- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Schedule C Part VII Line 51 & 52 - TurboTax added amounts that I cannot remove.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C Part VII Line 51 & 52 - TurboTax added amounts that I cannot remove.

When TurboTax 2023 completed its analysis of my filing is flagged Schedule C Part VII Lines 51 & 52. I did not enter in any values to those fields. I cannot remove those amounts ($7000 and $7000) or find where they were calculated.

The only difference between this year and previous filings is that my business automobile was a total loss after an accident. It has not been replaced. This information was included in my filing.

I appreciate any advice and resolution to my issue.

I have been a TurboTax user for almost twenty years and have never had any problems.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C Part VII Line 51 & 52 - TurboTax added amounts that I cannot remove.

Can you clarify which form you are attaching your Schedule C to? Schedule C for Form 1040 does not have a Part VII or lines 51 & 52.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C Part VII Line 51 & 52 - TurboTax added amounts that I cannot remove.

Basis for gain/loss is on your 2021 tax return. It is the basis at the end of the year that was remaining on the car. TurboTax seems to have moved the $7000 figure over from last year. So, you just need to adjust it by subtracting the expenses deducted for last year and whatever expenses or mileage deduction you have for this year as well.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C Part VII Line 51 & 52 - TurboTax added amounts that I cannot remove.

Can you clarify which form you are attaching your Schedule C to? Schedule C for Form 1040 does not have a Part VII or lines 51 & 52.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C Part VII Line 51 & 52 - TurboTax added amounts that I cannot remove.

It seems we are both correct. The TurboTax message exists. I printed the return and there is no Part VII, lines 51 or 52.

Perfect, TurboTax flags a part and lines that do not exist on the actual tax forms.

Now what do I do? I am concerned that other calculations are skewed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C Part VII Line 51 & 52 - TurboTax added amounts that I cannot remove.

It would be helpful to have a TurboTax ".tax2022" file that is experiencing this issue.

You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions:

In TurboTax Online, go to the black panel on the left side of your program and select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen and then you will get a Token number.

In TurboTax CD/Download versions, go to the black panel on the top of your screen and select Online.

- Scroll down to and select Send tax file to Agent.

- You will see a message explaining what the diagnostic copy is. Click send through this screen and then you will get a Token number.

Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C Part VII Line 51 & 52 - TurboTax added amounts that I cannot remove.

Token - 1114794

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C Part VII Line 51 & 52 - TurboTax added amounts that I cannot remove.

Upon review, the lines being referenced are from Form 4562 that is attached to your Schedule C.

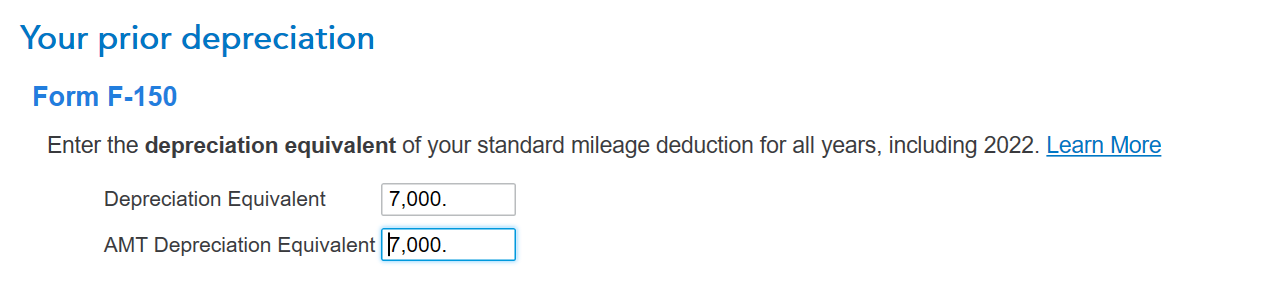

The error is caused by entering the depreciation equivalents for depreciation and AMT depreciation on the worksheet shown with the error. If you took the standard deduction in previous years, you need to calculate the portion of the standard deduction rate that applied to depreciation and enter that amount on the Prior Depreciation Equivalent line and the AMT Prior Depreciation Equivalent line. See Standard Rate Depreciation for the table of rates to calculate your depreciation.

If you used actual expenses in previous years you are required to use actual expenses for 2022 as well. This process calculates the depreciation as an expense and does not require you to calculate the already reported expense.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C Part VII Line 51 & 52 - TurboTax added amounts that I cannot remove.

I don't see a form 4562. I do see a Form 4797 "Sales of Business Property".

Under Part III Lines 22 and 25a there are entries for $7000. I cannot fine a corresponding entry in TurboTax where I might make a correction. Also, since I purchased the automobile in 2010 and I would not expect any depreciation in 2022. I most normally take the standard deduction but last year the expenses related to the disposition of the automobile exceeded the the mileage allowance so I switched.

Where in TurboTax will I find the place to adjust the depreciation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C Part VII Line 51 & 52 - TurboTax added amounts that I cannot remove.

You need to go to the business entry section in TurboTax and Update Business use and Expenses. Then Edit the business you are working with. Then Update the Business Vehicle Expense under Business Expenses. Under the Vehicle Summary you will see the vehicle you sold and you need to Edit the entry. Work through that section and you will come to a screen that says Your prior depreciation and that is where you will see the depreciation and AMT depreciation equivalent entries, or if you didn't take the mileage allowance it will just say depreciation and AMT depreciation. Those numbers will be the cost that you entered for your vehicle if it is fully depreciated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C Part VII Line 51 & 52 - TurboTax added amounts that I cannot remove.

The heading does not say: "Your prior depreciation"

The heading I see says: "Let's get the info on your gain or loss basis"

I read the "listed property" definition and that does not seem to apply.

I read the "gain or loss basis" and I am not sure but it seem to want me calculate all money spent on improvements. I can do that but do not know what to input into the fields Basis for gain/loss and Basis for AMT gain/loss.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule C Part VII Line 51 & 52 - TurboTax added amounts that I cannot remove.

Basis for gain/loss is on your 2021 tax return. It is the basis at the end of the year that was remaining on the car. TurboTax seems to have moved the $7000 figure over from last year. So, you just need to adjust it by subtracting the expenses deducted for last year and whatever expenses or mileage deduction you have for this year as well.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

saurabh-doctor1

New Member

maryherndon54

Level 2

AndrewA87

Level 4

welschboyd

New Member

gangleboots

Returning Member