- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

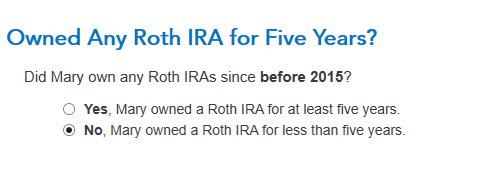

You must first enter the 1099-R as you have it (make sure all boxes (IRA) is checked and the correct code for Box 7). Then you must keep going through the TurboTax questions- there will be several regarding rollovers and disaster area distributions... just keep going until you see

then you can enter the correct amounts and create the 8606 needed to exclude the contributions.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 14, 2020

6:10 PM