- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Solution here for program asking for farm income when you don't own a farm doesn't work

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solution here for program asking for farm income when you don't own a farm doesn't work

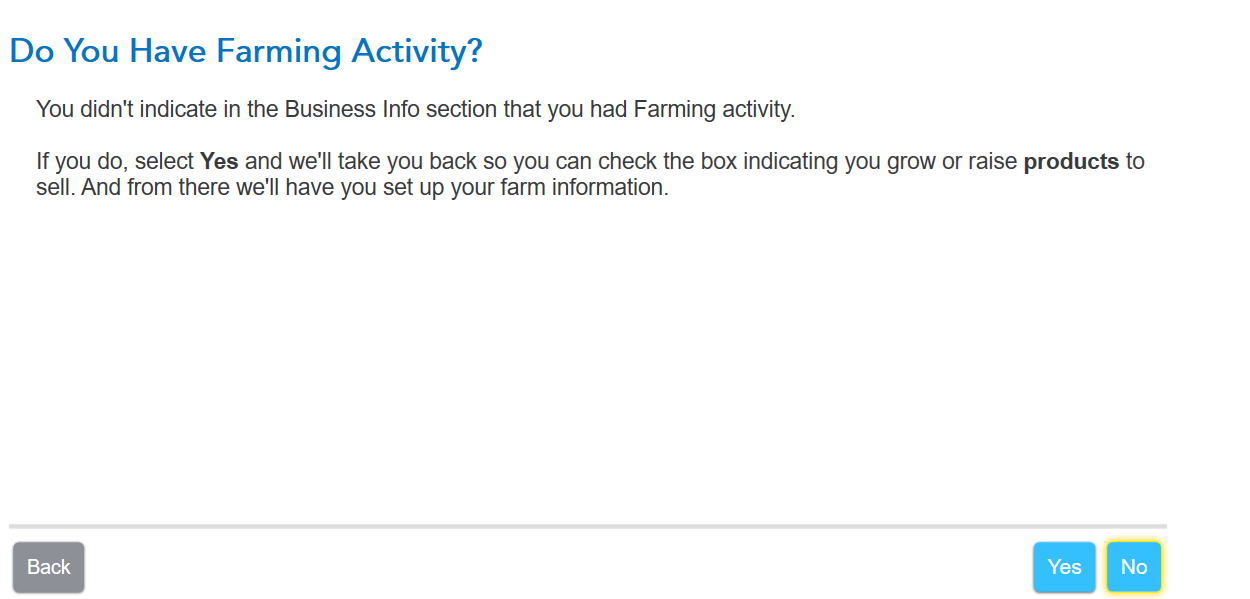

This screen in TurboTax Business can be accessed by selecting Business Info, then Farming.

Select No unless you have previously cycled through this section. If you have previously cycled through this section, you may have to select Yes and delete any entries that have previously been entered.

Critter3 is correct. You are able to select FORMS in the upper right hand corner of the screen to activate FORMS view. Click OPEN FORM in the upper left under the word TurboTax. Enter 'schedule f' or perhaps '4835' and select Open Form. If the form comes up, click Delete Form at the bottom of the page.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solution here for program asking for farm income when you don't own a farm doesn't work

Interesting

The only tabs under Business Info are 'About Your Business'' and 'Shareholder Info'. There are no questions in the 'About Your Business' about Farming.

I access Form View from the 'View' Tab on the upper left corner.

This strange.

Perhaps you are using the online version? I have the desktop downloaded version. No?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solution here for program asking for farm income when you don't own a farm doesn't work

I just added Form F and then deleted it. No impact.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solution here for program asking for farm income when you don't own a farm doesn't work

Be sure you are filing your farm business under the correct business structure. If the only items under Business Info are About Your Business and Shareholder Info, you are using TurboTax Business to file a Form 1120S U.S Income Tax Return for an S-Corporation. An S-Corp does not use Schedule F to report farm income, it merely treats the income as income and expenses of the business.

If you have not formed your farm as an S-Corp or have elected to have your LLC treated as an S-Corp for tax purposes, you are filing the wrong form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solution here for program asking for farm income when you don't own a farm doesn't work

Thanks Alicia. Right on all counts. This is an 1120S. Sorry I didn't mention that earlier. The point being is I never had Farm Income, never indicated I had Farm Income and can't find the 'switch' to turn off the silly messages saying that I had indicated earlier that I had Farming Activity. This is something I saw doing last year's return, but this year it is popping up everytime I finish an entry. I assume it is something that carried over from last year's return (also an 1120S).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solution here for program asking for farm income when you don't own a farm doesn't work

There are a couple places you can check to be sure you don't have your return set up as a farming enterprise:

- Under Business Info and About Your Business, scroll down to Type of Business and Product or Service Provided and verify your entries

- Verify your entry for your Business Activity Code there as well

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solution here for program asking for farm income when you don't own a farm doesn't work

Type of Business = Repair/Maintenance

Product or Service Provided = Car Repair

Business Activity Code = 811110

Nope, doesn't sound like Farming Activity to me...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solution here for program asking for farm income when you don't own a farm doesn't work

Why don't you simply scroll on top where it shows Farming and when it asks if you had Farming activity, simply say no and let's see what happens. There must be some input under that screen that is triggering the error.

Good luck!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kudoo1

New Member

user17621839383

New Member

BME

Level 3

gmoore140520

New Member

willgal

New Member