If the long-term disability payments were taxable and reported on your 2024 return, you can deduct the repayment by reporting it as negative income in the other income section of your tax return. Note that if the long-term disability payments weren't taxable, you cannot deduct the repayment.

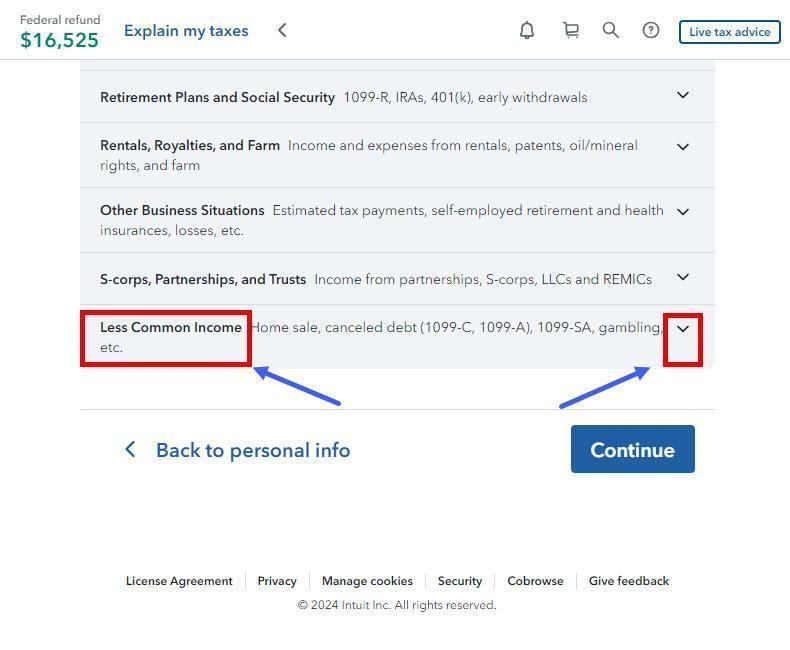

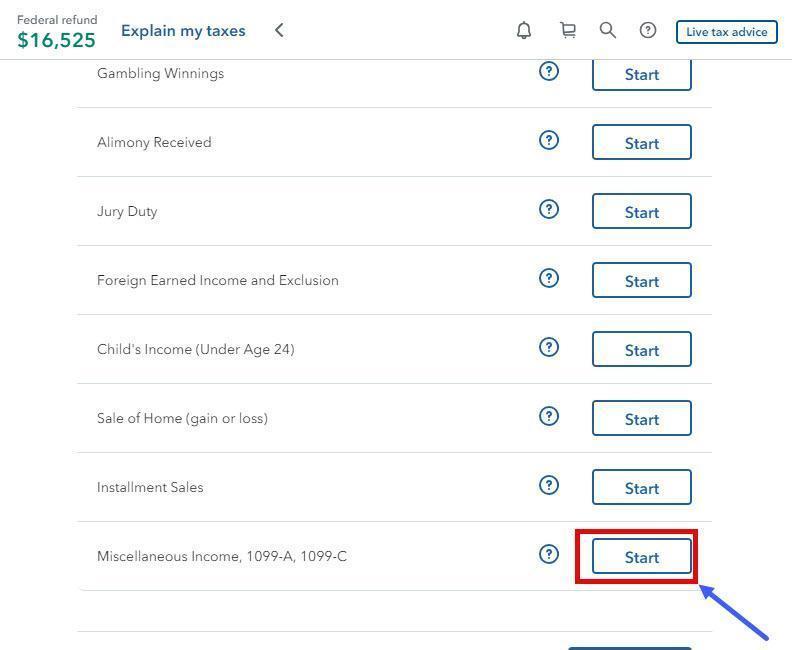

On the wages and income section of your return, scroll down to Less Common Income and then click Start next to Miscellaneous income.

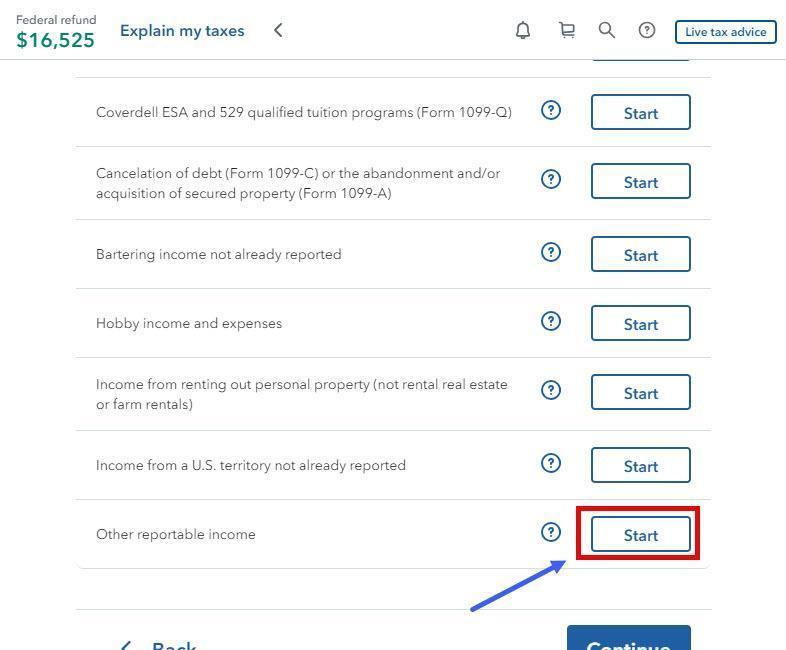

Next, click Start next to Other Reportable income.

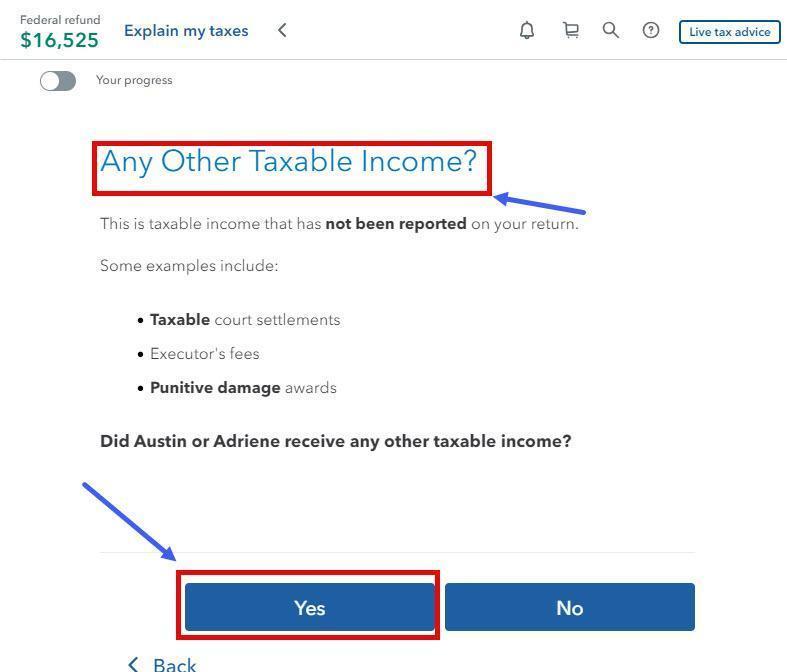

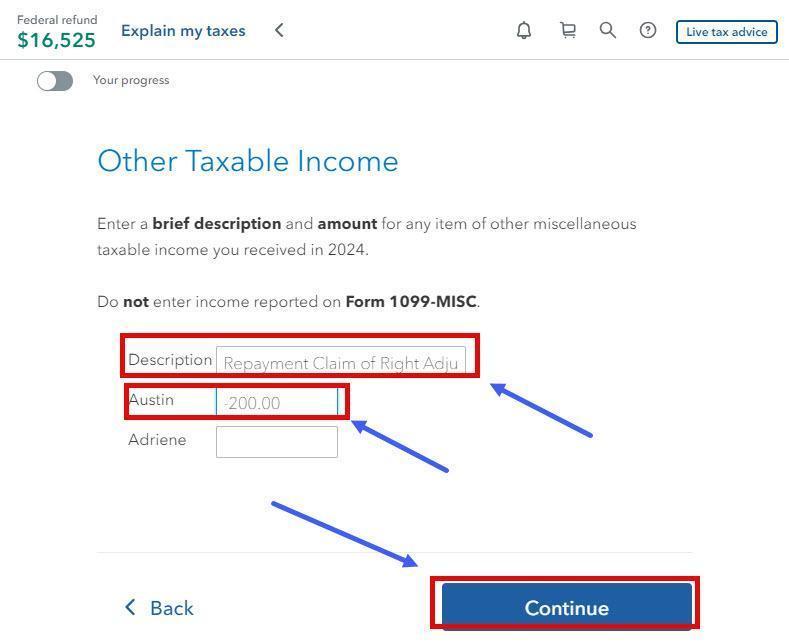

Click Yes on the screen that asks if you had any other taxable income. Then on the next screen, enter Repayment of Claim of Right Adjustment and the amount. You'll need to enter the amount as a negative.

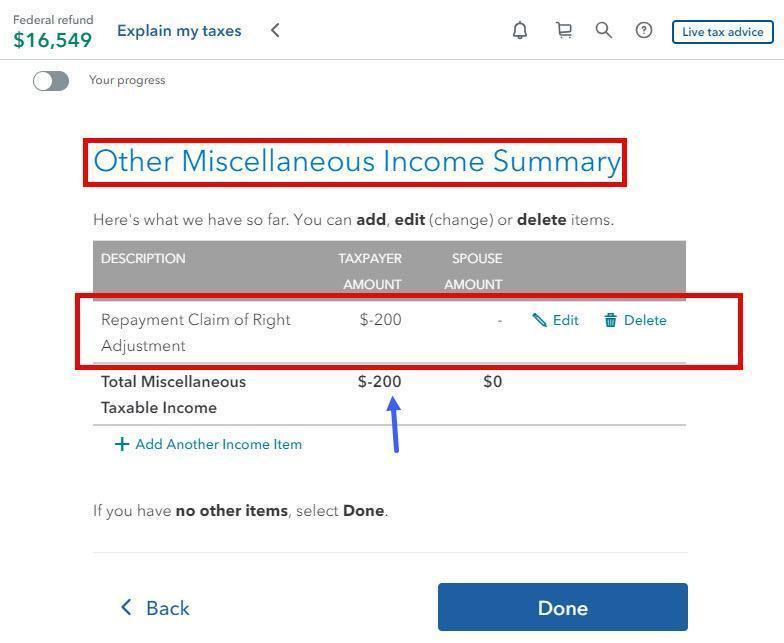

The next screen will show a summary.