- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Schedule K-1 Form 1065

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Form 1065

HELP

I am currently using the Deluxe Edition of Turbo Tax . My husband just received a Schedule K-1 (form 1065). He is a partner for this publicly owned company since he owns some units in 2023? He has not taken distributions or sold any units. I have been trying to read the instructions on the IRS website to see if I need to report this, however, it's very confusing to me. I have no idea what to do with this form.

Here are some of the items on the form:

Part III:

Box 1: -188

Box 9a: 0

Box 10: -1

Box 13: A, 0 & K,0

Box 17: A, 4

Box 19: A, 160

Box 20: A, 0 ; N, 47; V, -191

Do I need to report these items on my federal return? If so,

- What section is this under?

- Can I still use the Deluxe edition to report this?

I really appreciate any assistance on this.

Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Form 1065

Yes, if you are using TurboTax Deluxe installed on your computer (not in a browser), you can report Schedule K-1 under Investment Income. If you're logging into TurboTax through the website, you'll need to upgrade to TurboTax Premium before you enter a K-1.

Follow the interview and answer all questions as best you can. The K-1 should have all the information you need.

To enter your K-1 information, follow these instructions: Where do I enter a Schedule K-1 that I received?

See also: How do I upgrade or switch to a higher version of TurboTax Online?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Form 1065

Found it.

Thank you Ms. Patricia!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Form 1065

Dear Intuit and members,

I am using Turbo Tax Premium to prepare my tax return. I received K1s, Form 1065 and they all have small entry numbers less than $200, but with entries more than Line 1 and Line 4 . In prior years, Turbo Tax premium allow you to put in more than 2 entries (Line 1 and line 4). For 2024, Turbo Tax Premium only provides 2 entries (Line1 and 4) . The received statement states K1 , Form 1065. Please let me know how to enter these small numbers on Line 5,8 , 11 16 and 20 into Turbo Tax premium. I hope I do not have to waste time and do the tax entries again with Turbo Tax Business. Thanks , Paul

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Form 1065

Please use these instructions to reach the Schedule K-1 input section. Be sure to select Schedule K-1 for Form 1065.

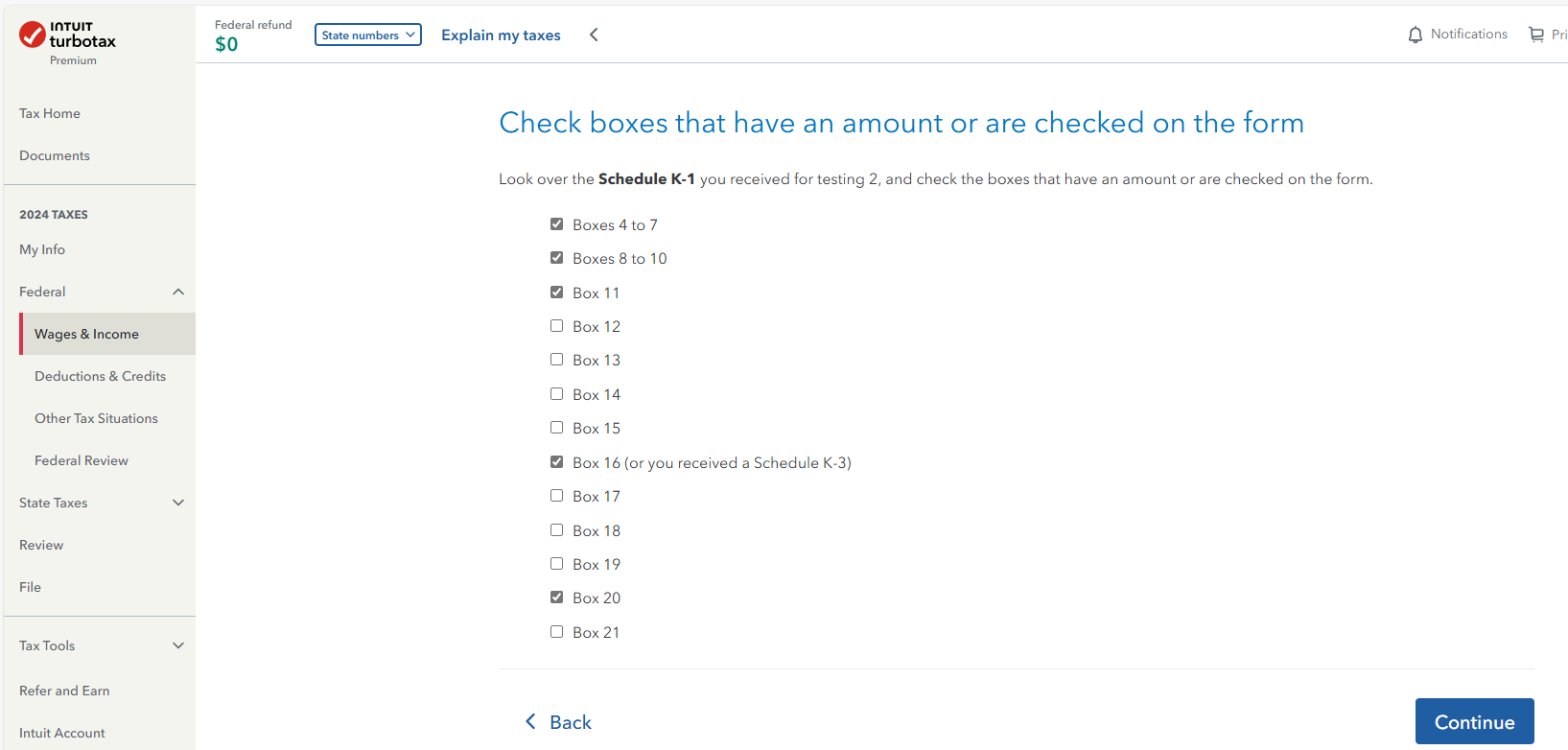

Proceed through the screens until you see the option to select input from several boxes. The page will be titled "check the boxes that have an amount or are checked on the form." Once you select the applicable boxes, each of the screens that follow will provide areas to input the amounts for each line item based upon your Schedule K-1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jyelton13

New Member

thecenturion

New Member

bluepig2020

Level 2

user17696480691

New Member

sewnice55

New Member