- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Tax treatment of cash payout from ESOP buyback

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of cash payout from ESOP buyback

Situation

In 2023, while working in the US, I received a $2500 cash payout from my previous employer in India. This payout was part of an Employee Stock Ownership Plan (ESOP) buyback program (reference: https://www.business-standard.com/companies/news/flipkart-employees-to-receive-cash-payout-from-700m...). The payout was available to current and former employees based on the number of vested stock options held.

Tax Filing Question

I'm using TurboTax to file my taxes and am unsure how to categorize this income. It feels similar to a dividend, but since it resulted from a company split, I'm not confident in that classification.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of cash payout from ESOP buyback

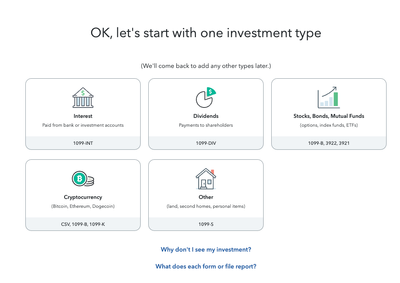

This is reported as other income. Select other for the category. To report:

- Log into your account

- Select Wages and income

- Less Common income

- Miscellaneous Income, 1099-A, 1099>start

- Scroll to the bottom of the page to Other Reportable Income

- Other taxable income, answer yes

- Then give a brief description of the income and the amount listed. Here describe this as ESOP Buyback From Employer and then the amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of cash payout from ESOP buyback

Thanks Dave. So, i think you are saying it is ordinary income.

One thing I was not sure how to treat it. Whether it is wages (ordinary income), capital gains, or some combination of the two. Is there any definition provided by IRS what does ESOP buyback cash payout categorize into? If not, can you please share your reasoning why it is ordinary income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of cash payout from ESOP buyback

Typically, benefits paid from the ESOP to the participant will be taxed at ordinary income tax rates when those shares are bought back at retirement, death, or separation from the company. These were granted to you at the time they were issued under the condition that you stay with the company.

Unless, you traded the stocks and received a 1099B for the sale, this is ordinary income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of cash payout from ESOP buyback

Thanks for your reply.

Just to give some more information so that you can advise me better:

1. I was once an employee of Flipkart when I was working back in India.

2. I received around 40 vested ESOPs of Flipkart during that time.

3. I never sold or do anything with them when I moved to US.

4. Then the split of Flipkart happened, which directly gave me some money to my bank account in India. (around 2.5K)

Few questions:

1. Why does the split of the company giving any money to the existing ESOP holders?

2. My understanding is I own 40 ESOPs and it is not tied to leaving the company or retirement. Is that correct?

3. Given it all happened in India, I didn't receive any form.

4. Based on all this information, does that seem like ordinary income?

5. If I end up selling these ESOPs in future, I guess once in a while, company offers to buyback. Will it be considered as capital gains or ordinary income?

Sorry for the naive questions. I never really understood the concept of ESOP and how my previous employer Flipkart did that. Thanks for offering your help. Appreciate it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of cash payout from ESOP buyback

To clarify, I believe the payout from the split could be the buyback of your shares? Did you get any explanation for the $2.5K amount that was paid to you?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of cash payout from ESOP buyback

Thanks Dave.

Unfortunately, I haven't received any communication from my employer.

Re: buyback, I think the number of ESOP I hold would decrease if it would have been a buyback but that was not the case here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of cash payout from ESOP buyback

From the public news, it feels like company buyback esops. Doesn't buyback result in reduction of ESOPs?

In any case, how does buyback handled in taxation? Is it ordinary income or capital gains?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of cash payout from ESOP buyback

Yes, buybacks will reduce the number of shares, sometimes to zero.. Complete buybacks will reduce the number of shares to zero. You would need to first know why you received this money and if you still own those 40 shares or partially own them.

If this is the case, you would need to report this as a stock sale. This would be capital gains or losses depending on what you paid from them at the time these were issued to you.

Until you know the nature of this sale, i would suggest you request an extension of time to file your return until you can find out the specific details of this transaction and why you were awarded $2.5K.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of cash payout from ESOP buyback

Thanks for the reply.

Can you help me understand in which cases, it is considered as ordinary income and in which cases it is considered as capital gains?

If company did a buyback from me, will it be ordinary income or capital gains for me?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of cash payout from ESOP buyback

If the company did do a buyback of your stocks, it would be capital gains income. If you have own the stocks for more than one year, you would be taxed at the long-term capital gains rate, which is much more favorable than an ordinary tax rate.

If you own the stocks one year or less, it would be taxed as a short term capital gain and taxed as ordinary income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Roy Vanderlinden

Returning Member

cooljmac50

New Member

knownoise

Returning Member

knownoise

Returning Member

shubham-123

Level 2