- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- SC Handling Interest of Treasury Bill Interest

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC Handling Interest of Treasury Bill Interest

2022 Federal Return, Interest Income, listed some $11,720 as Dept of Treasury Interest.

South Carolina Department of Revenue Ruling #16-2 lists Treasury Bills and Treasury Notes as deductible.

The $11,720 did not flow over to the SC 1040, "SUBTRACTION FROM FEDERAL TAXABLE INCOME", line "m" as a deduction.

Is this an item that must be manually entered?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC Handling Interest of Treasury Bill Interest

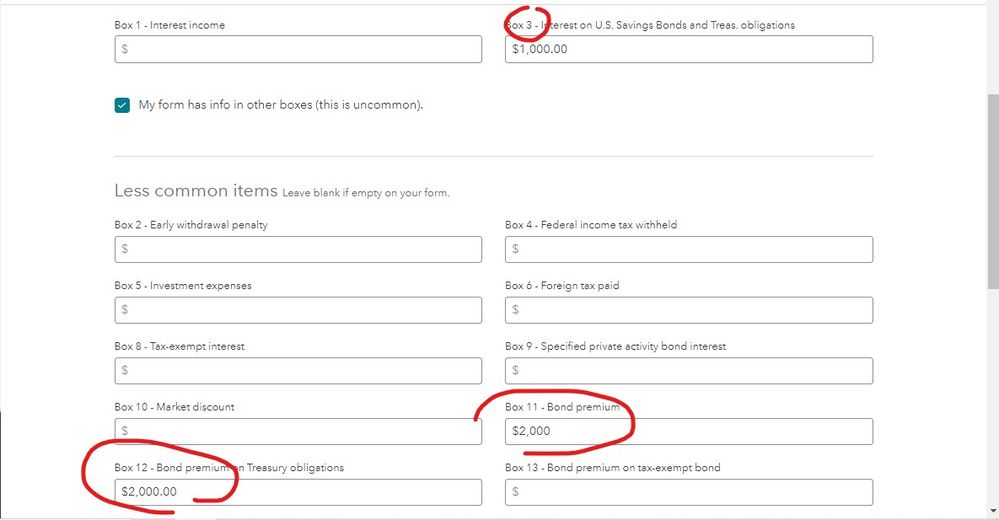

Which box was the interest reported in on the form 1099-INT? And did you get it entered in the correct box?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC Handling Interest of Treasury Bill Interest

Sorry....I am running Turbotax Delux, I don't see that screen.....(almost wish I did) I am given the options to either load the 1099s individually or download them from a brokerage. Since 1099 from Treasury Direct are a printed, I load that one myself. 😀

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC Handling Interest of Treasury Bill Interest

Hey, thank you. I finally saw the little check-box that you indicated which allowed the proper characterization of the U. S. Treasury interest on my feds which allowed me to do an amended SC state return. That little check-box is not intuitively obvious at least for me. The SC amended return was a struggle but at least finally came to what I had worked out the long way (pencil and paper). Now is it worth my time and effort to go back and do 2021?

🙂

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jvmorrow

New Member

SandyG19

Level 2

HollyP

Employee Tax Expert

user17629581143

Level 2

in [Event] Ask the Experts: Biz Recordkeeping & 1099-NEC Filing

user17544025394

New Member