- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Royalty Income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Royalty Income

Where do I enter my 1099-Misc Royalty income from gas and oil revenue? I do not own the property only the mineral rights...(actually only a portion) the only options I am given are: It says I have to choose:

- Investment income from property you own – This includes natural resources extracted from your property by a third party who leases your property, as well as royalties from intellectual property that you didn't create yourself. This gets reported on Schedule E.

- Royalty income from a business you own. Artist royalties or operating a natural resource company.

I DO NOT operate a natural resources company... and I don't own physical land. So which choice do I make?

Thanks in advance for answers and clarity!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Royalty Income

You enter your 1099-MISC from oil and gas lease income in Box 2. On the next screen, choose Investment income from property you own as the source of your 1099-MISC. Although you do not own the property, this income still has to be reported on a Schedule E. Choosing the latter (royalty income from a business you own), would flow to a Schedule C on your return.

TurboTax will then create a Schedule E on your tax return. Once you enter the address of where you own the mineral rights, you will select Oil and Gas Income and be able to enter any expenses relevant to this income.

Please follow the steps below to correctly report your royalty income:

- Open your return.

- Search 1099-MISC and select the Jump-to link.

- Enter your royalties in Box 2.

- Select Investment income from Property you own for the page titled Source of 1099-MISC Income.

- Search for Schedule E and select the Jump-to link.

- Click Edit next to the Royalty entry.

- Answer the remaining on-screen questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Royalty Income

You enter your 1099-MISC from oil and gas lease income in Box 2. On the next screen, choose Investment income from property you own as the source of your 1099-MISC. Although you do not own the property, this income still has to be reported on a Schedule E. Choosing the latter (royalty income from a business you own), would flow to a Schedule C on your return.

TurboTax will then create a Schedule E on your tax return. Once you enter the address of where you own the mineral rights, you will select Oil and Gas Income and be able to enter any expenses relevant to this income.

Please follow the steps below to correctly report your royalty income:

- Open your return.

- Search 1099-MISC and select the Jump-to link.

- Enter your royalties in Box 2.

- Select Investment income from Property you own for the page titled Source of 1099-MISC Income.

- Search for Schedule E and select the Jump-to link.

- Click Edit next to the Royalty entry.

- Answer the remaining on-screen questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Royalty Income

Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Royalty Income

How would this work for patent royalties? If there is no 1099 what is the reporting threshold?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Royalty Income

Royalties from copyrights, patents, and oil, gas, and mineral properties are taxable as ordinary income. You generally report royalties in Part I of Schedule E (Form 1040), Supplemental Income and Loss. However, if you hold an operating oil, gas, or mineral interest or are in business as a self-employed writer, inventor, artist, etc., report your income and expenses on Schedule C (Form 1040).

yes $1 or more

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Royalty Income

I have oil income and received a 1099 misc form with my royalties and oil production taxes on it. If I enter under the 1099 misc I don't have to add it again under rental properties and royalties do I? It would seem that I'm adding the income twice

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Royalty Income

Yes, you don't enter the form twice.

How do I enter a 1099-MISC for royalty income?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Royalty Income

The amount of the royalty received for mineral rights only, was reduced by turbo tax by more than the depreciation even though I did not have any expenses or losses the prior year .It wouldn't let me correct it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Royalty Income

TurboTax applies the depletion allowance of 15%. If you want to adjust it, you will have the find the Schedule E entry and

Edit/Add (see below). @99E

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Royalty Income

Read Reply below. Very helpful. Received Royalty income on 1099MIS, do not own or rent property. After following instruction in Reply below I go to Schedule E and select "EDIT" .

How do I answer questions regarding a business name when I do not have a business related to Royalty income, when attempting to enter production taxes and deductions identified on 1099-MIS.

Please, Please, Please provide through instruction as found in Reply below for me to complete entering all steps necessary to complete this process.

Thank You

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Royalty Income

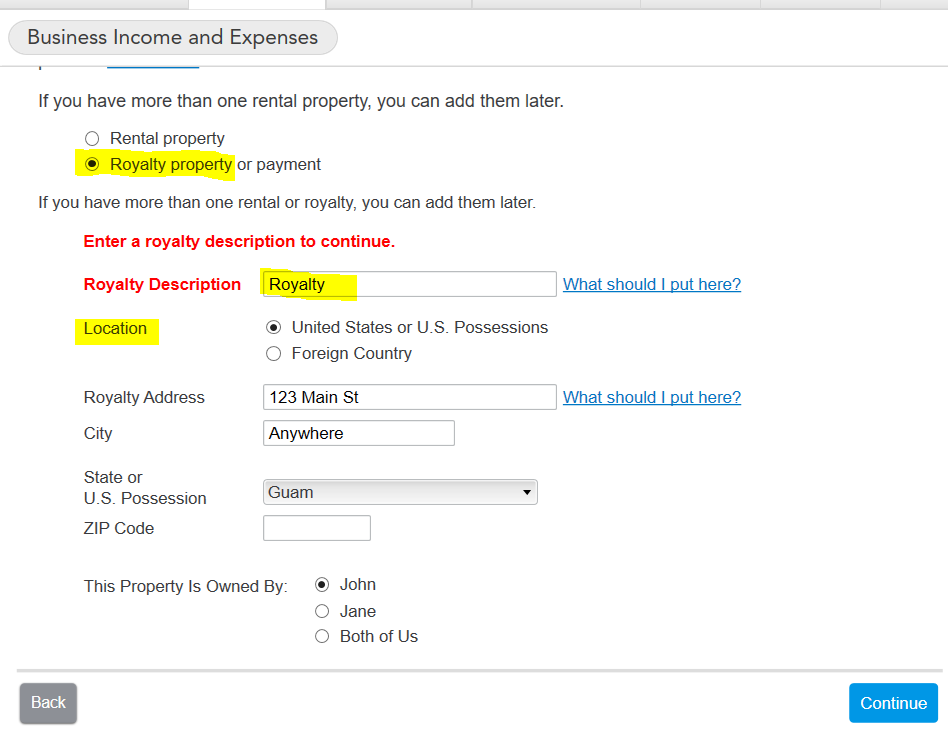

I am going to assume that you went into the schedule E, got frustrated and left. Follow these steps:

- Open your return

- Go to the rental section

- continue to the summary

- select Property Profile

- Select Royalty property or payment

- Enter description - keep it simple

- Location - select U.S. or Foreign

- Enter Royalty address and owner

- continue

- All income on return? probably a yes as this is most common

- What type of Royalty Income? select your type

- Enter income from 1099-Misc

- Check the box if there was no tax withheld on your form, which is the most common.

- Depletion allowance is calculated for you

- select Finished

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Royalty Income

Thank you

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

colehabbels

New Member

reneesmith1969

New Member

ajm2281

Returning Member

waynelandry1

Returning Member

Lukas1994

Level 2