- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Taxes and Credits Summary: TurboTax Summary Not Matching Amount on My W-2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes and Credits Summary: TurboTax Summary Not Matching Amount on My W-2

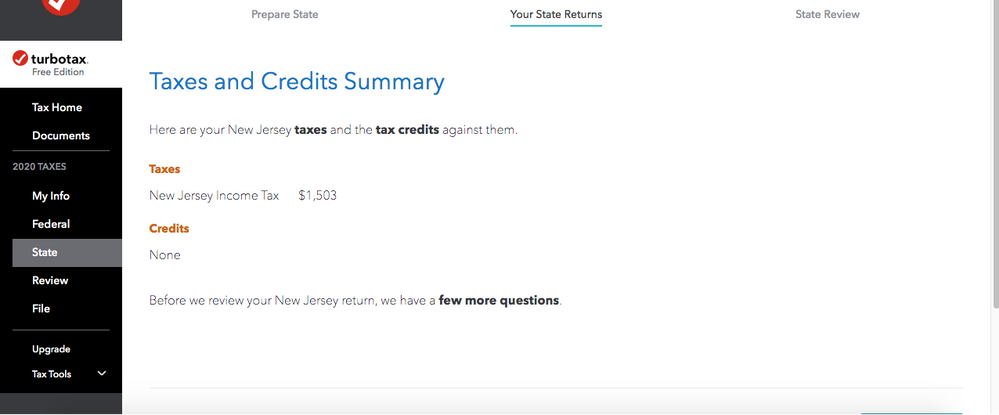

I'm filing out my state taxes. After going through the process, I ended up on this page (see image). However, the $1503 here does not match the amount I have in Box 17 on my W-2; which is $1660.82. Does this mean I either entered something incorrectly somewhere on the form, or omitted something I should have included?

I do contribute to a 401(k) and have codes AA and DD in Box 12, but I did not manually enter any of that information anywhere on TurboTax. From the way I read each page, it was my understanding I didn't have to.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes and Credits Summary: TurboTax Summary Not Matching Amount on My W-2

The $1,503 figure represents your New Jersey income tax, not the New Jersey tax you had withheld from your pay (box 17 on your W-2 form). When you complete your tax return, your tax is based on your income and deductions, whereas the tax withheld from your pay is simply an estimate based on your income. Your tax withheld is netted with your tax to determine your refund or tax due.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes and Credits Summary: TurboTax Summary Not Matching Amount on My W-2

Thanks for the comment. So essentially you’re saying the number I’m seeing on the image I initially posted is accurate and I didn’t make a mistake somewhere?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes and Credits Summary: TurboTax Summary Not Matching Amount on My W-2

That is correct. That was your NJ tax liability for the year and the $1661 was the amount that was withheld.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sorensen-carl

New Member

MCSmith1974

Level 2

Vinyl Disc Man

New Member

statusquo

Level 3

meghana1991

New Member