- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 Premier Behaving Badly WRT Accrued Market Discount

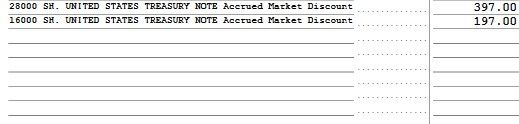

I’d like to ask the community for help on an issue handling Accrued Market Discount in TurboTax Premier.

I searched the community and found a similar problem (https://ttlc.intuit.com/community/taxes/discussion/accrued-market-discount-turbotax-2022/00/2890389).

Sadly, the solution described there doesn’t work for my version of TurboTax!

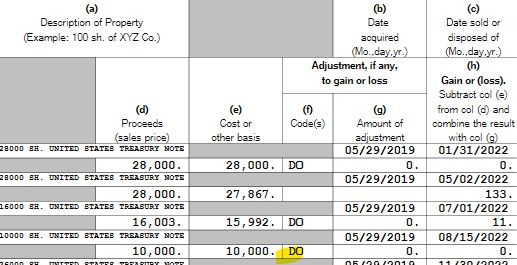

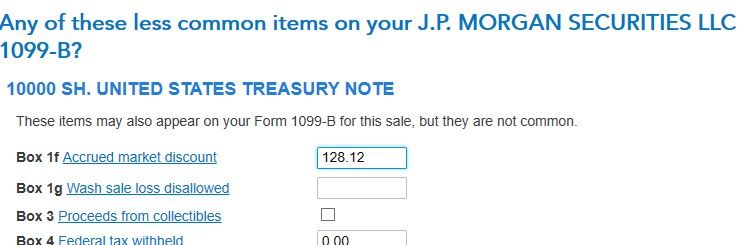

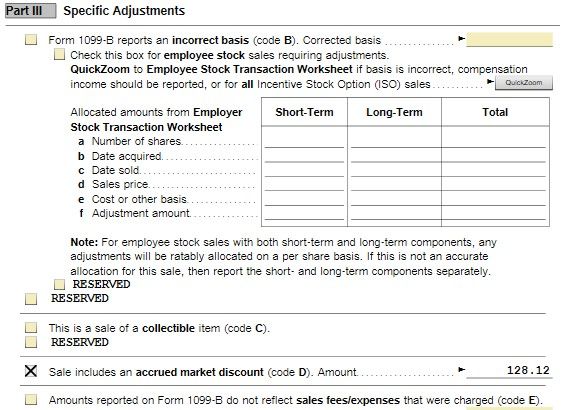

Similar to bobp55, I am having difficulty getting code D ONLY populated in form 8949 box 1f.

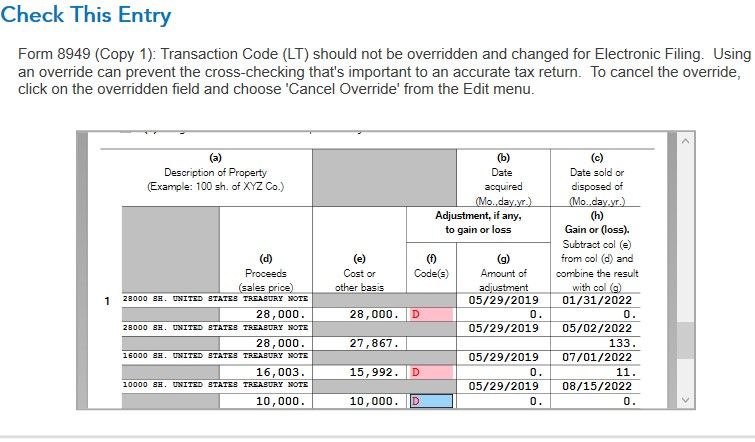

I can’t just override and clear the other code since SMARTCHECK catches this:

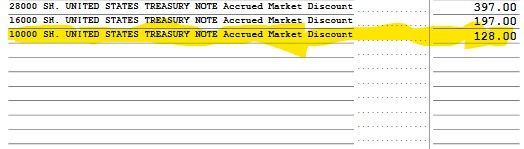

I have 3 of these to fix, and I will use one as an example:

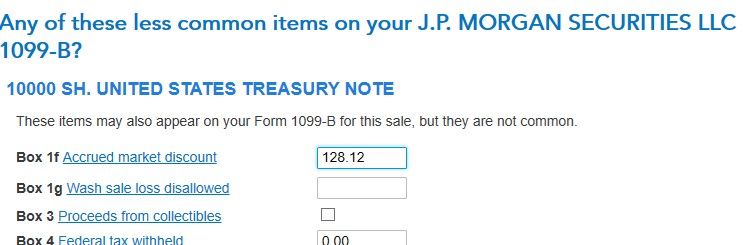

I have entered the Accrued Market Discount in the step-by-step as shown below:

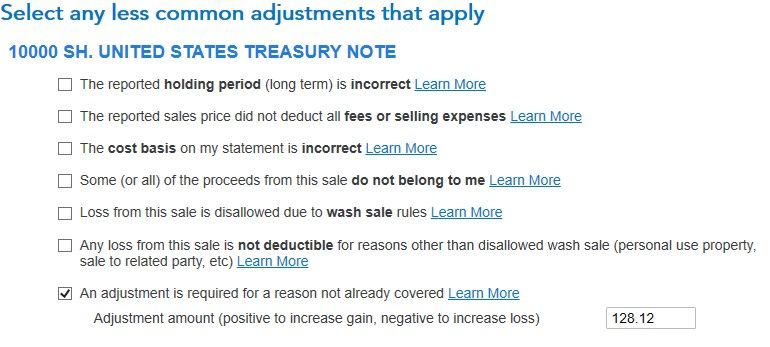

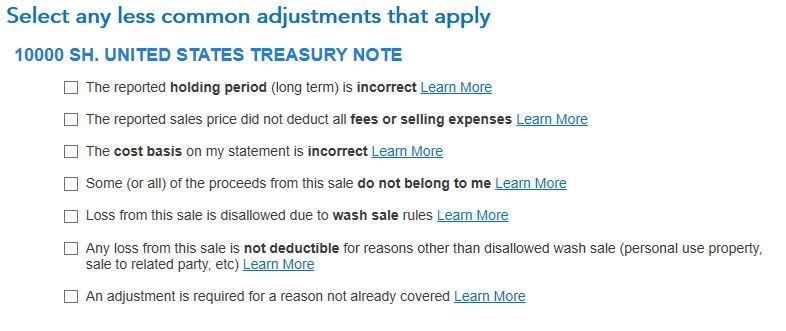

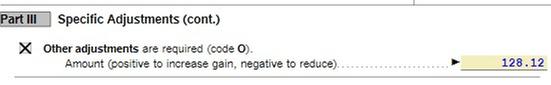

If I start from the same starting point as bobp55, I have checked the box for an “adjustment for a reason not already covered” and populated that field with the Accrued Market Discount, as shown below:

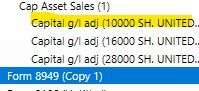

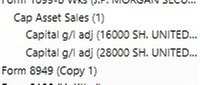

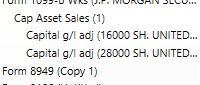

This seems to MOSTLY work! A Capital g/l adj worksheet IS generated, and interest IS added to schedule B

However, doing this results in both a D and and O entry in box 1f on form 8949, but I need to have just a D there.

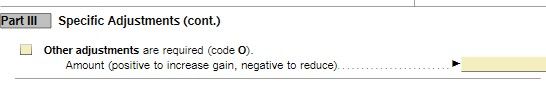

The suggested solution to populate the interest on Schedule B, and add the code D to box 1f on form 8949 is to NOT ENTER ANYTHING on the less common adjustments step-by-step page, as shown below. (NOTE: I also cleared the value for the adjustment required for a reason not already covered field.)

The result of that is no generation of a Capital g/l adj worksheet, and no interest added to schedule B ( see below).

Just for grins, I went back to the first case, where there was a capital g/l adj worksheet and tried unchecking the box that adds the “O” in box 1f on Form 8949.

When this checkbox and field

are overridden to clear the value and uncheck the box for other adjustments, this immediately removes the capital g/l adj worksheet for this transaction.

It seems to me that to work like GeorgeM777 said, the Capital g/l adj worksheet has to be created automatically if there is an entry for Accrued Market Discount is entered on the less common items page below, and if there isn’t a Capital g/l adj worksheet there is no way to get ONLY a “D” code in Box 1f of form 8949.

I hope the community can come up with a bug fix for TurboTax Premier so it works like it did for bobp55, otherwise I’m going to have to override the DO in box 1f of form 8949, and file a paper return. ☹