- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Texas residents 2020 tax year filing deadline.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas residents 2020 tax year filing deadline.

When will Intuit fix the deadline filing for Texas residents in the TurboTax software? Residents of all Texas counties have until June 15, 2021 to file their federal taxes. It was announced on February 22 and Intuit still not fixed that. What is the plan?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas residents 2020 tax year filing deadline.

I wish I knew.

What I have been doing is checking periodically. When I initially went to file, TurboTax was requiring a date of April 15 or earlier. Trying again just now, it will let me use May 17 or earlier.

So the necessary change for the later deadline for all states (because of COVID-19) has now been put in place.

But still no option for June 15 for those of us in Texas. 😕

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas residents 2020 tax year filing deadline.

what is it you are looking for in the software to be changed?

if you file after May 17 but before June 15 and you are a TX resident, what do you expect to see within the software?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas residents 2020 tax year filing deadline.

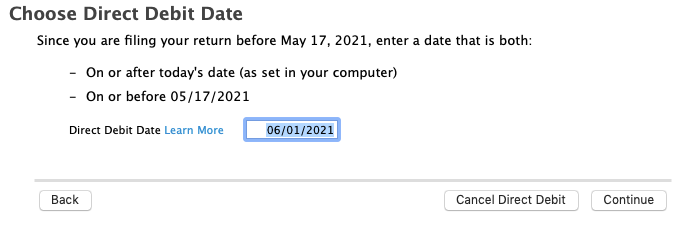

The change I am looking for is to enter a date in June. As of today, TurboTax won't accept it.

The Continue button in the screen shot below does not work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas residents 2020 tax year filing deadline.

Intuit needs to fix the software so that it knows that the deadlines for Texas are June 15, 2021, to file, pay amount due, pay first estimated tax payment, etc. This isn't rocket science. The April 15 deadlines do NOT apply to Texas residents. The software needs to be updated to reflect the later due dates for Texas...period. Do it. Fix it. Make it right for those of us who reside in Texas.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas residents 2020 tax year filing deadline.

Agreed. TurboTax needs to fix this ASAP for Texas residents - The date is June 15, 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas residents 2020 tax year filing deadline.

I just got off the phone with Intuit and they said they will not be updating the software for the June 15, 2021 filing deadline. Talked to them on 4/1/21. Very disappointing for a software that hangs it hat on finding all tax benefits available to customers. I asked for some sort of compensation (even a gift card for next years filing software) and was told no can do.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas residents 2020 tax year filing deadline.

I just called and checked as well (April 9th). They haven't updated the software to reflect Texas residents filing extension. So trash

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas residents 2020 tax year filing deadline.

If you want to pay after 05/17, you can tell TurboTax that you are sending a check and then e-file. Then you can pay at the IRS site and choose whatever day you would like. I don't know if TurboTax is going to change the federal program for one state, but they have not done it yet.

The IRS site also reflects a payment date of 05/17, but you can choose any payment on their website - direct debit is free to use. @aksaahmed

If an affected taxpayer receives a late filing or late payment penalty notice from the IRS that has an original or extended filing, payment or deposit due date that falls within the postponement period, the taxpayer should call the telephone number on the notice to have the IRS abate the penalty. For information on services currently available, visit the IRS operations and services page at IRS.gov/coronavirus.

The IRS automatically identifies taxpayers located in the covered disaster area and applies filing and payment relief. But affected taxpayers who reside or have a business located outside the covered disaster area should call the IRS disaster hotline at 866-562-5227 to request this tax relief.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas residents 2020 tax year filing deadline.

Yes, another option is to print out and snail mail your form with payment for this year. That is what I will be doing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas residents 2020 tax year filing deadline.

I recommend you pay online at Payments. If you do snail mail, you will want to verify your payment has safely arrived and that you have proof of paying on time.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas residents 2020 tax year filing deadline.

This is pathetic customer service from Turbo Tax. It is actually 3 states that are effected, not just Texas. It shouldn't be that hard for Taxpayers that reside in any of those 3 states to have a later filing deadline. One of the things I liked about Turbo Tax was having all my information in one place year after year. Why are we having to do these work arounds when we paid for a Software program that should be competent on when our taxes are due? Sounds like a good time to break the loyalty to Turbo Tax-there are other good options now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas residents 2020 tax year filing deadline.

it's not even just those three states... it's whoever got affected by the winter storm, including those has a business (e.g., rental house etc.) in the disaster area. Turbotax should have updated with a question asking whether the filer is affected and change the filing and payment deadline. this has been 3 months since IRS announced this.

not acceptable... yes I could choose to pay paper check, and separately pay IRS, but I already paid money for turbotax for easy handling of my tax return, and I expect it provide such basic functionality.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas residents 2020 tax year filing deadline.

I'm confused as to why Turbotax didn't get the filing dates right for Texas residents

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas residents 2020 tax year filing deadline.

Apparently they didn't feel it was worth the effort for only a few states.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hpccpatest

Level 2

jnstevenson

Returning Member

loucindasnyder

New Member

mpannier1968

New Member

davidpgapro

New Member