- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Roth Distribution and Form 8606 help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth Distribution and Form 8606 help

Hi, I took out a distribution from my Roth IRA in 2019, which I have contributed to for over 5 years. On my 1099-R, it is reported as full income, which is incorrect (to my understanding, I can withdraw up to the amount I have contributed over the years, tax free)

After some reading, I am told that I need to file Form 8606. However, it is not being auto-generated for me. I looked at the FAQ and there is no question/part in Turbotax that says "When you reach the screen Any nondeductible contributions to [taxpayer's] IRA? answer Yes, then continue. We'll generate and fill out the 8606 behind the scenes."

Any help? Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth Distribution and Form 8606 help

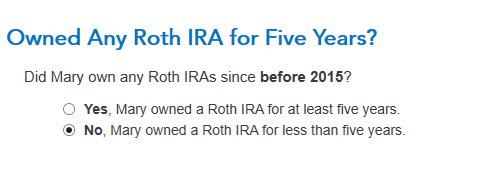

You must first enter the 1099-R as you have it (make sure all boxes (IRA) is checked and the correct code for Box 7). Then you must keep going through the TurboTax questions- there will be several regarding rollovers and disaster area distributions... just keep going until you see

then you can enter the correct amounts and create the 8606 needed to exclude the contributions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ovillanos

Level 1

edbrogan

New Member

stephensjones

New Member

in Education

emily

New Member

in Education

thrillgraphics

New Member