- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- TurboTax 2023 bug with Form 8615 Schedule D Worksheet lines 44-47

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 bug with Form 8615 Schedule D Worksheet lines 44-47

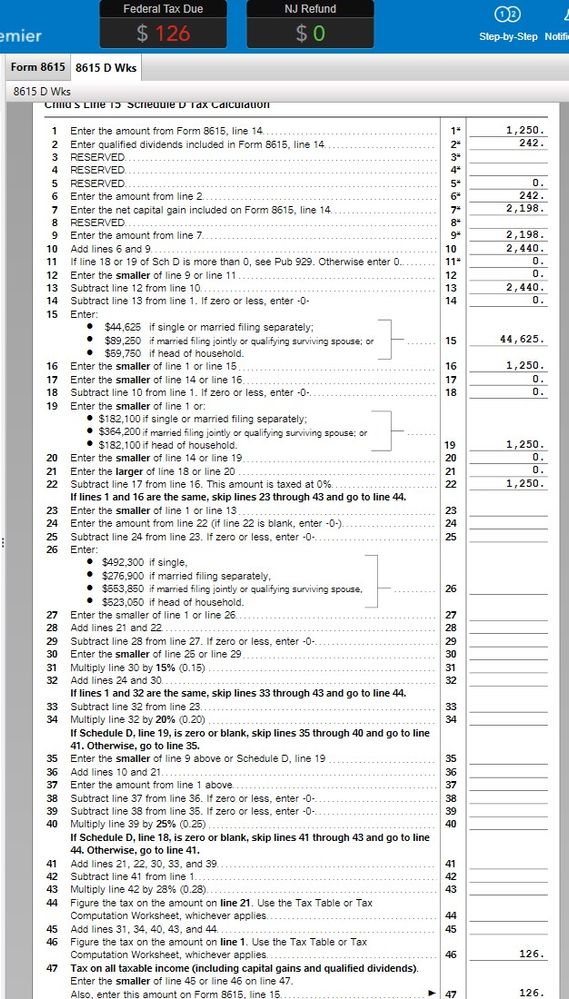

Form 8615 Schedule D is not completing line 44, and as a result line 45 is blank where as, on my return, it should be $0. The form is then calculating line 47 to be the lesser of $126 vs [blank], selecting $126 instead of what should be $0. As a result, TurboTax is computing a $126 tax owed on my child's return when there should not be any. Please fix this before April 15.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 bug with Form 8615 Schedule D Worksheet lines 44-47

Mine is showing a zero instead of a blank. Follow these steps:

Desktop version:

- Delete the form

- Save your return while closing the program.

- Update the program

- Open

- Enter the information again.

Online version:

A full or corrupted cache can cause problems in TurboTax, so sometimes you need to clear your cache (that is, remove these temporary files).

For stuck information follow these steps:

- Delete the form/ worksheet- if possible, see How to Delete

- Log out of your return and try one or more of the following:

- Log back into your return.

- Enter the information again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 bug with Form 8615 Schedule D Worksheet lines 44-47

I deleted the form, updated (software said "Your software is up to date"), then re-entered the data, once directly into the form and once through the step-by-step, both resulted in the same blank 44 & 45 fields.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 bug with Form 8615 Schedule D Worksheet lines 44-47

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 bug with Form 8615 Schedule D Worksheet lines 44-47

Amy, your line 46 is blank! Is that a completed return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 bug with Form 8615 Schedule D Worksheet lines 44-47

Intuit sent an email reporting they have fixed the problem. After updating, fields 44 and 45 are still showing blank but the amount of tax now calculates correct. Good enough for me. Hopefully good enough for the IRS 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 bug with Form 8615 Schedule D Worksheet lines 44-47

Sweet! Got the same email. I haven't tried resubmitting yet after getting rejected the first time but will probably try tomorrow.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 bug with Form 8615 Schedule D Worksheet lines 44-47

OMG! I efiled my taxes and they were accepted. Then I get this email:

Dear TurboTax customer,

Thank you for being patient while we investigate your issue.

We’re still working on a solution and we’ll send you an email once a fix is in place.

Thank you for being a TurboTax customer.

Sincerely,

TurboTax

WTF Turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 bug with Form 8615 Schedule D Worksheet lines 44-47

Yesterday TurboTax said this problem is fixed, and they deleted the thread. Unfortunately the problem persists after the software update.

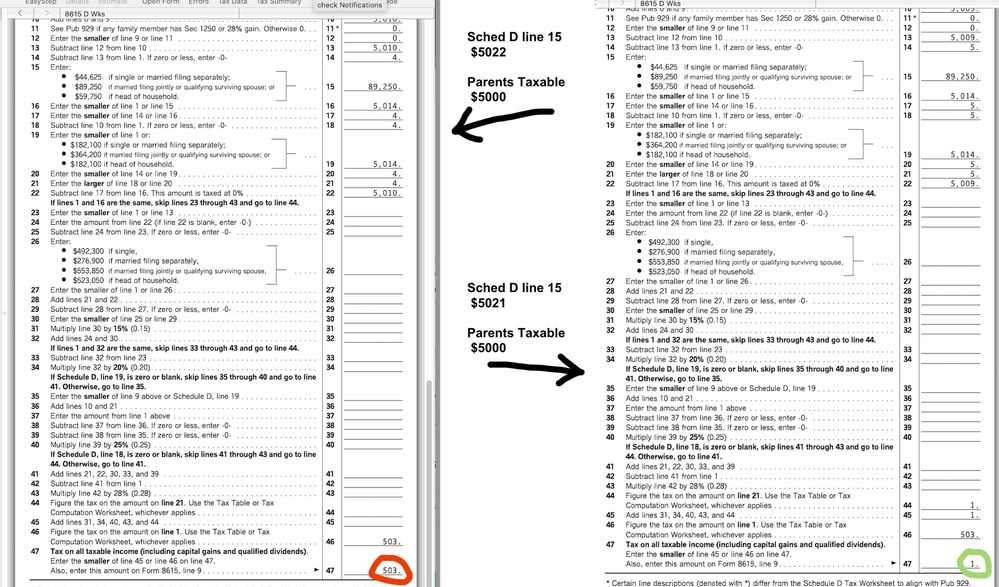

In case it helps the TurboTax development team, the problem is easy to reproduce. Below is an example with screenshots of the Form 8615 worksheets.. with incorrect on the left and correct on the right. The difference is a $1 with one field.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 bug with Form 8615 Schedule D Worksheet lines 44-47

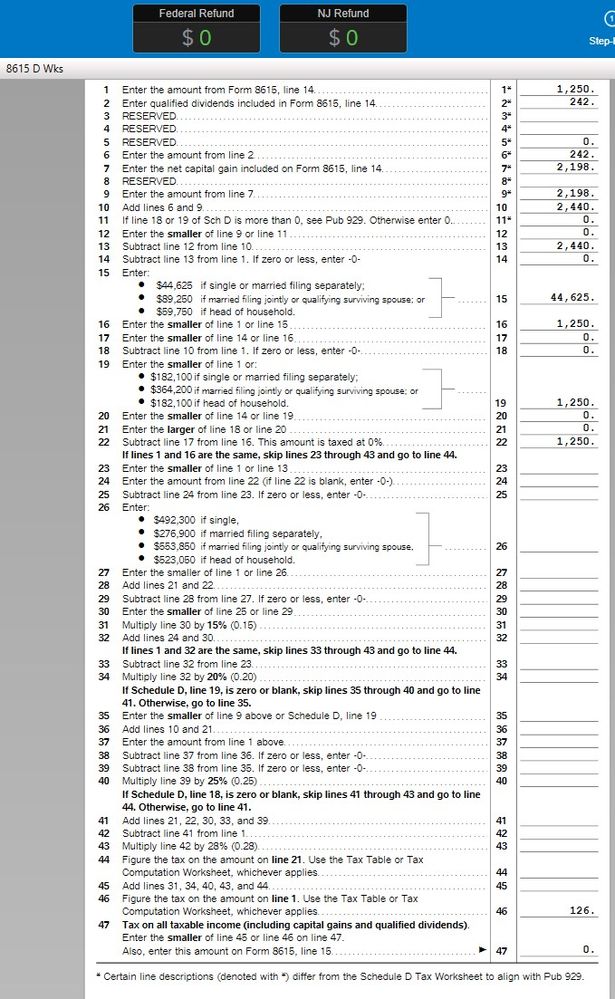

This is mine after yesterday's update. So it does appear to be right for me. Before the update, it had 179 in line 47.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 bug with Form 8615 Schedule D Worksheet lines 44-47

FYI, I followed Amy C's instructions for the Desktop (Mac) Turbotax.. namely, delete form 8615, update Turbotax (none needed) and restart the program. Got the same result as shown in an earlier post, eg: With parents taxable income at $5000 and parent's schedule D line 15 at $5022.. the net tax is $603. Reduce the schedule D line 15 a dollar, to $5021, and the tax goes to $1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 bug with Form 8615 Schedule D Worksheet lines 44-47

Gary, I noticed your line 15 shows $89,250. Line 15 of the worksheet is supposed to be the child's filing status. If the child is married filing jointly, I believe they are not subject to the 8615 kiddie tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 bug with Form 8615 Schedule D Worksheet lines 44-47

Thank you for giving it a look. His taxes are filed separately, cause he made more in unearned income than the cutoff to be included in my taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 bug with Form 8615 Schedule D Worksheet lines 44-47

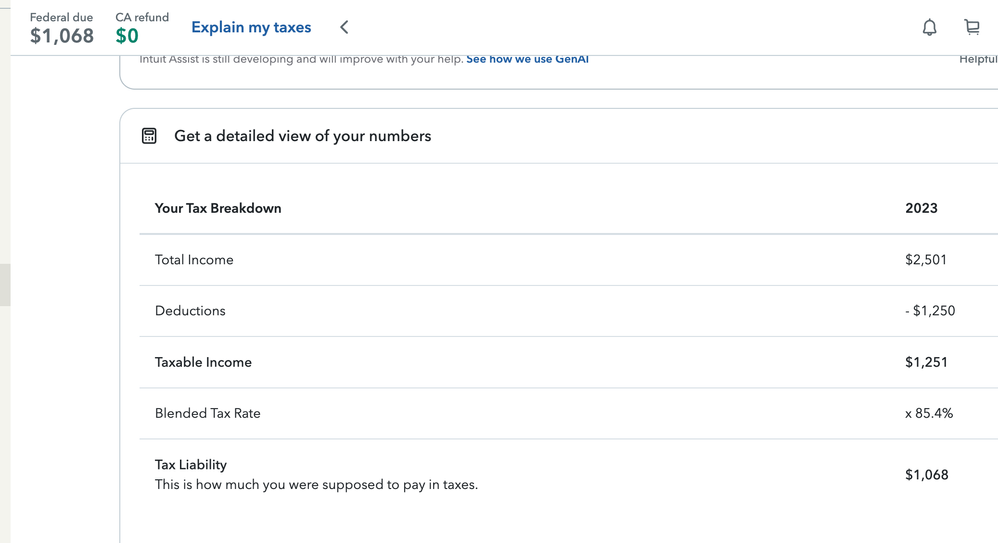

I ran the number in Turbotax Online, and could reproduce the problem there. Simplified the data, and came up with a cutoff at $2500 of unearned income. If it's above this (eg $2501), the fed tax due is $1068 (see screenshot). Otherwise fed tax is $0

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 bug with Form 8615 Schedule D Worksheet lines 44-47

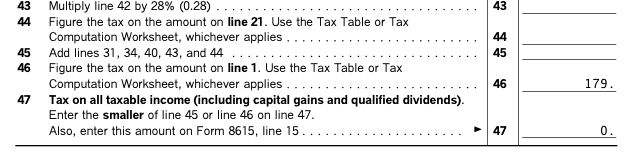

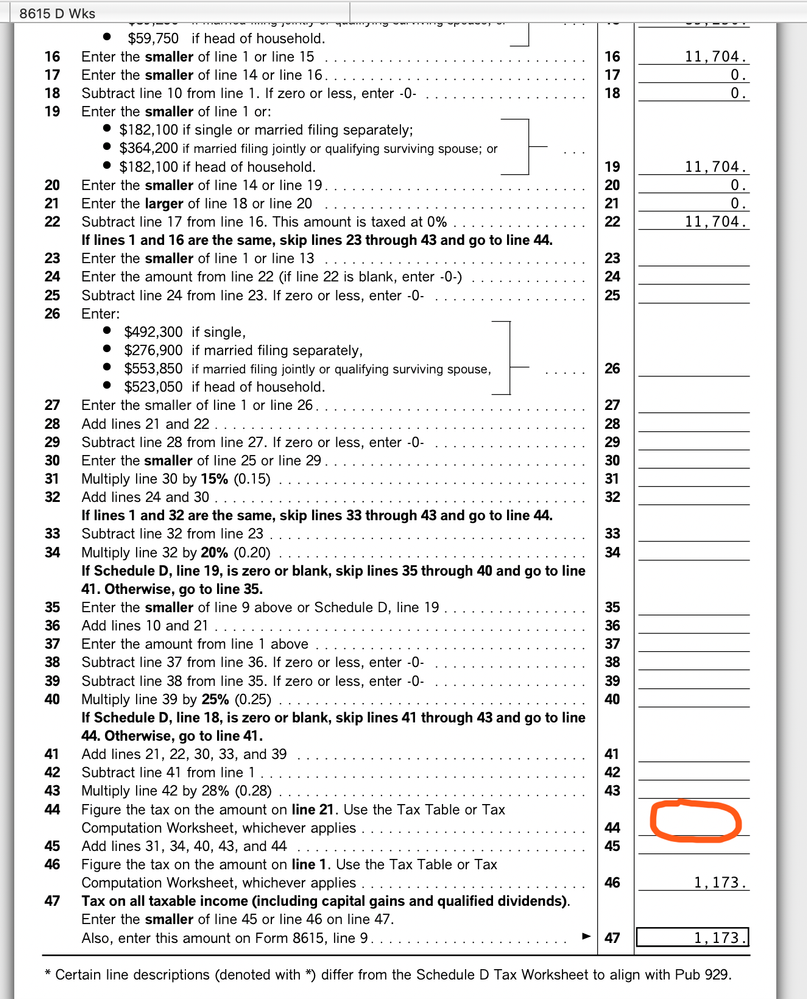

Walking through Form 8615, and checking the logic.. it appears that Turbotax is erroring on Line 44: "Figure the tax on the amount on line 21". If Line 21 is zero, TurboTax does not put a zero in Line 44. Below is a screenshot

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nosheens

New Member

tz3019

New Member

taxhard47

Level 3

planetkreitlow

New Member

jrW9A8dBAY

New Member