- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- State Tax filing Help; Michigan Part-year resident one spouse & Full-year for other spouse; Ohio Part-year resident for one spouse

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Tax filing Help; Michigan Part-year resident one spouse & Full-year for other spouse; Ohio Part-year resident for one spouse

I am looking for some help filing our 2024 taxes.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Tax filing Help; Michigan Part-year resident one spouse & Full-year for other spouse; Ohio Part-year resident for one spouse

For both Michigan and Ohio, you would file Part-Year Resident returns.

Michigan and Ohio have tax reciprocity, which means the income is only taxed in the resident state. On the Ohio return, you'd only allocate your wife's income up until she moved to Michigan. The rest of her income is only taxable to Michigan. Allocate all of your income and your wife's Michigan income to the Michigan return.

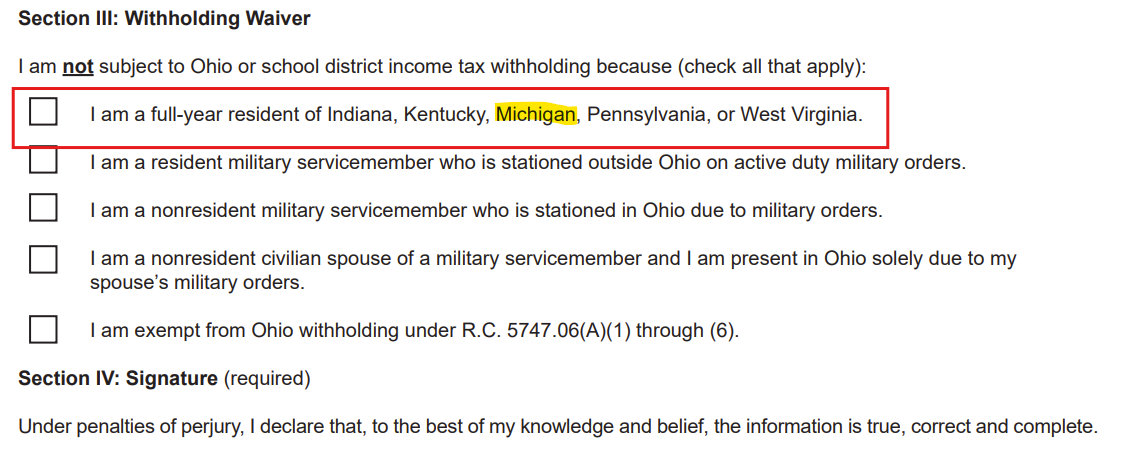

You'll probably have a balance due in Michigan since there were no taxes withheld from your wife's pay. She should request that her employer stop withholding tax for Ohio. She should submit a Form IT-4 and check the box that says she's a full year resident of Michigan. She may then need to provide her employer with a Form MI-W4 so that they can withhold for Michigan taxes, if they offer that option. If not, you should make estimated tax payments to avoid a balance due on your return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lsw7266506

Level 3

lsw7266506

Level 3

mgoksel1

Level 2

endres_lisa

New Member

anrkay4za

New Member