in [Event] Ask the Experts: Investments: Stocks, Crypto, & More

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- sale of vacation home

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

sale of vacation home

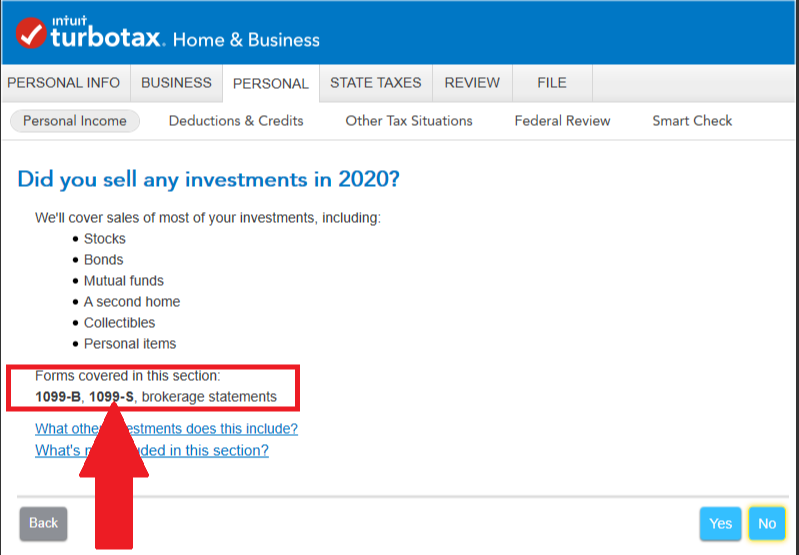

I have a form 1099-S from the sale of a vacation home. How do I enter the information under Investment income? When I click on the "Stocks, Mutual Funds, Bonds, Other" section, I'm taken to the "Did you sell any investments in 2020" page. I answer Yes and I am taken to "Did you get a 1099-B or brokerage statement for these sales?" page. If I answer No, I'm taken to "tell us about this sale" page. Now I'm stuck! Previous workarounds are not applicable in 2020. Solution???

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

sale of vacation home

@biologist3 I do know that this issue has been reported to TurboTax Moderators for investigation. So far, I've not heard back about resolution, or even a workaround.

I've included your post in the thread where this is being discussed. I will keep you informed as soon as I learn more. So sorry for the difficulty.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

sale of vacation home

@biologist3 Although we are all accustomed to the "old" format for entering 1099-S investment sales, it appears that TurboTax has modified the format and it's not changing.

Thanks to a couple of my co-Champs, @rjs and @Anonymous_ , here are options to enter this investment sale.

If you are using the Desktop (CD/Download) TurboTax program, the screenshot below will assist you.

If you are using TurboTax Online (web-based), you can enter the sale by looking for the place to enter an investment sale not reported on a 1099-B, and select Box C or F on form 8949. For the description, enter "Vacation Home". @rjs also reminds you that if you sold the home at a loss, you'll need to check the box on the "less common adjustments" screen, indicating that the loss is not deductible.

Here's that screenshot for Desktop:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

sale of vacation home

I was able to figure it out with the instructions you posted. Not ideal for TurboTax to leave paying customers hanging but luckily there are community members who provided a workable solution. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

sale of vacation home

Hallelujah! Unfortunately, TurboTax has decided to leave these screens as they are. I'm not a fan of the change they made, but I don't make the decisions. 😉 So glad you were able to complete your return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17525168329

Level 1

user17524181159

Level 1

philsmithgeologist

New Member

bofaur

Returning Member

Dotson

New Member