- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Stimulus Direct Deposit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Direct Deposit

So for my 2018 taxes I used my personal checking account for my direct deposit, this year however I used the Turbo Card for my 2019 refund deposit. My question is since they aren't depositing the stimulus money to the turbo cards, will they use my bank info from my 2018 return to deposit the stimulus check?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Direct Deposit

Turbo Card and Stimulus Deposits - What you need to knowIn order to deliver money as quickly as possible to those who need it, the IRS is sending stimulus payments to eligible taxpayers who filed a tax return in either 2019 or 2018 and chose to receive their refund via direct deposit into their checking account. These taxpayers will automatically have their stimulus payment deposited into the account they received their refund.

We have not yet received confirmation from the IRS on whether they will be putting stimulus payments on prepaid debit cards. However, we have noticed that the IRS has started depositing stimulus payments on some prepaid debit cards for taxpayers that chose to receive their refund through that method in tax year 2019 or 2018. If you received your refund on a prepaid debit card in tax year 2019 or 2018, here is what you need to know:

- I have access to my debit card: If you have access to your debit card (most people), there is nothing more you need to do. If the IRS deposits a stimulus payment onto your prepaid debit card, you will be able to immediately use the stimulus funds upon deposit.

- I don’t have access to my debit card: If you received a notification that you will be receiving your stimulus payment from the IRS on your prepaid debit card and no longer have access to it, we will have information coming shortly. We encourage you to visit this site, where we are continually updating with the latest information and guidance. We know everyone is anxious to get their stimulus money and we are committed to helping our customers get access to their stimulus payment as fast as possible.

If you need to update your information to receive your stimulus payment, you will want to complete that through the IRS portal, which is expected to be available by April 17, 2020. See the Get My Payment link below for additional information:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Direct Deposit

Thanks for your response. What I'm asking though, I enter my personal bank account info 2018 taxes when I filed. So will they still be able to get my banking info from from 2018 return even though I filed this year with a different deposit method?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Direct Deposit

I dont work The IRS so I can't say specifically but I would imagine that it's just gonna default into the last bank account that was used when filing which in this case would be the turbotax a bank account I can't imagine an Irs combing through your return from the year before last year if you Have already filed for last year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Direct Deposit

Ok. 2018 return went to bank. 2019 to turbo card. I just got a payment to my checking for 1200. Should have been $3400. Married with 2 kids. Filed joint.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Direct Deposit

We did not get our stimulus check deposited as of 4/15 this morning. The IRS website on Get My Payment just rejects every time I put in our information. I have filed with Turbotax for YEARS and always use direct deposit which those details haven't changed either - why didn't we get a check and how can I find out why they don't have our info if I have been using turbo tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Direct Deposit

I finally got on n changed direct deposit info...u need exact amount fr tax file gross earning n return and correct dd info...it never filed the form they sent me.....caught sleeping.....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Direct Deposit

The IRS has a Websites to update information and check your filing status. I'm sure it is being overwhelmed. Please be patient. This is the best way to confirm your information.

Please read what it says on the right hand side where it says “Filers: Get Your Payment”

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Direct Deposit

1st of all let me suggest doing at through a desktop website if you're on your phone just go to your options and click request X top site I've learned that that give me better options as far as loading a page I also notice that it's not loading mainly because there's too many people trying to load at the same time however what I did notice through turbotax when I did access my documents that I filed because I didn't receive stimulus payment Is that the account number that my Turbo tax debit card online has Listed if I wanted to set up direct deposit through my job is the same account number listed on my tax forms that I filed with the Iris both numbers are a 12 digit number I noticed when I logged into the Iris website that theirs is a 16 digit But also that last 4 digits is my social security number so I'm wondering if maybe the Iris had compensated the last 4 digits of the account number for each individual's social security number digits last 4 and because of that obviously it's not gonna go into any bank account has there's none that exist hopefully I don't know this is all speculation because I can't get through to anybody but that's the best I can give you so far through my research now I'm gonna go back to try to find Waldo

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Direct Deposit

The best I'm gathering throw my research is that they're just winging it as it comes at them and haven't figured out the logistics yet so you know some people got lucky some people will logistics did not add up I don't kno...... Still Waiting for mine I'll keep you posted if anybody has a trick on how to get through to somebody at the Turbo tax debit card answering service that be awesome

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Direct Deposit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Direct Deposit

I have no option to update my payment information so I guess I'll keep trying to get ahold of somebody

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Direct Deposit

I had to go on irs .Gov clicked on get my payment bar....they said they had wrong acct numbers .....so u have to change it because when it filed ...they used there acct # to get there fees.....never sent them the correct turbo card #... when u get through on the app ..it'll tell you where it's at or what's the problem

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Direct Deposit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Direct Deposit

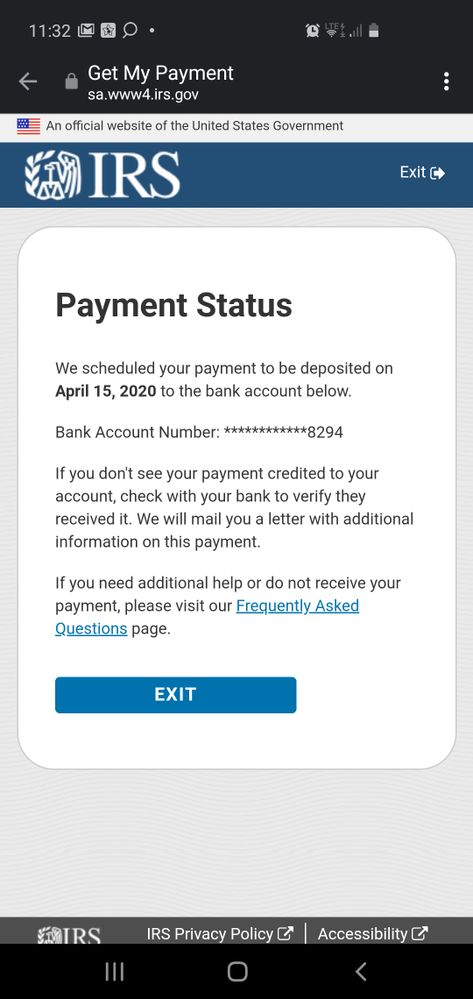

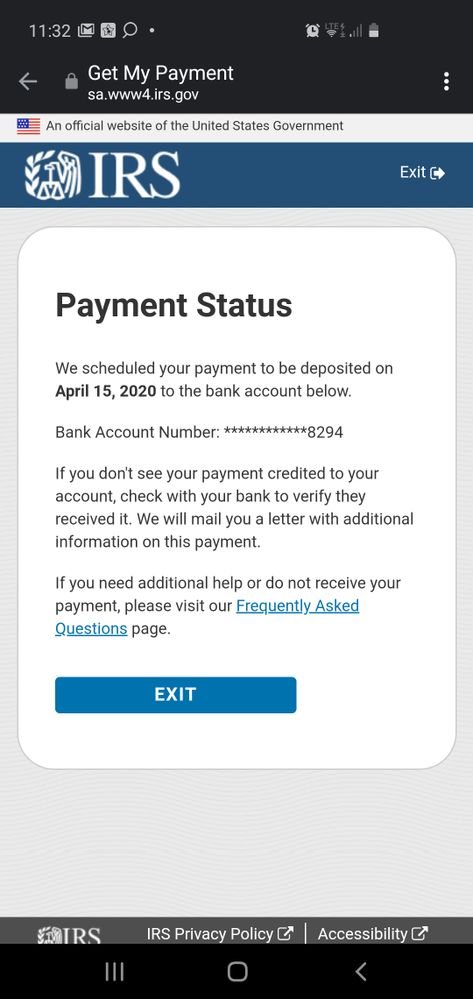

This is what mine said but I checked it again now in the payment is in there now so I guess they caught their mistake I did notice earlier though that the last 4 digits the Iris has for my account number is the last 4 of my social so maybe that's what they did who knows

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

myloveforGod21

New Member

olaya1725

New Member

jpm6747

New Member

robertsgeorgia1987

New Member

Not applicable