in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Turbo Tax Error on Student Information Worksheet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Error on Student Information Worksheet

The error is on the Student Information Worksheet Part V (Education Assistance); line 6 (Total qualified education expenses from Part VI below) was pulling from Part VI, line 13 (total qualified expenses) but from the incorrect column. It was pulling from the second column (American Opportunity Credit) when it should have been pulling from the fourth column (Qualified Higher Education Expense for 529 Plan).

To fix this, I had to go into the worksheet and type the correct number into line 6, Part V.

Someone please take a look at this. The way it was calculating stuff it was getting the incorrect Adjusted Qualified Expenses (Line 20 section VI) which affected the Earnings taxable to recipient (Line 8 Part VIII).

Please look into this. Thank you,

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Error on Student Information Worksheet

There is a screen in TurboTax to move the allocation of qualified expenses between the credits like the American Opportunity Tax Credit (AOTC) and the 529 plan distribution.

The screen you look for can be found by editing the Education Information section at the bottom of the screen "Here's your Education Summary". That "Here's your Education Summary" screen is the last screen in the Education and Scholarships (Form 1098-T) interview.

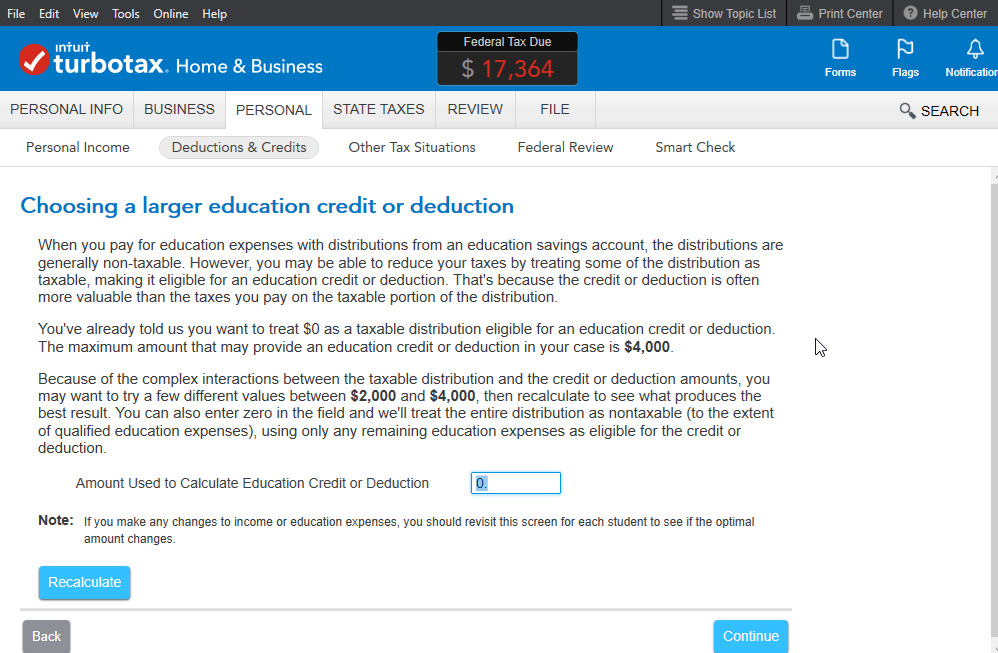

Click to Edit the" Education Information", and continue through the interview to the last screen "Choosing a larger education credit or deduction". That screen (see screenshot below) will allow you to assign education expenses between the 529 plan distribution and the other credits/deductions.

Note that you can do the same thing in the TurboTax Download/CD version. In Forms mode, find the Student Info Wk and use Part VI, line 17 to enter the amount you want allocated to the credits/other deductions. If you want everything to the 529 plan distribution, put a zero in the box on line 17 of Part VI.

Here is a screenshot of the TurboTax screen you are looking for:

Note that you can do the same thing in the TurboTax Download/CD version. In Forms mode, find the Student Info Wk and use Part VI, line 17 to enter the amount you want allocated to the credits/other deductions. If you want everything to the 529 plan distribution, put a zero in the box on line 17 of Part VI.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

BrettS1

New Member

taxanaut

Level 3

in Education

MojoMom777

Level 3

in Education

maple1122

New Member

quik_66-netzero-

New Member