- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Schedule UE summary page says to exclude it click edit then on the next screen check exclude. I don't see that box to exclude on the next screen

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule UE summary page says to exclude it click edit then on the next screen check exclude. I don't see that box to exclude on the next screen

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule UE summary page says to exclude it click edit then on the next screen check exclude. I don't see that box to exclude on the next screen

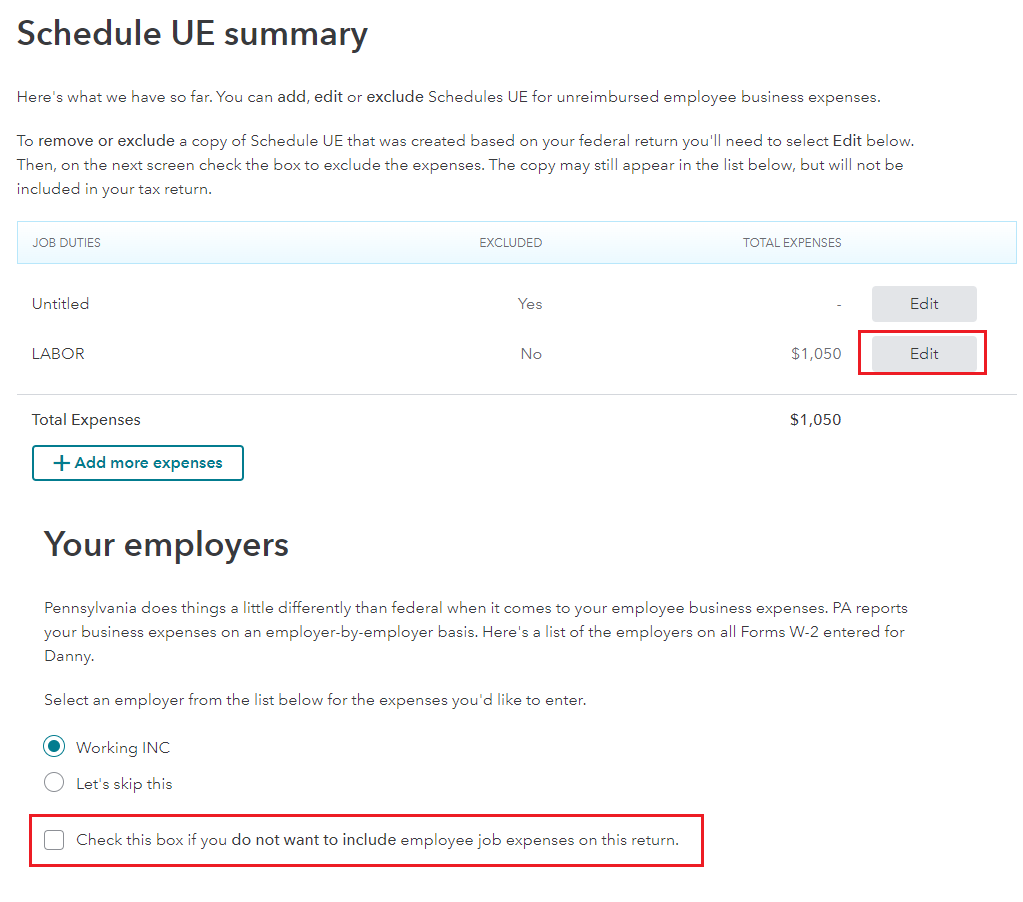

To exclude job-related expenses on your Pennsylvania return:

- Click Edit next to the job you want to exclude on the Schedule UE Summary

- On Your Employers, Check this box if you do not want to include employee job expenses on this tax return. Continue.

You can no longer deduct employee job expenses on your federal return. PA still allows a deduction.

Allowable Pennsylvania employee business expenses must be:

1. Ordinary, customary, and accepted in the industry or occupation;

2. Actually paid while performing the duties of the employment;

3. Reasonable in amount and not excessive;

4. Necessary to enable the proper performance of the duties of the employment; and

5. Directly related to performing the duties of the occupation or employment.

PA-40 Schedule UE is used to report unreimbursed employee business expenses incurred in the performance of the duties of the taxpayer’s job or profession.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule UE summary page says to exclude it click edit then on the next screen check exclude. I don't see that box to exclude on the next screen

Same issue as VevasJH, for tax year 2021.

THERE IS NO BOX TO CHECK TO EXCLUDE EXPENSES.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule UE summary page says to exclude it click edit then on the next screen check exclude. I don't see that box to exclude on the next screen

No such box.

Now what?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule UE summary page says to exclude it click edit then on the next screen check exclude. I don't see that box to exclude on the next screen

Once you finish the income for your Pennsylvania (PA) return, then you will come to 'Unreimbursed job expenses'. Then you click 'Continue' to select 'Edit' for your expenses.

To exclude job-related expenses on your Pennsylvania return:

- Click Edit next to the job you want to exclude on the Schedule UE Summary

- On Your Employers, Check this box if you do not want to include employee job expenses on this tax return.

- See the images below.

@wjwhitepa

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

LokiMiri

New Member

JohnASmith

Level 4

edmarqu

Level 2

Falcon5

New Member

Smithy4

Level 2