- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hi MarilynG1,

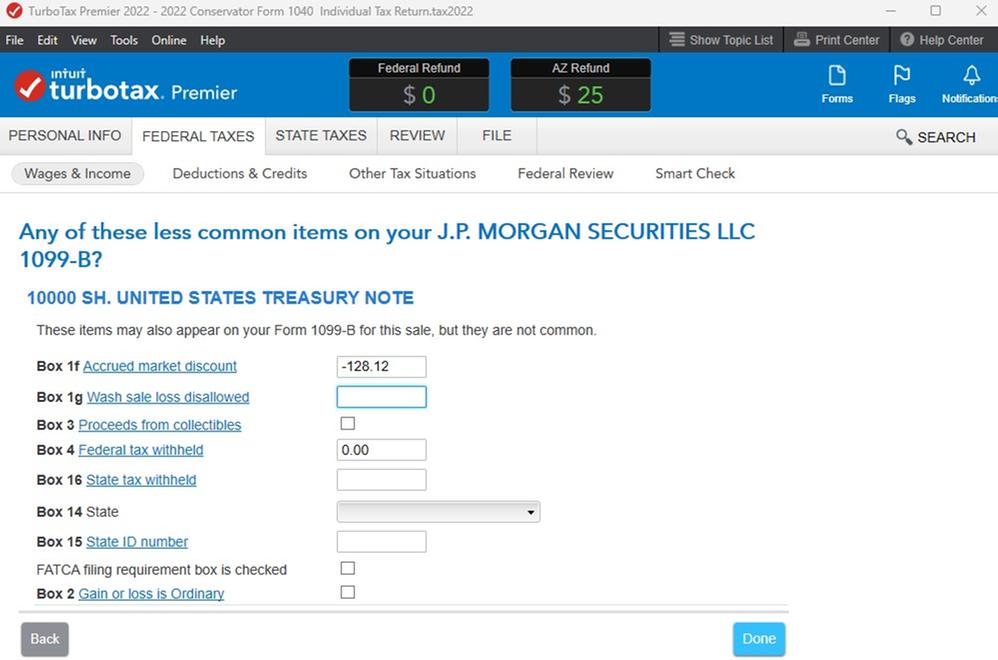

I more thoroughly tested use of a negative number for the AMD value in 1f, as you requested.

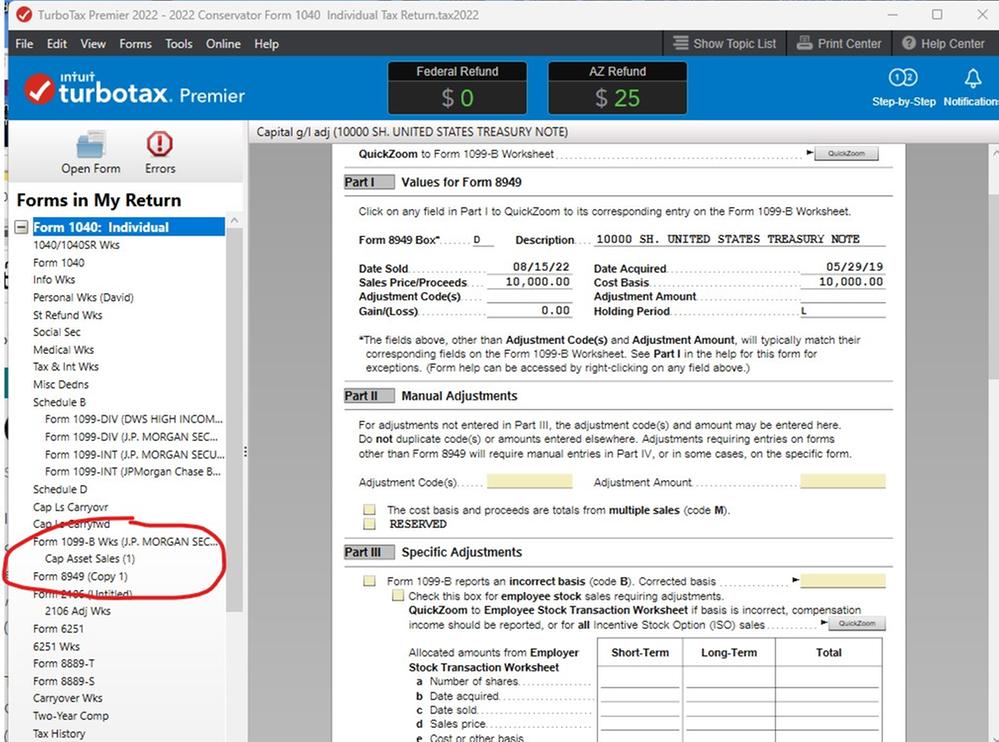

There seems to be a temporary Capital Gain/Loss worksheet ONLY AVAILABLE from the screen below:

The moment that you move on that worksheet is no longer available, see below. My observation is that adding another checkbox (for example O) is required to have the worksheet remain available (see screen shot included in previous post).

NOTE: THERE IS NO PRE-POPULATION of cap g/l worksheet Part II Manual Adjustments, if you were expecting that.

Thanks for providing guidance on how to treat capital gains on these transactions! It's certainly alot easier retain them as capital gains!

Thanks, JMFord