- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

For both Michigan and Ohio, you would file Part-Year Resident returns.

Michigan and Ohio have tax reciprocity, which means the income is only taxed in the resident state. On the Ohio return, you'd only allocate your wife's income up until she moved to Michigan. The rest of her income is only taxable to Michigan. Allocate all of your income and your wife's Michigan income to the Michigan return.

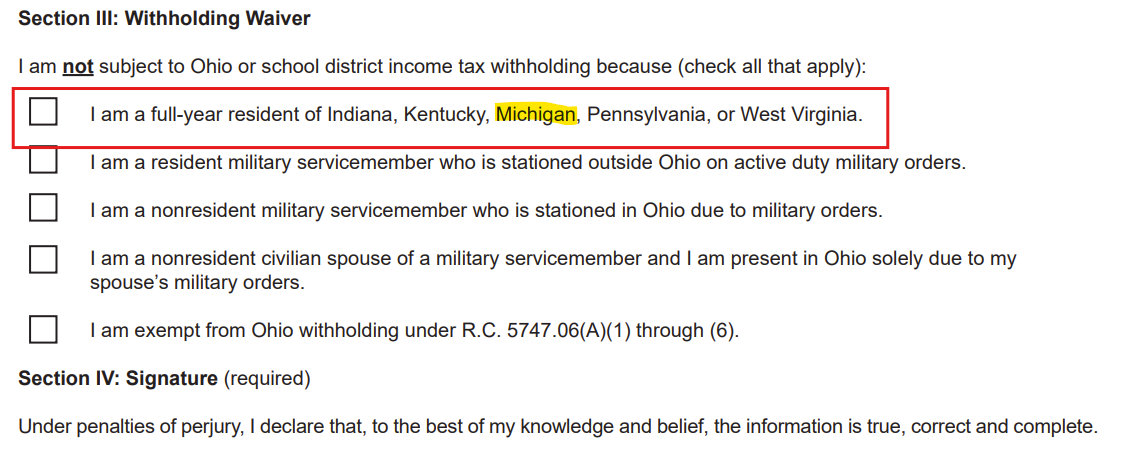

You'll probably have a balance due in Michigan since there were no taxes withheld from your wife's pay. She should request that her employer stop withholding tax for Ohio. She should submit a Form IT-4 and check the box that says she's a full year resident of Michigan. She may then need to provide her employer with a Form MI-W4 so that they can withhold for Michigan taxes, if they offer that option. If not, you should make estimated tax payments to avoid a balance due on your return.