- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- TurboTax 2022 Premier Behaving Badly WRT Accrued Market Discount

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 Premier Behaving Badly WRT Accrued Market Discount

I’d like to ask the community for help on an issue handling Accrued Market Discount in TurboTax Premier.

I searched the community and found a similar problem (https://ttlc.intuit.com/community/taxes/discussion/accrued-market-discount-turbotax-2022/00/2890389).

Sadly, the solution described there doesn’t work for my version of TurboTax!

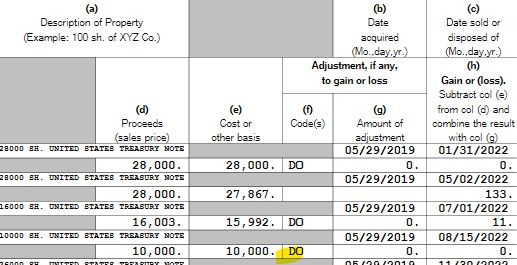

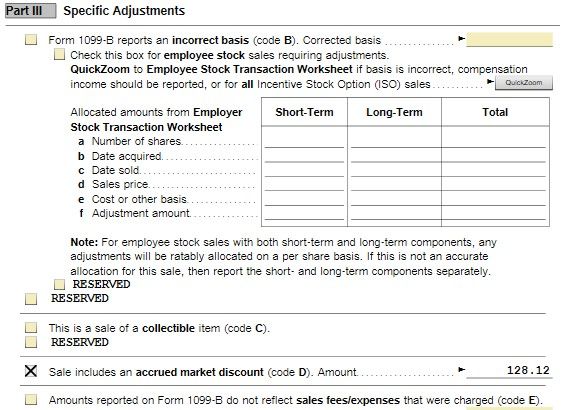

Similar to bobp55, I am having difficulty getting code D ONLY populated in form 8949 box 1f.

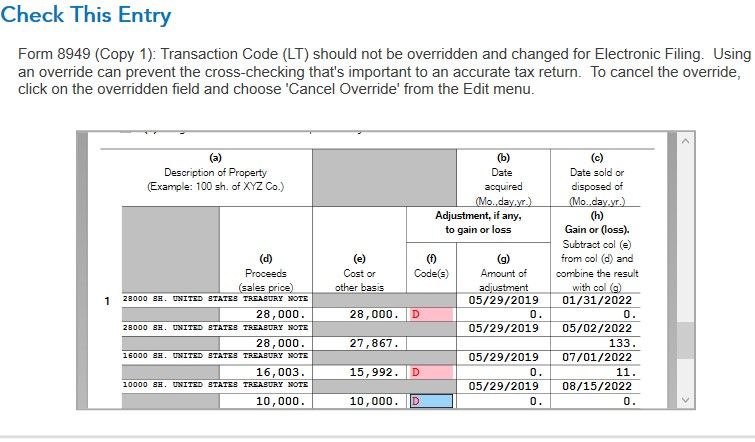

I can’t just override and clear the other code since SMARTCHECK catches this:

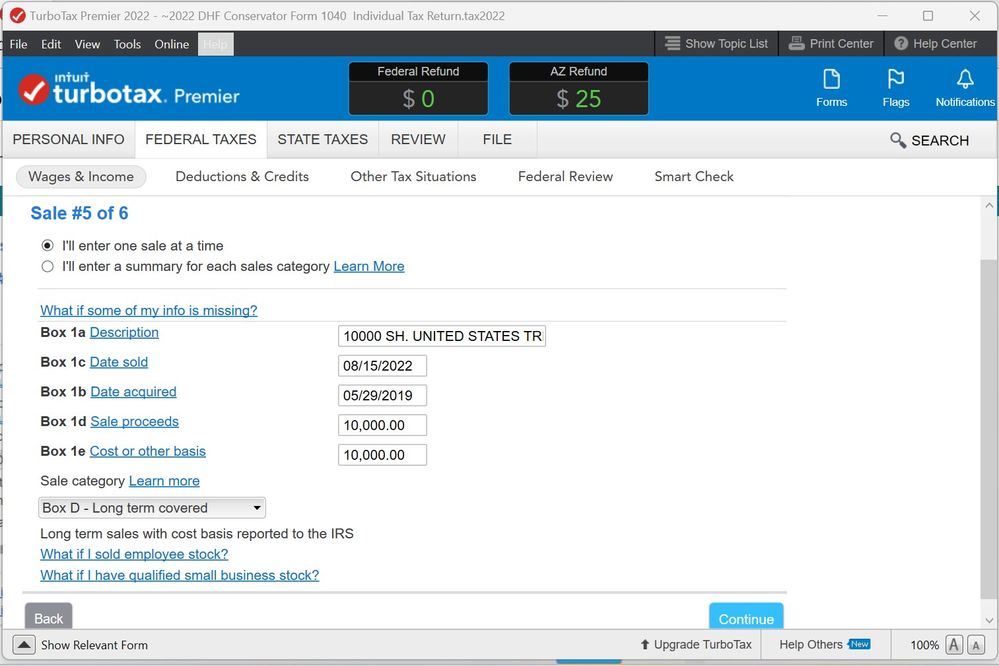

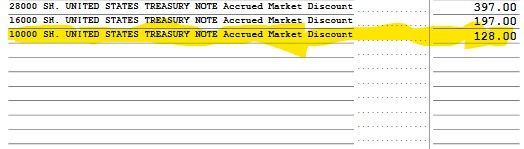

I have 3 of these to fix, and I will use one as an example:

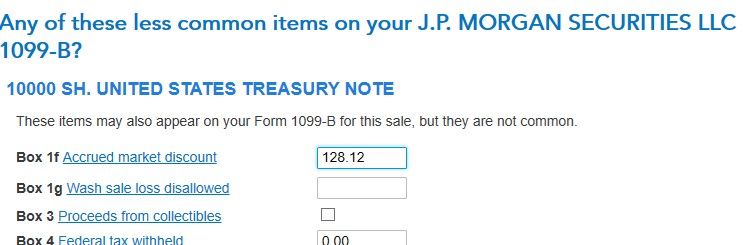

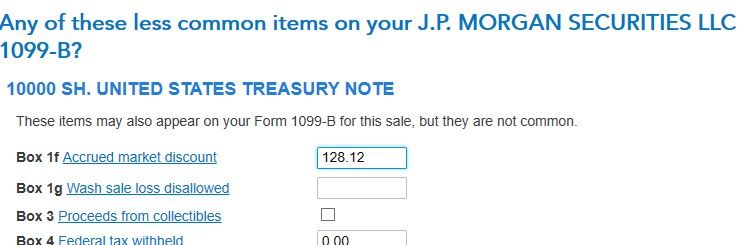

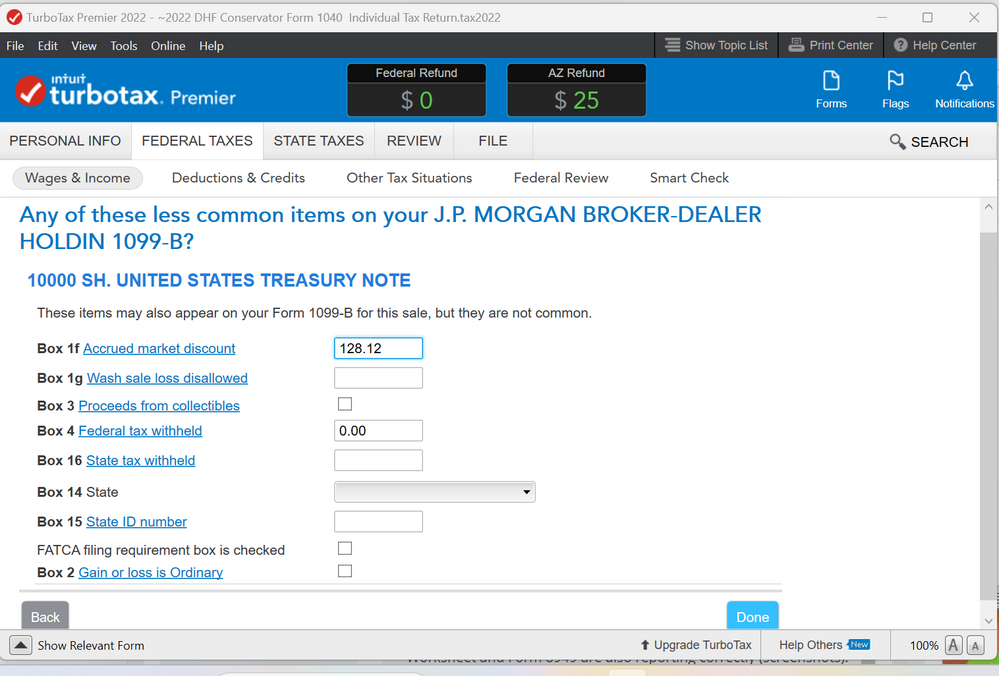

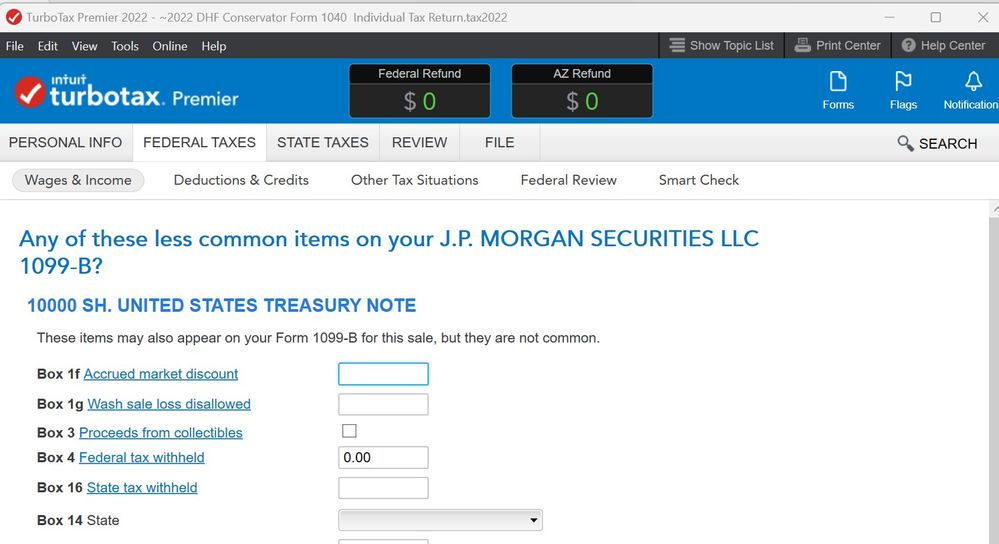

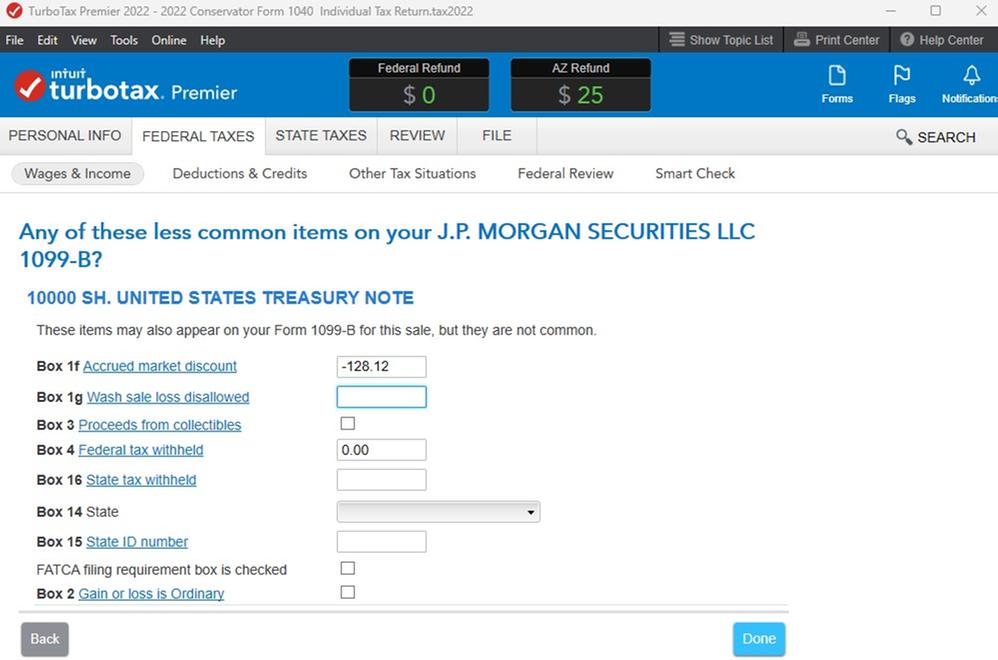

I have entered the Accrued Market Discount in the step-by-step as shown below:

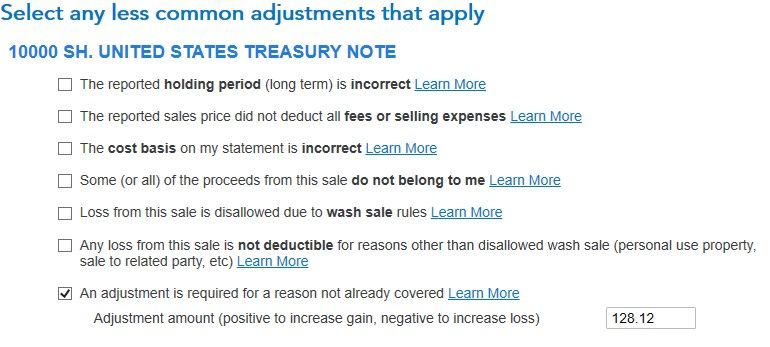

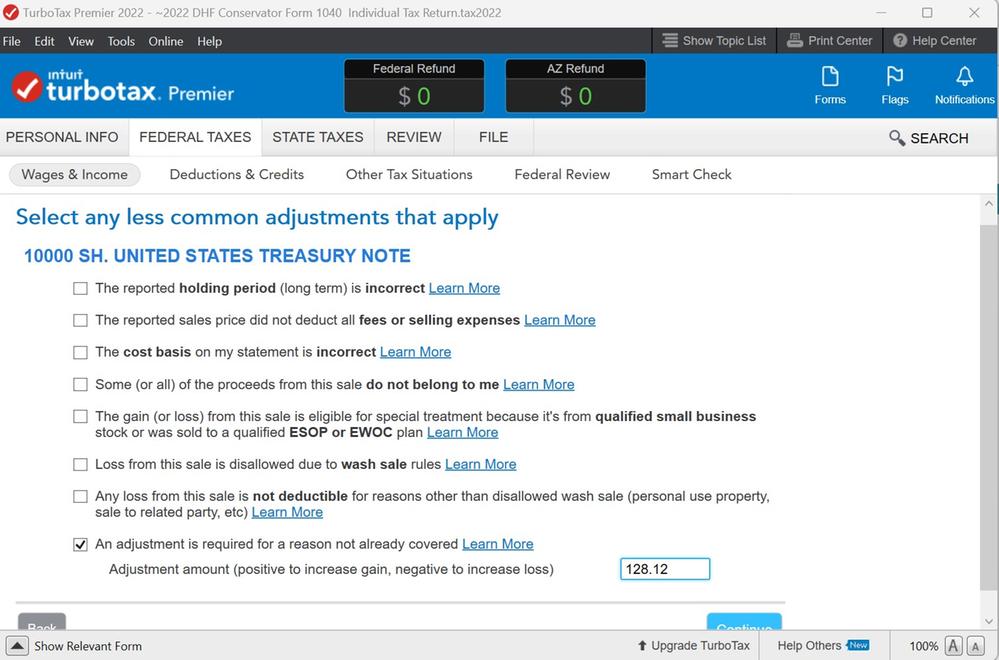

If I start from the same starting point as bobp55, I have checked the box for an “adjustment for a reason not already covered” and populated that field with the Accrued Market Discount, as shown below:

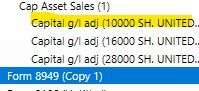

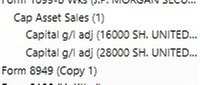

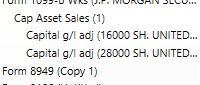

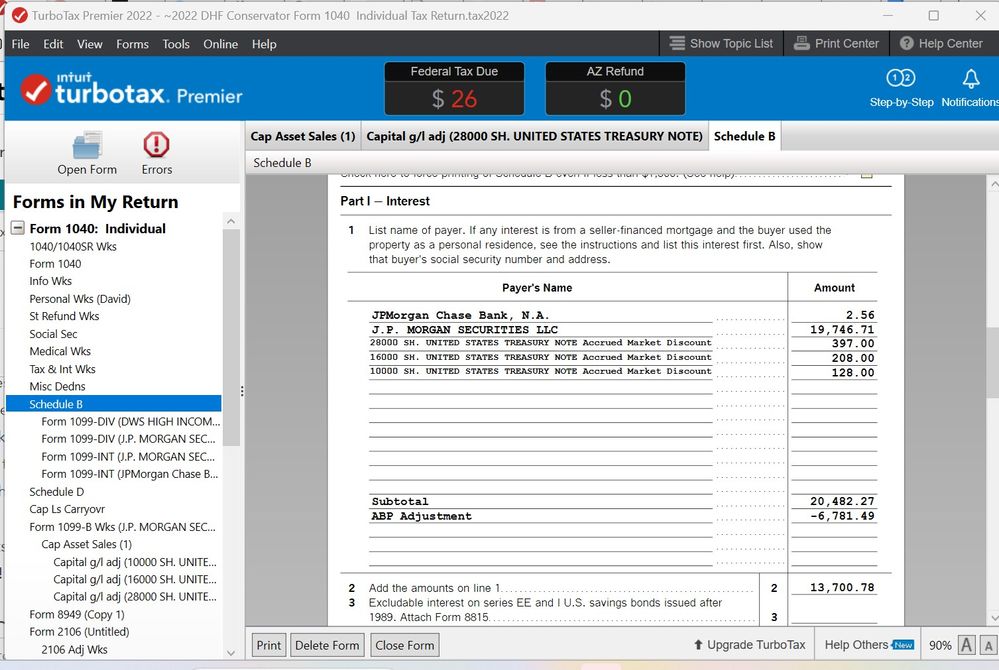

This seems to MOSTLY work! A Capital g/l adj worksheet IS generated, and interest IS added to schedule B

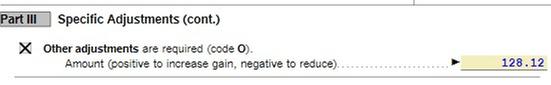

However, doing this results in both a D and and O entry in box 1f on form 8949, but I need to have just a D there.

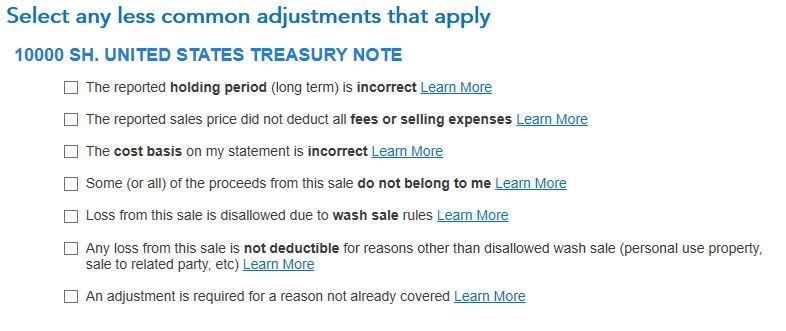

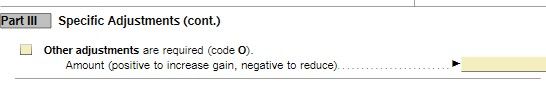

The suggested solution to populate the interest on Schedule B, and add the code D to box 1f on form 8949 is to NOT ENTER ANYTHING on the less common adjustments step-by-step page, as shown below. (NOTE: I also cleared the value for the adjustment required for a reason not already covered field.)

The result of that is no generation of a Capital g/l adj worksheet, and no interest added to schedule B ( see below).

Just for grins, I went back to the first case, where there was a capital g/l adj worksheet and tried unchecking the box that adds the “O” in box 1f on Form 8949.

When this checkbox and field

are overridden to clear the value and uncheck the box for other adjustments, this immediately removes the capital g/l adj worksheet for this transaction.

It seems to me that to work like GeorgeM777 said, the Capital g/l adj worksheet has to be created automatically if there is an entry for Accrued Market Discount is entered on the less common items page below, and if there isn’t a Capital g/l adj worksheet there is no way to get ONLY a “D” code in Box 1f of form 8949.

I hope the community can come up with a bug fix for TurboTax Premier so it works like it did for bobp55, otherwise I’m going to have to override the DO in box 1f of form 8949, and file a paper return. ☹

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 Premier Behaving Badly WRT Accrued Market Discount

Hi GeorgeM777,

I realized last night during my insomnia that I should sent this version of teh problem statement, rather than my final, frustrated post!

Thanks again for being wiling to look at this issue.

Best regards, JMFord

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 Premier Behaving Badly WRT Accrued Market Discount

In order to take a closer look at the situation you have described, it would be helpful if we can get a diagnostic copy of your tax file.

The diagnostic file will not contain personally identifiable information, only numbers related to your tax forms. If you would like to provide us with the diagnostic file, follow the instructions below and post the token number along with which version of TurboTax you are using in a follow-up thread.

Use these steps if you are using TurboTax Online:

- Sign-in to your account and be sure you are in your tax return.

- Select Tax Tools in the menu to the left.

- Select Tools.

- Select Share my file with agent.

- A pop-up message will appear, select OK to send the sanitized diagnostic copy to us.

- Post the token number here.

If you are using a CD/downloaded version of TurboTax, use these steps:

- Select Online at the top of the screen.

- Select Send Tax File to Agent.

- Click OK.

- Post the token number here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 Premier Behaving Badly WRT Accrued Market Discount

Hi GeorgeM777,

I have provided the diagnostic file as you requested, along with the Turbo Tax and Windows O/S information for my install(s). Please note that I have reproduced the issue on my laptop, as well as on my desktop. (I'm traveling right now).

Thanks for being willing to drive this.

Best regards, JMFord

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 Premier Behaving Badly WRT Accrued Market Discount

Unfortunately, we don't see the token number. Not sure why that number does not appear in your post. Can you repeat the steps and resubmit the token number.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 Premier Behaving Badly WRT Accrued Market Discount

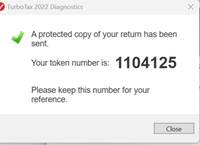

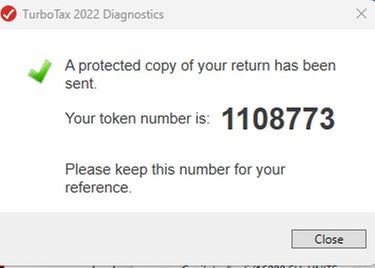

Hi, please try this new one

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 Premier Behaving Badly WRT Accrued Market Discount

HI GeorgeM777,

Just in case you meant thet you couldn't read the snapshot, the two token numbers are:

original: 1103791

resent: 1104125

Thanks very much! JMFord

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 Premier Behaving Badly WRT Accrued Market Discount

Hi GeorgeM777,

It's been quiet on this thread. Were you able to access at least oje of the diagnostic files that I provided?|

And if so, have you been able to reproduce the issue?

Thanks! JMFord

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 Premier Behaving Badly WRT Accrued Market Discount

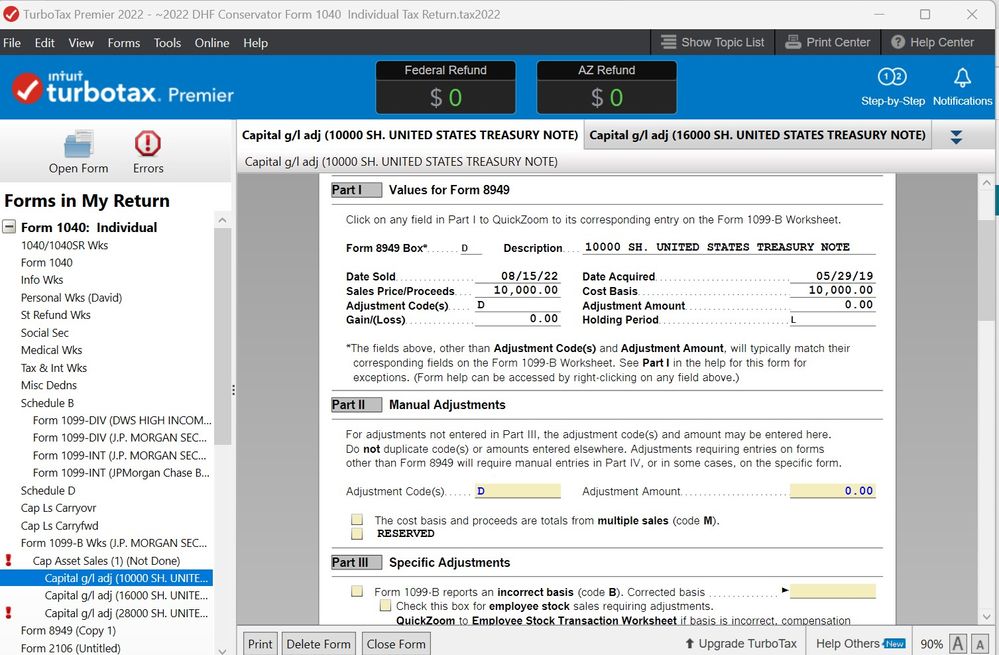

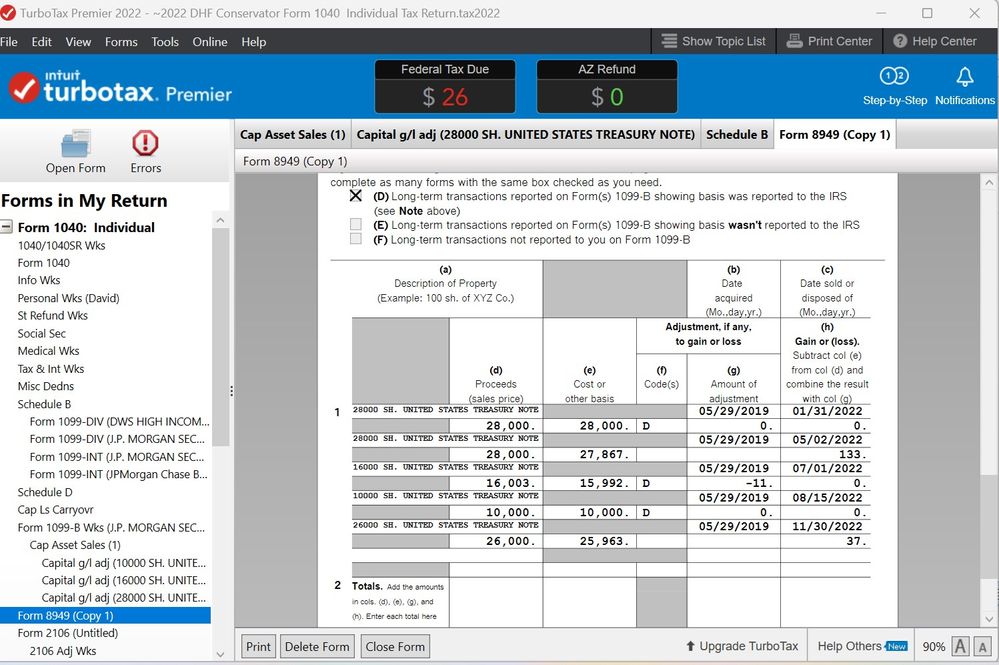

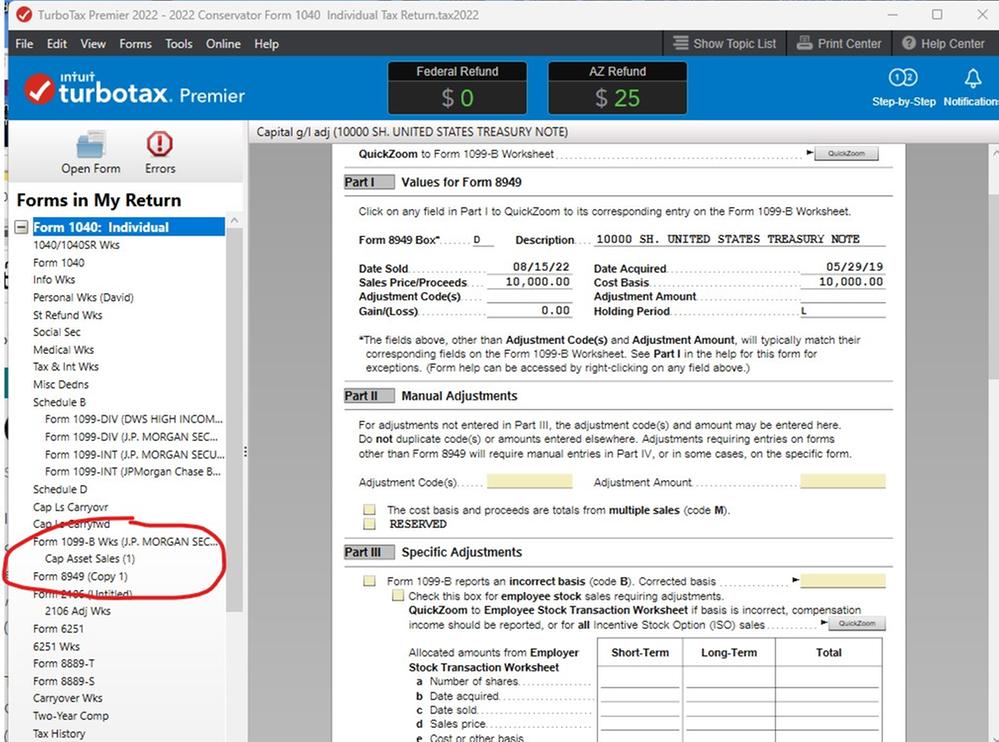

I was able to access your sanitized file, and admit that I could not figure out what was happening. I deleted your sales entries and made two 1099-B entries with an amount in Box 1f; one with Cost Basis equal to Sales Proceeds, and one with different amounts. In the interview entry, check the box for 'I need to enter amounts from Box 1f..' and enter the Box 1f amount as a negative number, with Code D (screenshot).

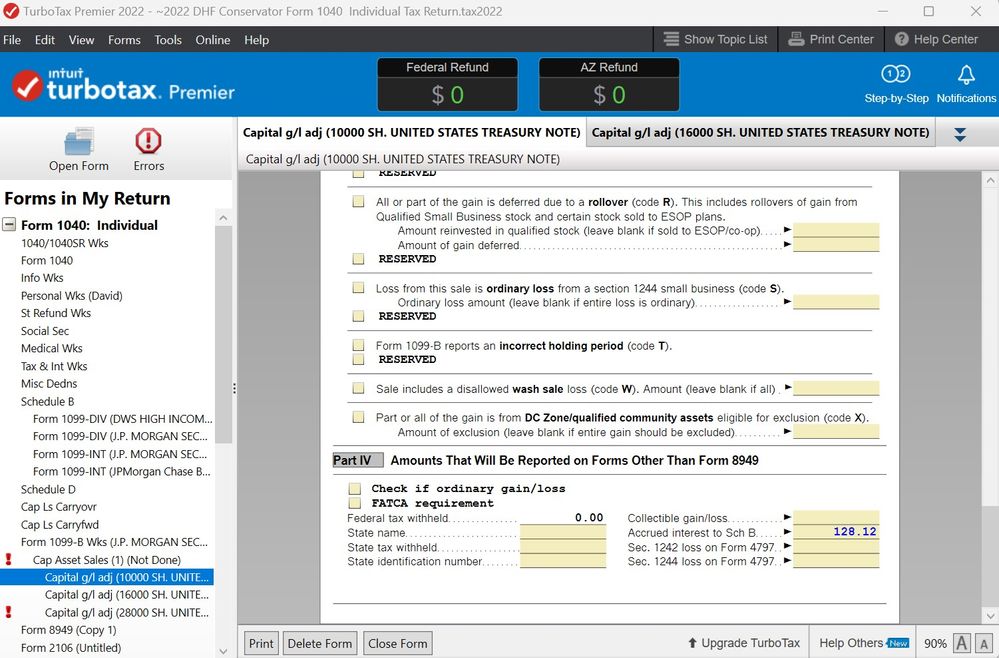

This created a Capital Gains Adj Worksheet, which shows the amount of Box 1f as an 'Adjustment' with Code D in Part II. The Code DM in Part I refers to the fact that a manual entry with Code D was made (screenshot).

However, in FORMS, an error shows for each of the Capital Gains Adj Worksheets (click on Errors at the top to see it pop up at the bottom of the form) stating that 'accrued interest requires a value when Code D is entered as a manual adjustment code' (screenshot).

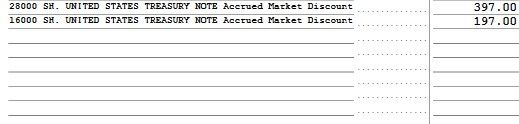

The adjustment amount needs to be manually entered in Part IV, Accrued Interest to Schedule B (screenshot).

This places the interest properly on Schedule B and the Capital Asset Sales Worksheet and Form 8949 are also reporting correctly (screenshots).

I would suggest deleting the entries you made with Box 1f amounts, and re-entering them.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 Premier Behaving Badly WRT Accrued Market Discount

Hi MarilynG1,

I would be happy to try your workaround, however I have TurboTax Premier, not TurboTax Deluxe as shown in your example.

The screen is different (see below). It does not give me the checkboxes shown in your example (ie. 'I need to enter amounts from Box 1f..)

Please advise on next steps.

Regards, JMFord

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 Premier Behaving Badly WRT Accrued Market Discount

Hi MarilynG1,

Regrets for not including the correct screen that doesn't match your example.

Please see below

Please advise on what to do next. I don't really want to have to buy a second copy of Turbo Tax for a lower tier product to get access to a workaround for something the product should handle seamlessly.

Best regards, JMFord

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 Premier Behaving Badly WRT Accrued Market Discount

Hi MarilynG1,

I was able to make some progress, hacking around the inability to set the switch as you suggested. For clarity, all screenshots are collected at the end of this post,

Since just having a value present in box 1f is not sufficient to create a Capital Gain/Loss worksheet in Turbo Tax Premier, I did two things different from before:

1) I cleared the value of accrued market discount, and

2) on the next page I checked the box for an “adjustment for a reason not already covered” and populated that field with the Accrued Market Discount.

This creates the Capital Gain//Loss Worksheet. which I then edited to

1) populate the schedule B interest using the entry at the end of the worksheet

2) and make the adjustments to capital gains using Part II Manual Adjustments

3) remove the value and the other adjustments tickbox (which just kept the Cap G/L Worksheet from being deleted while actions 1 & 2 were being done).

These edits successfully created a Schedule B with interest properly populated, and a Form 8949 with Box 1f populated with "D"! HOORAY!!

AT THIS POINT I NEED TAX HELP, BECAUSE I AM PUTTING ALL THESE NUMBERS IN MANUALLY WITH NO GUIDANCE FROM TURBO TAX!!

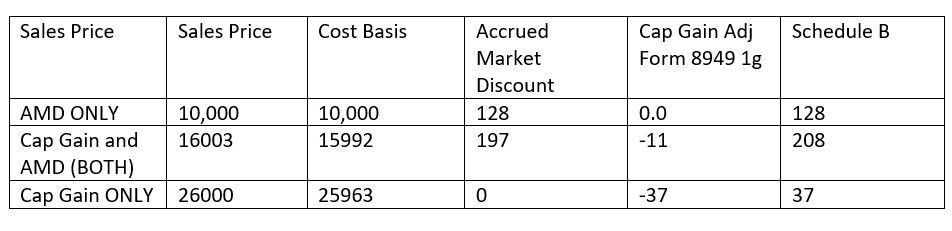

I know that the accrued market discount should be populated to schedule B. However, I had three types of transactions: Accrued Market Discount ONLY, Capital Gains ONLY, and both AMD and Capital Gains.

What I think I should enter to avoid being taxed on both capital gains and interest is the following for an example of each type:

Please share your guidance at your earliest convenience, because I'm guessing what the IRS requires based on my non-expert reading of the pub 550. I am very excited to see a path to filing!!

Thanks, JMFord

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 Premier Behaving Badly WRT Accrued Market Discount

I am in the process of obtaining TurboTax Premier to test further; however, I wanted to ask/comment in the meantime.

So, to confirm, in your first screenshot of entry for Box 1f, if you enter a Negative Amount there, a Cap Gain/Loss Worksheet is NOT generated?

I see that you were able to generate one, but it does not show the Manual Adjustment Amount in Part II.

However, your Schedule B and Form 8949 are correct, so it may be a moot point how you got there. The Worksheets are not filed with your return anyway.

FYI, on your screenshot of the chart you created, the last line for 'Capital Gain Only' would not have an amount going to Schedule B; only those with the AMD would have Sch B entries. The Capital Gain amount is not negative, and is not an 'adjustment'; it's straight reporting of the gain on the sale.

Really, the only thing you are trying to accomplish outside straight reporting of gain/loss on the sale, is reporting the AMD as interest on Schedule B.

Hope this helps!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 Premier Behaving Badly WRT Accrued Market Discount

Hi MarilynG1,

I more thoroughly tested use of a negative number for the AMD value in 1f, as you requested.

There seems to be a temporary Capital Gain/Loss worksheet ONLY AVAILABLE from the screen below:

The moment that you move on that worksheet is no longer available, see below. My observation is that adding another checkbox (for example O) is required to have the worksheet remain available (see screen shot included in previous post).

NOTE: THERE IS NO PRE-POPULATION of cap g/l worksheet Part II Manual Adjustments, if you were expecting that.

Thanks for providing guidance on how to treat capital gains on these transactions! It's certainly alot easier retain them as capital gains!

Thanks, JMFord

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 Premier Behaving Badly WRT Accrued Market Discount

HI MarilynG1,

I created a diagnostic file for the return that I intend to E-File. I would be very grateful if you would look at it and confirm that the content for the AMD only, Capital gains only and both look as expected.

As I mentioned earlier in this thread, I am having to enter my own date for the AMD population to Schedule B, and for corrections to cap gains since Turbo Tax is not doing any calculations here...

The token number for the sanitized return I intend to efile is 110873 (also shown at the end of this post).

Many thanks, Jenny

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ChickChicken

Level 2

yanks772

Returning Member

SWTL9

New Member

PJ58

Returning Member

FoundlingsAreOurFuture

Level 2