- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- sale of rental property - how to enter the basis?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

sale of rental property - how to enter the basis?

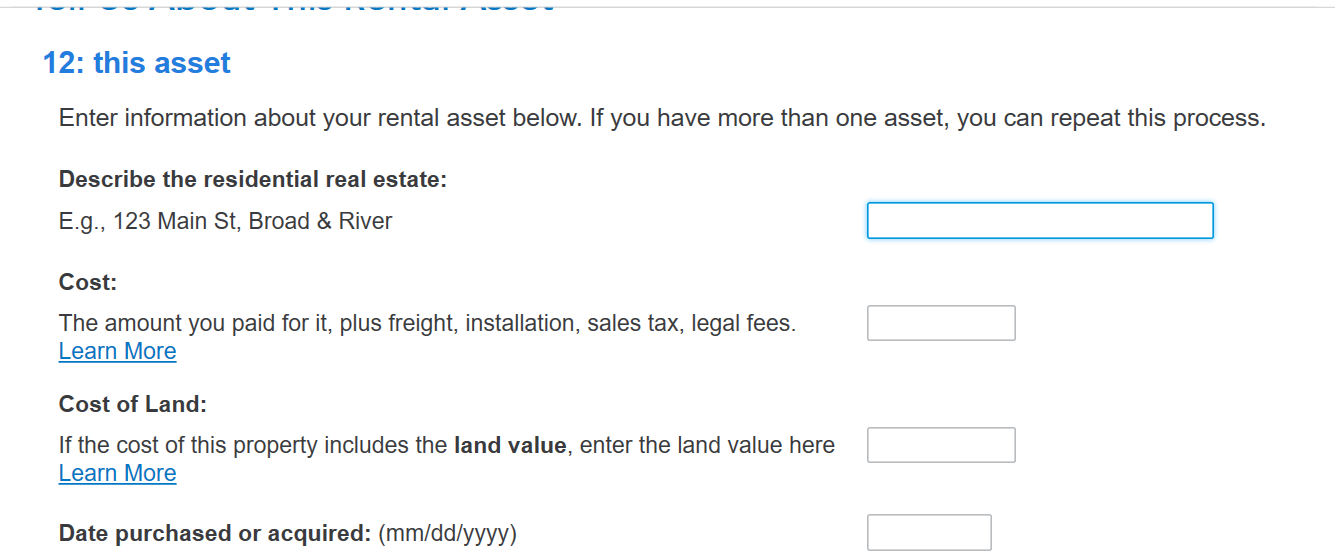

I see many postings about how to enter the info for the sale of a rental property, but I haven't seen any of them address where to enter the cost basis of the property. The only place I enter sales info is on this screen:

thx,

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

sale of rental property - how to enter the basis?

Your cost basis in the property is generally the amount that you paid for the property (your acquisition cost plus any expenses), including any money you borrowed to buy the place.

- With your return open in TurboTax, search for rentals and then click the "Jump to" link in the search result.

- Answer Yes to the question Did you have any rental or royalty income and expenses?

- When you get to Is this a rental property or royalty? select Rental property and fill out the description, address, and owner.

- When you hit Do any of these situations apply? you'll definitely want to check the Sold box along with any other boxes that may apply.

- Continue following the onscreen prompts to enter info about your rental property. Eventually, you'll get to the Rental Summary screen. Here, you can report the sale in the Sale of Property/Depreciation section, along with any other pertinent info (income, expenses, etc.)

See the screenshot below:

See how to report rental property

Review the link above for more detailed information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

sale of rental property - how to enter the basis?

Thanks.

Unfortunately that screen doesn't appear as I go thru the steps. But, looking at the forms (specifically the Asset Entry Worksheet), I think I see the issue. It has the cost basis in there. TT must have remembered those values from when we bought it in 2014 so it didn't feel the need to ask again. I'm gonna go with that assumption for now.

thx,

Mike

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

atn888

Level 2

WyomingClimber

New Member

pdlumsden

New Member

fjpuentes1974

Level 3

tompatty66

New Member