedents Date of Death" on the return is not accurate when reporting to IRS? This is the first return being filed for the estate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Business adding prior depreciation for asset placed in service in current year

FYI ... everything you enter in the program to complete the return is NOT reflected on the form 1041 ... this is not an issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Business adding prior depreciation for asset placed in service in current year

I updated like you said and got the depreciation schedule working properly. However the date of death did carry over to the Form 1041. I was able to update that date directly on the form without disrupting the depreciation schedule. TLDR: I got it to work; thanks for your help.

Btw, TT is telling me to prep 2 state returns (one for GA where the decedent was a resident; one for NC where executor is a resident). Do you happen to know the rules there? Idk why an NC return would need to be prepared since the estate is in GA where the decedent lived. I wouldn't think tax would be due in 2 states since all income (showing a taxable loss) was generated in GA, not NC.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

c0ach269

New Member

Idealsol

New Member

SB2013

Level 2

Kenn

Level 3

VAer

Level 4