- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Turbo Tax is showing 2 different tax liabilities when I click on the "why do I owe $[]" and it is saying I owe more than what it shows on "your tax breakdown" table.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is showing 2 different tax liabilities when I click on the "why do I owe $[]" and it is saying I owe more than what it shows on "your tax breakdown" table.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is showing 2 different tax liabilities when I click on the "why do I owe $[]" and it is saying I owe more than what it shows on "your tax breakdown" table.

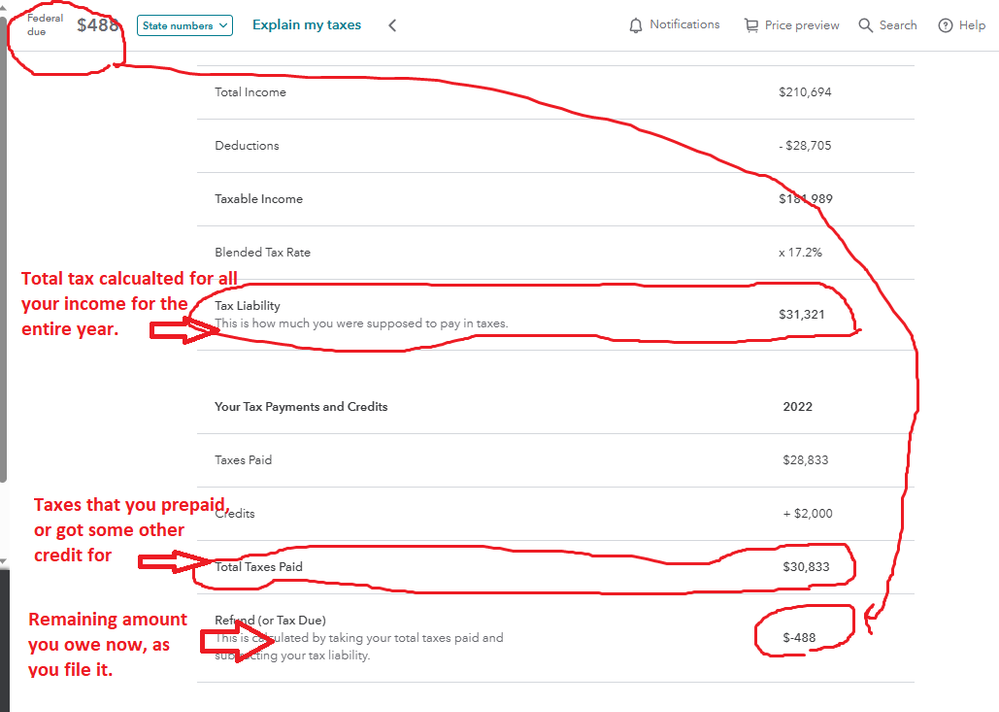

The one I see is details it all, not sure why there is any confusion.

1) Your Tax Liability is total tax calculated for all your income....ignoring credits and pre-payments.

2) Then a section showing all the taxes you have already pre-paid,...i.e. Withholding, Quarterly Estimated tax payments, PLUS any other credits applied as a total credit.

3) then a final line indicating what is left for you to pay now (or refund you will receive if #2 is greater than #1)

_________

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mailsaurin

New Member

rolfarber

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

keriswan58

New Member

keriswan58

New Member

shawnpm123

New Member