- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

There is a screen in TurboTax to move the allocation of qualified expenses between the credits like the American Opportunity Tax Credit (AOTC) and the 529 plan distribution.

The screen you look for can be found by editing the Education Information section at the bottom of the screen "Here's your Education Summary". That "Here's your Education Summary" screen is the last screen in the Education and Scholarships (Form 1098-T) interview.

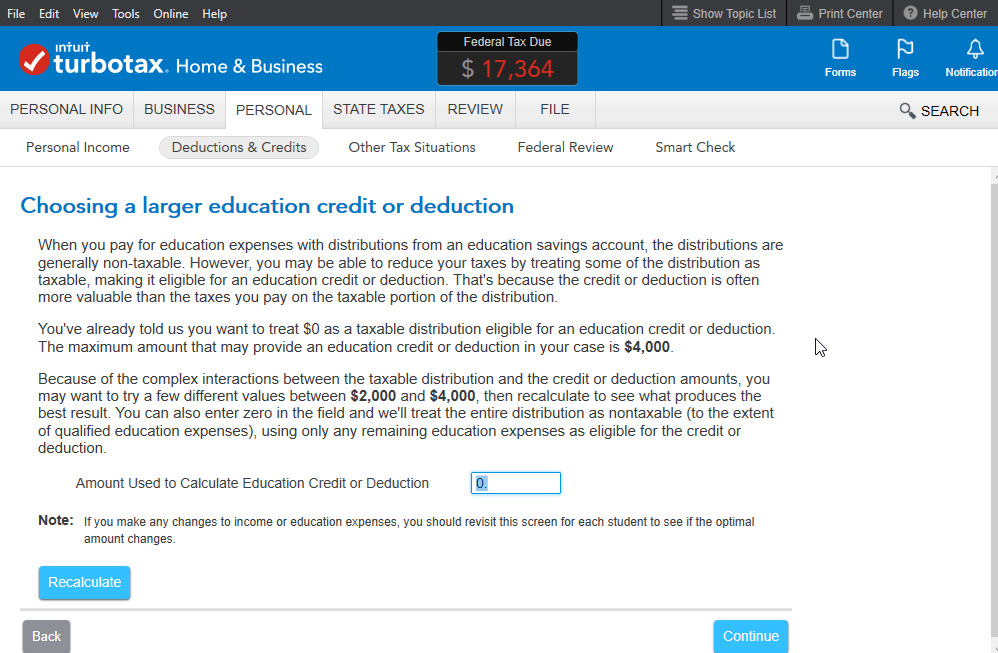

Click to Edit the" Education Information", and continue through the interview to the last screen "Choosing a larger education credit or deduction". That screen (see screenshot below) will allow you to assign education expenses between the 529 plan distribution and the other credits/deductions.

Note that you can do the same thing in the TurboTax Download/CD version. In Forms mode, find the Student Info Wk and use Part VI, line 17 to enter the amount you want allocated to the credits/other deductions. If you want everything to the 529 plan distribution, put a zero in the box on line 17 of Part VI.

Here is a screenshot of the TurboTax screen you are looking for:

Note that you can do the same thing in the TurboTax Download/CD version. In Forms mode, find the Student Info Wk and use Part VI, line 17 to enter the amount you want allocated to the credits/other deductions. If you want everything to the 529 plan distribution, put a zero in the box on line 17 of Part VI.

**Mark the post that answers your question by clicking on "Mark as Best Answer"