- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Should I subtract 1099-NEC amounts from my Quickbooks Gross Income, since these payments were recorded using Quickbooks invoicing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I subtract 1099-NEC amounts from my Quickbooks Gross Income, since these payments were recorded using Quickbooks invoicing?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I subtract 1099-NEC amounts from my Quickbooks Gross Income, since these payments were recorded using Quickbooks invoicing?

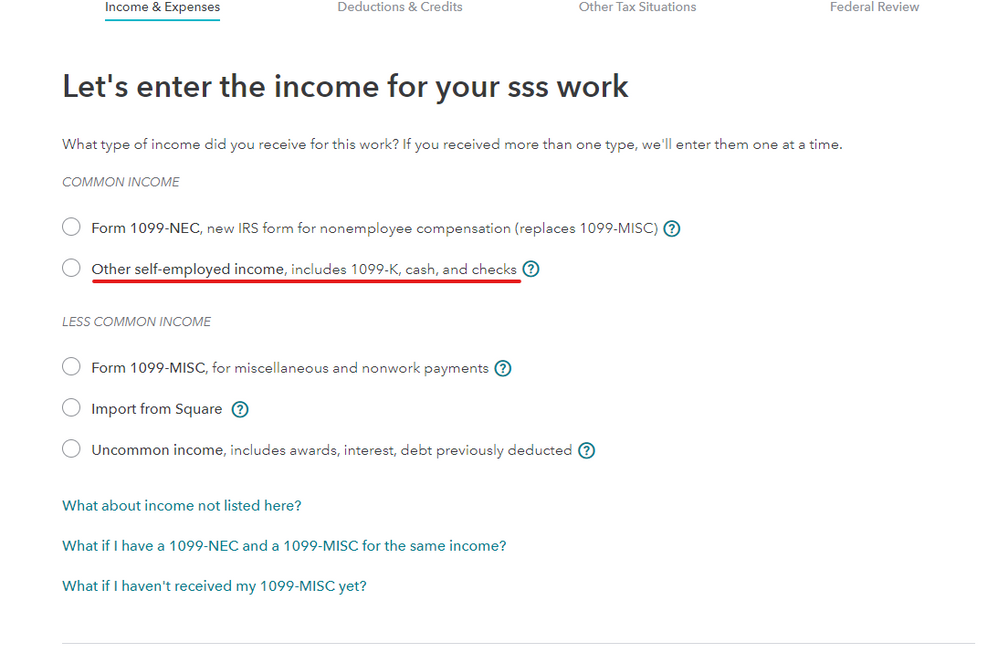

Ok ... all you need to enter is the total income ... you can skip using the 1099-NEC screens as it is there only for your use ... all the IRS wants is the total income on the Sch C. Entering in the income in pieces is NOT required ... so if you have the total just enter the total in the other income section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I subtract 1099-NEC amounts from my Quickbooks Gross Income, since these payments were recorded using Quickbooks invoicing?

Thank you so much! That's what I was thinking, otherwise, I would be counting the 1099's twice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I subtract 1099-NEC amounts from my Quickbooks Gross Income, since these payments were recorded using Quickbooks invoicing?

Correct. Since you are keeping good records you don't need to use that breakdown section ... just enter the total once.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kwilcox695

New Member

lizy15

New Member

lonnyandmary

New Member

michaelg4

New Member

neighborhoodtree-llc

New Member