- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Taxable Income anomaly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable Income anomaly

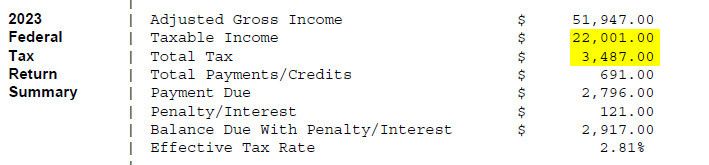

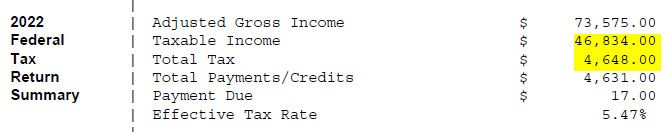

We had a substantially lower income this past year due to my retirement. Our Taxable income dropped by over half, to just over $22,000 from $46,834 in 2022, yet our Total Tax line (NOT the payment due) only dropped from $4648 to $3487. Everything I have read has indicated that we should just barely be in the 12% bracket, but most of the income should be taxed at 10%, so approximately $2200 tax due. I have double checked to make sure that married filing jointly is checked (it is), but I am stumped as to why my tax due only dropped abut 25-30% when our taxable income dropped by over half. Any clarification would be appreciated. Thank you!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable Income anomaly

That doesn't show enough details. The Total Tax is from line 24. The tax on your income is on line 16. You need to look at the actual 1040 returns and see if there are any other taxes on lines 17-23.

So you really need to compare line 16 to 2022.

And It depends on what kind of income you have. There are like 7 different ways to figure the tax. Even though it shows up as income on the first page,if you have capital gains or qualified dividends the tax is not taken from the tax table but is calculated separately from schedule D. The tax will be calculated on the Qualified Dividends and Capital Gain Tax Worksheet. It does not get filed with your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable Income anomaly

What does your total tax for 2023 include? Look at your tax return Form 1040 - is there anything on Line 17 or 23?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable Income anomaly

Those figures don't show all the details....look at the actual form 1040.

1) IF any of that income was self-employment income (1099-NEC), then there's added SS and Medicare taxes on those $$. That adds into and above your ~$2200

2) IF you took $$ form a Retirment fund, and were under age 59.5 for the person it belonged to, then there is an added 10% penalty, that adds into and above that $2200.

________________________

Look at lines 16-to-24 of your 1040, and you'll see where most of it all came from there

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable Income anomaly

That's why I posted. You provided insight that I saw nowhere else. The increase in my wife's self employment tax from last year is more or less the difference. We will look at that again. The lesson is that you cannot just use that Taxable income figure on the main page. Thank you so much!!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Richard137

New Member

chinths

New Member

sidc58

New Member

mitchden1

Level 3

RShaunSmith

New Member