- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Social Security suspended, no ssa-1099?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Social Security suspended, no ssa-1099?

I receive a small ss benefit because of the Wep. Last year my ss benefit was suspended because my part b medicare premium was more then my ss. I had to Mail a check for the balance of the part b premium. The problem is I did not receive a ssa-1099 and ss says they will not be issuing one.

Do I need to report the ss benefit $ that went to medicare?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Social Security suspended, no ssa-1099?

The Forms SSA-1099 are not actually out yet. According to the SSA website they will be issued by January 31st. My suggestion is to wait until you can check for the document on My SSA by logging in our setting up an account. It may make a difference on your return so you should wait for the form. You do actually have some income for 2021.

- If you add all of your taxable income (and tax exempt interest if applicable) plus half of your social security from Form SSA-1099, and that amount is greater than $32,000 for married filing jointly ($25,000 for single) then some of your benefits will be taxable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Social Security suspended, no ssa-1099?

I called ss 3 times. They insist that I will not be issued a ssa-1099. They suggest that since all my ss benefit went to medicare premiums, it is not taxable. Doesn't sound correct to me, but I can't find anything to support their position. I believe I should have been issued a ssa -1099 for the amount of my yearly benefit, even if it all went to medicare.

I don't want to have to amend my taxes if they fix an error in the future and issue a ssa-1099 at a later time.

Any advice?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Social Security suspended, no ssa-1099?

My advice is to sign into your account (or set it up) online to check for a document there. Not all SSA-1099s have been received as of today, but they are now all online for printing.

- My Social Security

- Sign in or create an account

- Once you have your account open click on 'Replacement Documents'

- On this page towards the bottom you will find the SSA-1099 that can be printed

- If you do not see a document, then you should file your return.

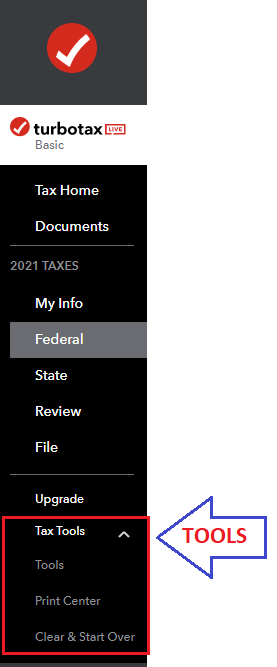

If you want to add in the amount of your total social security you can add the form and enter the medicare as well just to see if you have any part of it that would be taxable. Once you do that here are the steps to view your 1040 before you finalize it.

ou can view your 1040 form before you e-file:

- Open or continue your return. (TurboTax Online)

- With the Tax Tools menu open, you can then:

- View only your 1040 form: Select Tools. Next, select View Tax Summary in the pop-up, then Preview my 1040 in the left menu.

- TurboTax CD/Desktop - Select Forms (upper right) > Scroll to Schedule 3 (left) > View line 11

- Scroll to line 6b to see if any of the social security is taxable. If not, simply file your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mannyht3

New Member

stss

New Member

ddcnga

Level 2

nancybird

New Member

fox0558

New Member