- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Business adding prior depreciation for asset placed in service in current year

Background:

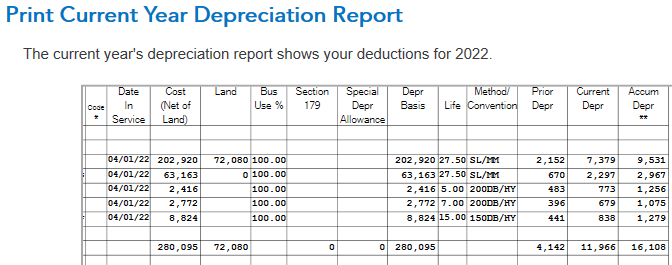

I'm preparing an estate tax return for 2022. The decedent passed in August 2021 and left house to 2 beneficiaries. The estate is still open as of 12/31/22. In April 2022, the house was placed in service as rental property for 100% business use for the remainder of the year.

In the Assets section, I've used the Date In Service as 4/1/22. However, TT is reflecting depreciation for the prior year which makes no sense bc the asset was not PIS until 2022, so there could not be any depreciation in 2021 as it was not used for business purposes. Also, its showing a full year of depreciation in the "Current Depr" which also doesn't make sense bc it wasn't in service for the entire year.

Questions:

-How do I get TT to show $0 for prior year (2021) depreciation?

-How do I get TT to show the proper depreciation, prorated for the current year (2022)

-Is there a way to change the depreciation method? I'd prefer to just use SL for all assets. The property is already showing a taxable loss with SL depreciation, so no need to speed up depreciation and take more this year.