- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable Income anomaly

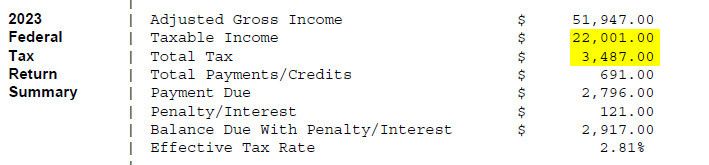

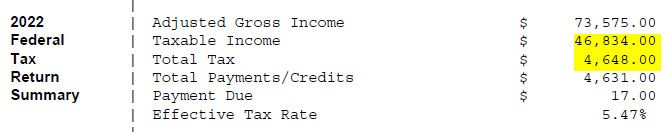

We had a substantially lower income this past year due to my retirement. Our Taxable income dropped by over half, to just over $22,000 from $46,834 in 2022, yet our Total Tax line (NOT the payment due) only dropped from $4648 to $3487. Everything I have read has indicated that we should just barely be in the 12% bracket, but most of the income should be taxed at 10%, so approximately $2200 tax due. I have double checked to make sure that married filing jointly is checked (it is), but I am stumped as to why my tax due only dropped abut 25-30% when our taxable income dropped by over half. Any clarification would be appreciated. Thank you!!

April 13, 2024

12:53 PM