- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hi MarilynG1,

I was able to make some progress, hacking around the inability to set the switch as you suggested. For clarity, all screenshots are collected at the end of this post,

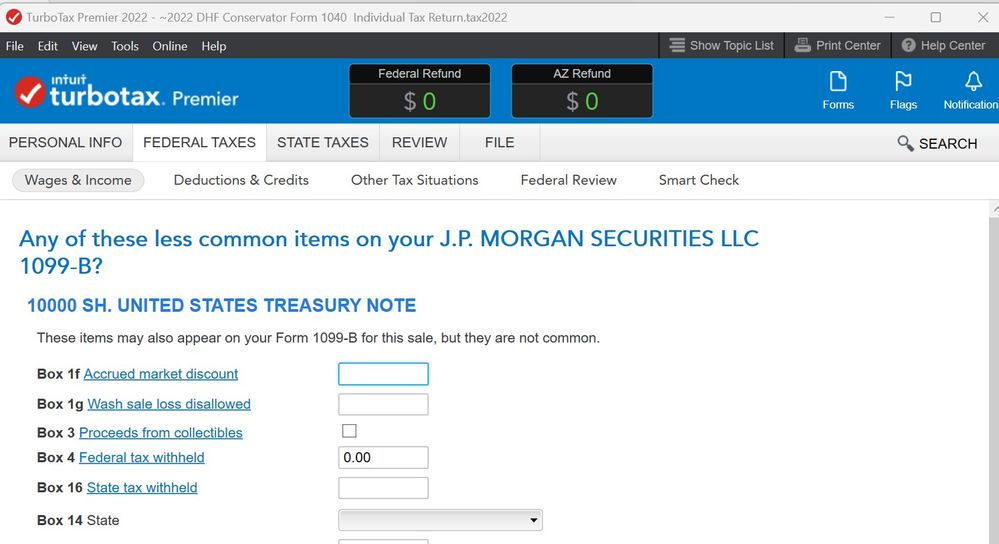

Since just having a value present in box 1f is not sufficient to create a Capital Gain/Loss worksheet in Turbo Tax Premier, I did two things different from before:

1) I cleared the value of accrued market discount, and

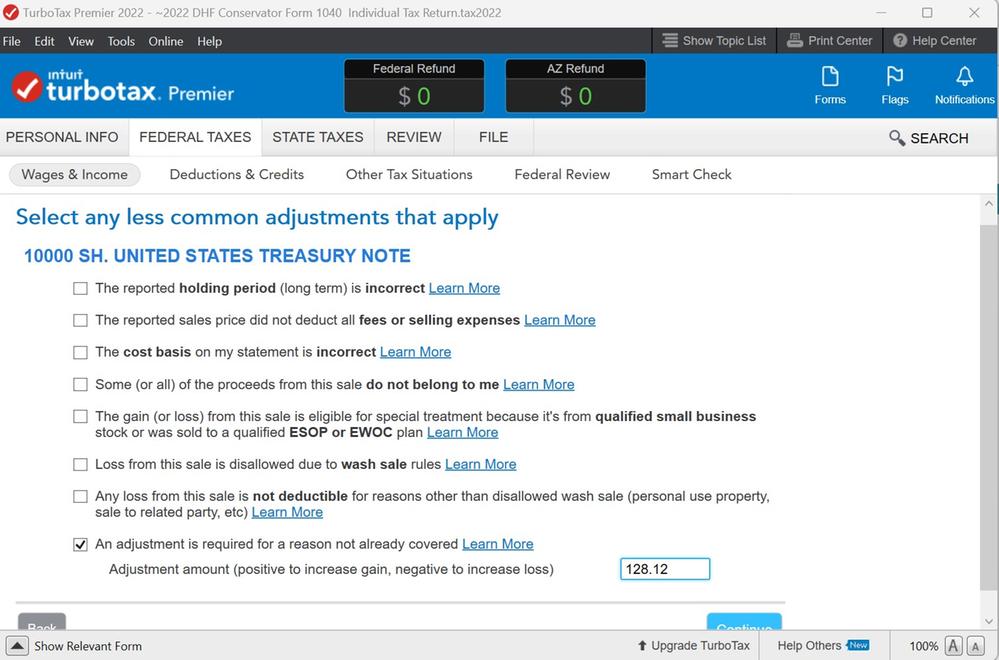

2) on the next page I checked the box for an “adjustment for a reason not already covered” and populated that field with the Accrued Market Discount.

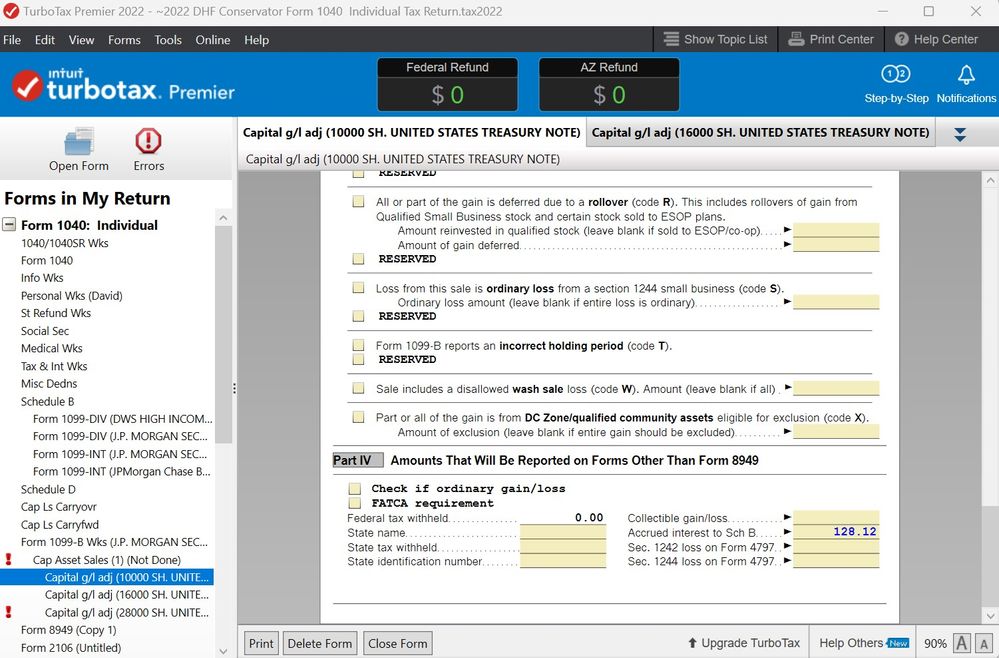

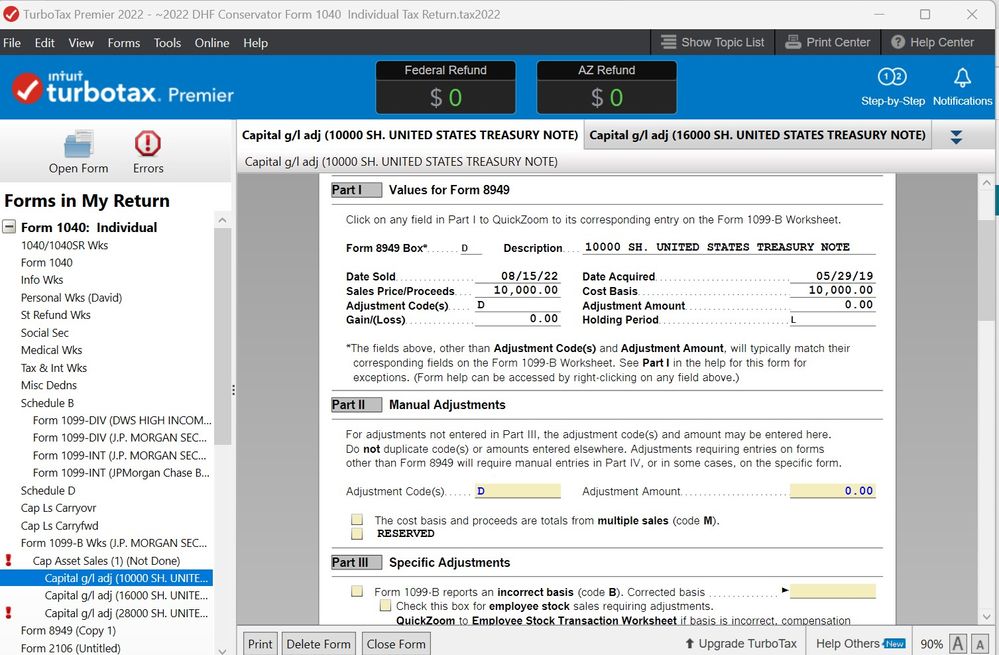

This creates the Capital Gain//Loss Worksheet. which I then edited to

1) populate the schedule B interest using the entry at the end of the worksheet

2) and make the adjustments to capital gains using Part II Manual Adjustments

3) remove the value and the other adjustments tickbox (which just kept the Cap G/L Worksheet from being deleted while actions 1 & 2 were being done).

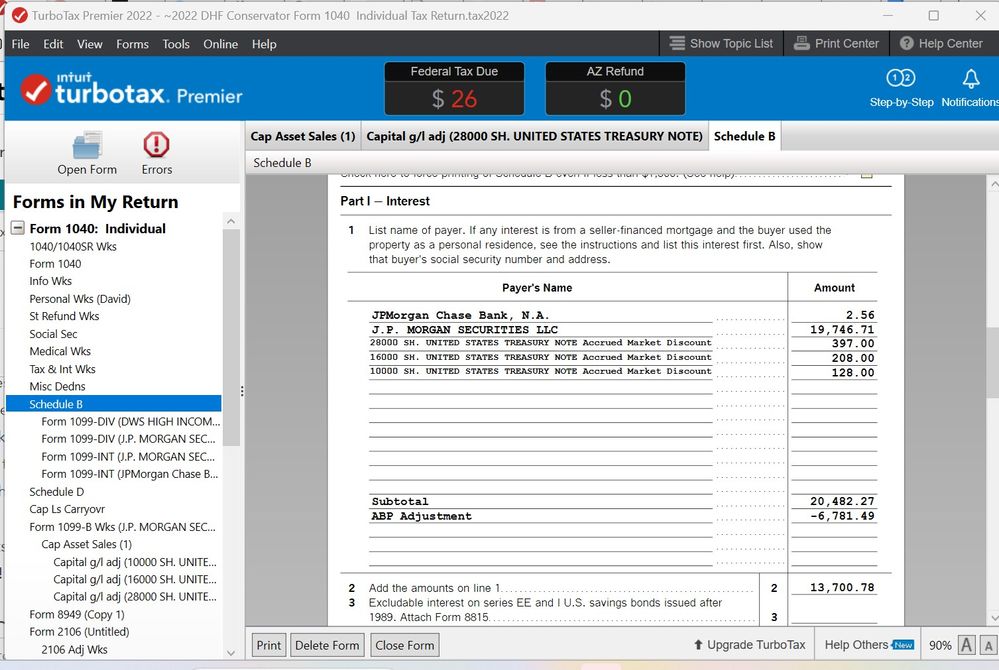

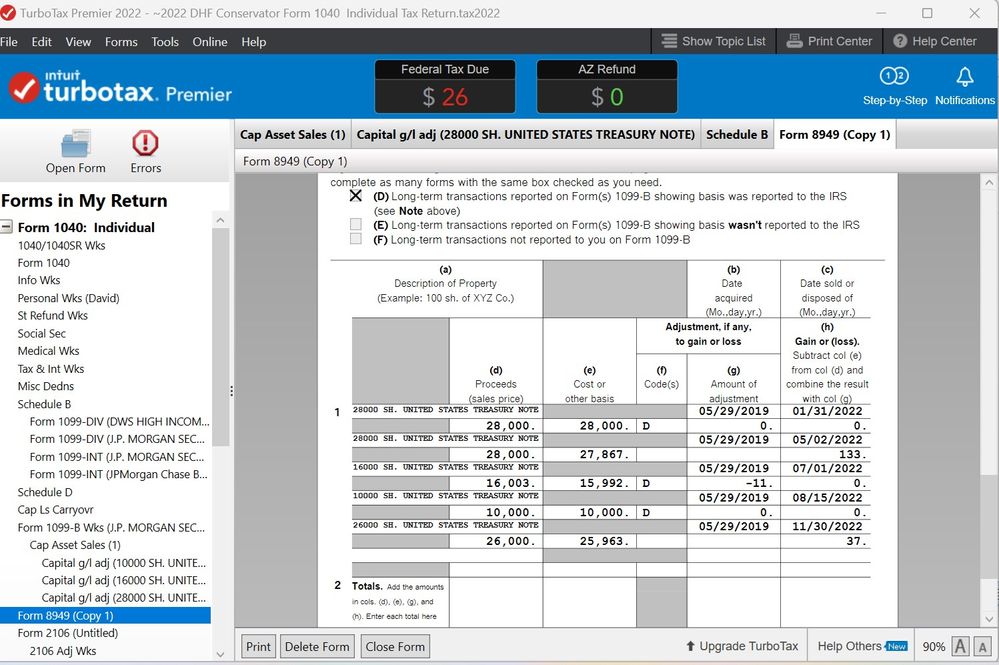

These edits successfully created a Schedule B with interest properly populated, and a Form 8949 with Box 1f populated with "D"! HOORAY!!

AT THIS POINT I NEED TAX HELP, BECAUSE I AM PUTTING ALL THESE NUMBERS IN MANUALLY WITH NO GUIDANCE FROM TURBO TAX!!

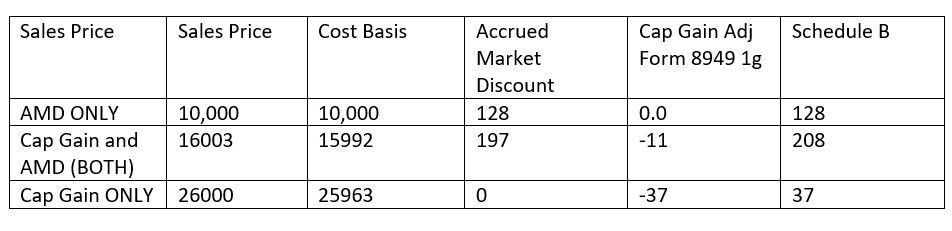

I know that the accrued market discount should be populated to schedule B. However, I had three types of transactions: Accrued Market Discount ONLY, Capital Gains ONLY, and both AMD and Capital Gains.

What I think I should enter to avoid being taxed on both capital gains and interest is the following for an example of each type:

Please share your guidance at your earliest convenience, because I'm guessing what the IRS requires based on my non-expert reading of the pub 550. I am very excited to see a path to filing!!

Thanks, JMFord