- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Should I click remove these wages or not? The language is vague at best in regards to what to actually do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I click remove these wages or not? The language is vague at best in regards to what to actually do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I click remove these wages or not? The language is vague at best in regards to what to actually do?

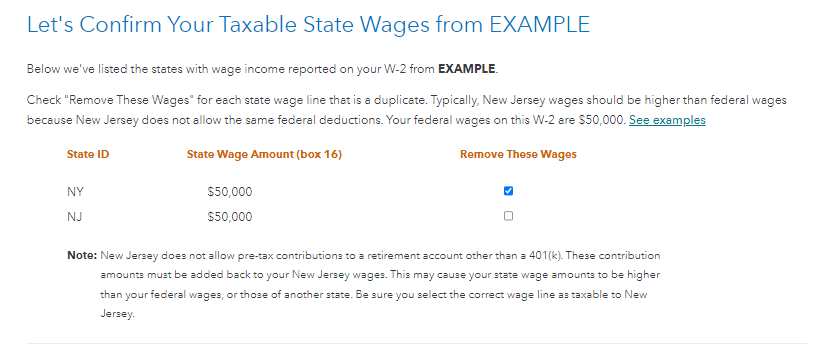

Yes. If you are seeing this screen populate on your return, I am assuming that either you are a resident of New York with New Jersey sourced income or a resident of New Jersey with New York sourced income. Because of state programming requirements, TurboTax includes both income lines (as per Box 16 on your W-2) as part of New Jersey income, which doubles the amount of income that is taxable to New Jersey. You need to remove one of these lines so you will not be double-taxed on the same income. Since you are filling out a New Jersey return, you would delete the New York wages.

I have attached a screenshot below for additional guidance.

Your income will be taxed in the state it was sourced, as well as taxed by your resident state. Your resident state, however, will give you a credit of taxes paid to your nonresident state. For this reason, you should complete the nonresident return first to ensure accurate calculations of the credit of taxes paid.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17549282037

New Member

madj2025

Level 1

randallabrum

New Member

Fionja

Level 2

RL257

New Member