- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of cash payout from ESOP buyback

Situation

In 2023, while working in the US, I received a $2500 cash payout from my previous employer in India. This payout was part of an Employee Stock Ownership Plan (ESOP) buyback program (reference: https://www.business-standard.com/companies/news/flipkart-employees-to-receive-cash-payout-from-700m...). The payout was available to current and former employees based on the number of vested stock options held.

Tax Filing Question

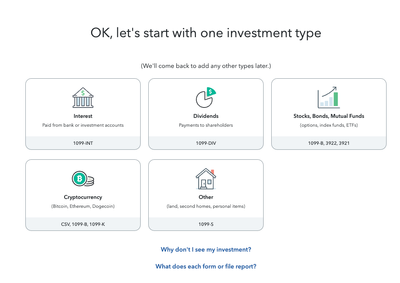

I'm using TurboTax to file my taxes and am unsure how to categorize this income. It feels similar to a dividend, but since it resulted from a company split, I'm not confident in that classification.

Topics:

March 31, 2024

8:28 AM