- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Section 199A Information (Code Z)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Information (Code Z)

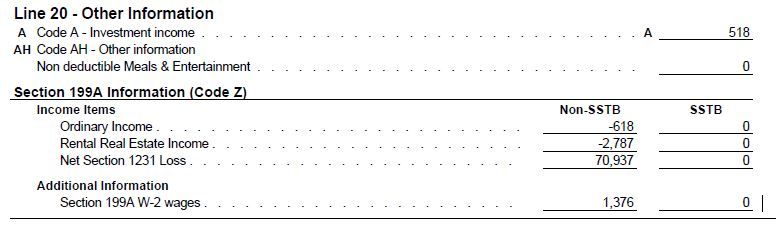

Hello. I have a couple of 2019 Schedule K, line 20 questions (- see the first screenshot).

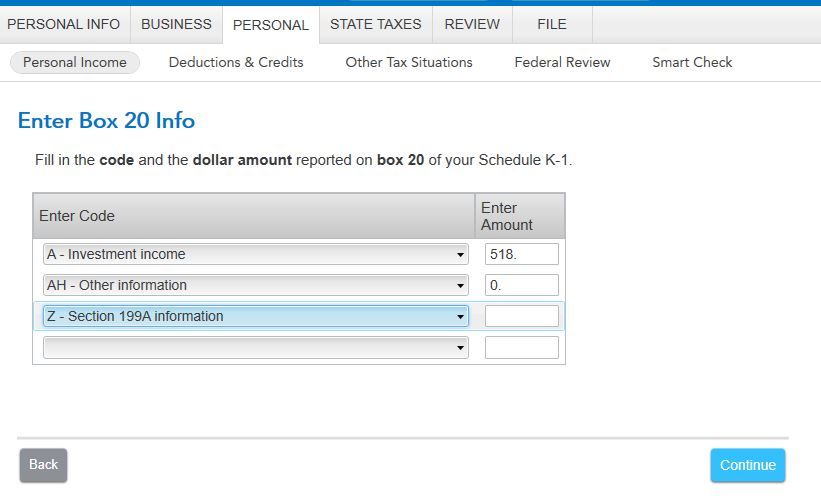

1/ How, what and where do I enter the info for section 199A information (code z) into Turbotax Home and Business (- second screenshot).

2/ I have already entered ordinary income and rental real interest income in 2 separate step-by-step entries into Turbotax. What do I do with the "Net Section 1231 Loss" number?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Information (Code Z)

Enter the code Z when you enter the K-1 box 20 screen, but you don't need to enter an amount on that screen. Continue on, and you'll eventually find the screen "We need some more information about your 199A income or loss". When you check the box next to a category on that screen, a place will open up to enter the amounts from the Statement or STMT that came with your K-1. Note that there are lines for the Ordinary Income, the Rental Income, the Section 1231 loss, and the W-2 wages reported on your Section 199A statement.

The applicable category (or categories) on this screen (and the following "Let's check for some uncommon adjustments" screen, if applicable) must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here are the "We need some information about your 199A income or loss" and "Let's check for some uncommon adjustments" screens where you enter the information from your K-1 Section 199A Statement/STMT:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Information (Code Z)

What if you have four companies listed separately on the statement to enter for 199A? How do you enter them? It doesn't prompt me to add any other companies?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Information (Code Z)

Because your K-1 is reporting Section 199A information generated by the partnership and Section 199A information generated by several passthrough entities, you'll need to "split" this K-1 into separate K-1s for entry into TurboTax. Enter one K-1 with only the "box" amounts generated by the "main" partnership, and a additional K-1s with only the "box" amounts generated by each separate passthrough entity. During the first part of the K-1 entry, all the separate K-1s use the name, address, and EIN of the "main" partnership shown on the K-1 you actually received.

The boxes 1-20 on the K-1 you received are the combined totals of the main entity and the passthrough entities. You must figure out how much of each box 1-20 is for the main entity versus each passthrough entity, and that is the "split" you use to enter the box 1-20 on the separate K-1s. The total each numbered box for your separate K-1 forms must equal the total for that box on the K-1 you actually received. For example, all box 1 amounts on the separate K-1s should add up to the box 1 amount for the actual K-1 you received. If you can't figure (deduce) that "split" from the information you have, you will need to contact the preparer of the K-1 to get those amounts.

The Section 199A Statement you received for box 20 code Z should already "split" the Section 199A amounts between the entities, so you enter the Section 199A amounts for each entity on the K-1 you've created for that entity.

Note that when you enter each K-1, you'll encounter the question "Is the business that generated the Section 199-A income a separate business owned by the partnership?" screen, TurboTax is asking if the Section 199-A income was passed through to the partnership sending you the K-1 by another partnership, S-Corp, or trust; versus being generated by the business operations of the partnership that sent you the K-1. So, on one of the K-1s you enter you will answer that it is from the "main" partnership, and on the other you will enter that it is from the pass-through entity. TurboTax will ask for the name and EIN of each pass-through entity.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Information (Code Z)

My child had Section 199A income report on a 1099-DIV from a brokerage. Where is this amount entered?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Information (Code Z)

Dependents who have unearned income, such as interest, dividends or capital gains, will generally have to file their own tax return if that income is more than $1,100 for 2021. A parent can elect to claim the child's unearned income on the parent's return if certain criteria are met.

If your dependent child made less than $1,100 in interest, dividends, and capital gains distributions combined, and that was their sole source of income, the child's income doesn't need to be reported on any tax return.

For more information please check Tax Rules for Children and Dependents

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Information (Code Z)

Although I understand the rules and qualifications for entering a child's income, I do not know where to include Section 199A [which I believe is from REIT in a brokerage account] totals. Where do I submit 199A even on my own return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Information (Code Z)

if you report the child's income on your return you don't get his 199A deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Information (Code Z)

In general, where does one enter the 199A information? The brokerage sent me that 199A information, and I just don't want to ignore it accidentally.

Thanks for the clarification that the child's 199A is not applicable to my return. The child in this case is required to file a separate return, but attached to mine. So, does that mean the 199A information should be entered?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Information (Code Z)

Was the child's income entered from a partnership K-1? Is this section 199A information an attachment to the K-1?

Please clarify.

If so, you enter the section 199A information during the K-1 entry process.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Information (Code Z)

The issue is that on one or two of my dividends they could not identify a date. The amount was relatively minimal. I am not sure about the holding period as I received these over a period of time.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

wewright

New Member

user17707899157

New Member

jackpallen3

New Member

user17701524502

Level 1

NotHappyWithT-Tax

Level 2