- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

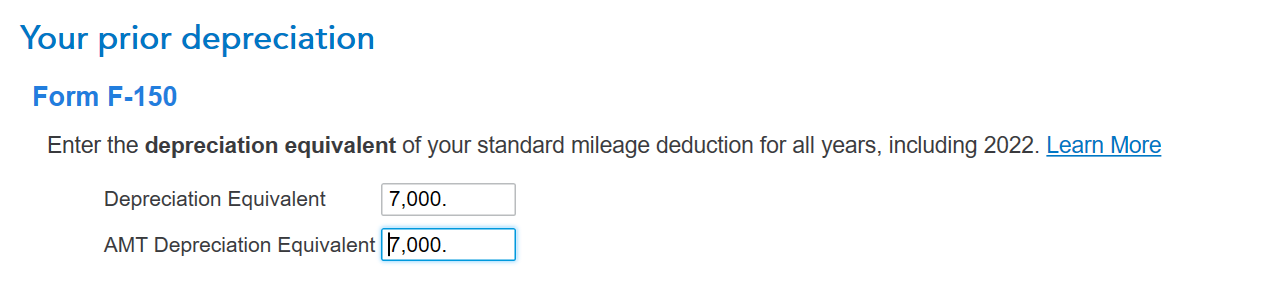

You need to go to the business entry section in TurboTax and Update Business use and Expenses. Then Edit the business you are working with. Then Update the Business Vehicle Expense under Business Expenses. Under the Vehicle Summary you will see the vehicle you sold and you need to Edit the entry. Work through that section and you will come to a screen that says Your prior depreciation and that is where you will see the depreciation and AMT depreciation equivalent entries, or if you didn't take the mileage allowance it will just say depreciation and AMT depreciation. Those numbers will be the cost that you entered for your vehicle if it is fully depreciated.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 3, 2023

4:42 PM