- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Reporting excess Roth IRA Contribution

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting excess Roth IRA Contribution

I entered total distribution minus the loss in box one and checked box 7 as 1 and P. However, it makes my income look like it is $6700 more than it should be. Do I still enter the initial $7000 contribution that I was not eligible for in the Rertirement/Investment section under contribution to IRA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting excess Roth IRA Contribution

No, you do not enter the $7,000 contribution under Deductions & Credits that you withdrew. If you had entered it already the contribution then you can enter that you withdrew the excess contribution of $7,000 on the penalty screen.

Please be aware, the $6,700 should only show in line 4a of Form 1040. Line 4b taxable will show $0.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting excess Roth IRA Contribution

I didn't add it to the deductions page. But when I get to the end of my federal review, it is added to my total income which raises me into a higher bracket. Is this correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting excess Roth IRA Contribution

Also, for over 59.5 age, turbox says box 7 codes P and 7 can't be used together.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting excess Roth IRA Contribution

Please use codes 1 and P.

You only entered the distribution in box 1 ($6,700) and $0 in box 2a, correct?

Please verify, that the distribution is only listed on 4a but not 4b on Form 1040. It should not be taxable since only earnings are taxable and you had a loss.

[Edited 2/21/2022 | 10:36am PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting excess Roth IRA Contribution

Yes, $6700 for box 1 and $0 for box 2. What form for 4a and 4b? I'm sorry I didn't explain better. Both my husband and I had excess contributions. I'm under 59 and he is over. Both get P and 1 in box 7?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting excess Roth IRA Contribution

Form 1040 4a and 4b

To preview Form 1040:

- Click on "Tax Tools" in the left menu

- Click "Tools"

- Click "View Tax Summary" in the Tool Center window

- Click on "Preview my 1040" on the left

Yes, you will both enter codes 1 and P since you didn't have any earnings you do not have to worry about the 10% early withdrawal penalty.

If you had earnings you would enter the exception for the person over 59 1/2 (the person under 59 1/2 would have to pay the 10% penalty on the earnings):

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R” and enter your 1099-R

- Click "continue" after all 1099-R are entered and answer all the questions.

- Continue until "Did you use your IRA to pay for any of these expenses?" screen and enter the amount under "Another reason".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting excess Roth IRA Contribution

4a and 4b are both blank. I had a loss. My husband had $335 gain and this gain shows up on line 1 of the 1040. I see now that the distribution is in the total income, but not the AGI. So I guess that's ok?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting excess Roth IRA Contribution

Please make sure that you check the "IRA/ SEP/ SIMPLE" box on each 1099-R since it was for a traditional IRA.

- Click on the "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

Your husband's 1099-R will have the earnings in box 2a and total distribution in box 1 (excess contribution plus earnings).

Please make sure you click "continue" after all 1099-R are entered and enter your husband's earnings under "Another reason" on the "Did you use your IRA to pay for any of these expenses?" screen since he is over 59 1/2.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting excess Roth IRA Contribution

No, I had not checked the box ira/sep/simple. It is now fixed and his total distribution with earnings in box 1 and earnings in box 2. Thank you so much for your help!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting excess Roth IRA Contribution

Hi @DanaB27 :

Thank you for your detailed responses!

I am in the same situation as the opening poster (CRL), except my situation is where both myself and my wife overcontributed in 2020; we took distributions to correct it before the 2021 filing deadline. I opted for the first option you provided, and am now looking to amend my 2020 Return. I recently received the 2021 1099-R from my brokerage institution, and it does have the "P" and "J" distribution codes on it.

Brief History:

March 2020 -- Contributed $6000 each to RothIRA for 2020 year (12k total)

Feb 2021 -- Contributed $6000 each to to RothIRA for 2021 year (12k total)

Late March 2021 -- realized overcontributed

Late March 2021 -- ~$800 distribution each wife and myself, plus some fed. witholding (box4)

- I had originally used TurboTax 2020 to do my 2020 return, and now returning back to it so that I can do the Amendment. Within the 1099-R form process, when I select "P" in Box7, it says "Return of Contribution Taxable in 2019". I'm assuming that this is ok, and I should continue to select "P"?

- Within TT 2020 Amendment process, it also asks for the value of my RothIRA as of December 31, 2020. Do I enter the exact value as shown on my 2020's 5498 I received from the Brokerage Firm? Or should I subtract out the distribution I took in March 2021?

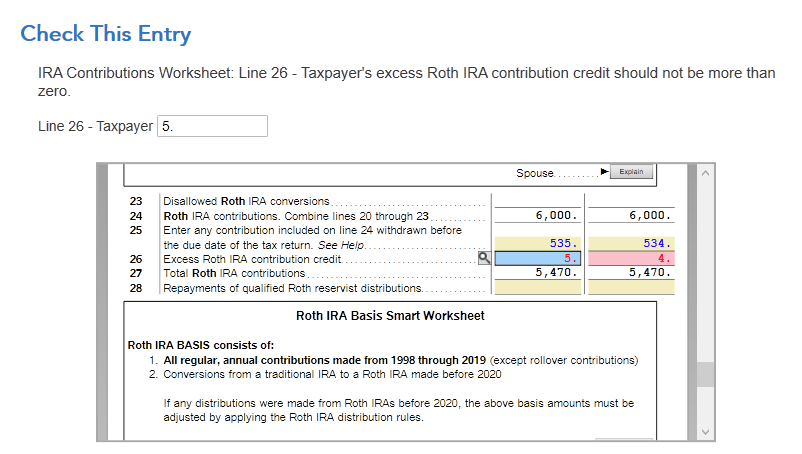

- After finalizing the TT2020 Amendment, I get an error on line26 of IRA Contribution Worksheet. @dmertz on another post said this was some sort of bug in TT2020. Can I simply delete the $5/$4 entries below?

- In filling out my 2021 Return within TT 2021 software, TT asks me "Enter your total Roth IRA contributions for 2021, even if you transferred, or "recharacterized" some or all of it to a traditional IRA" --- Do I enter $6000 here, or do I enter $6000 minus $800? Or $6000 minus 800 minus Fed Withholding?

Thanks for all the help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting excess Roth IRA Contribution

- Yes, code P will say in the drop-down menu "Return of contribution taxable in 2019" but you can ignore that since the follow-up question will tell TurboTax that it will be taxable in 2020.

- Yes, you enter the exact value as shown on your 2020's 5498 I received from the Brokerage Firm for Roth IRA as of December 31, 2020.

- If you didn’t have any excess contributions from the prior year that you are applying to 2020 then you can delete the numbers in line 26.

Please be aware, since you had withholdings in box 4 you must enter the 2021 Form 1099-R also in your 2021 tax return since the withholding is reported in the year that the tax was withheld. The 2021 code P will not do anything in 2021 tax return but the withholding will be applied to 2021.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting excess Roth IRA Contribution

Thanks @DanaB27 .

Could you also confirm also the following:

- In filling out my 2021 Return within TT 2021 software, TT asks me "Enter your total Roth IRA contributions for 2021, even if you transferred, or "recharacterized" some or all of it to a traditional IRA" --- Do I enter $6000 here, or do I enter $6000 minus $800? Or $6000 minus 800 minus Fed Withholding?

- After I've entered 2021 1099-R information into my 2021 Return (in addition to the 2020 return I've already appended), the federal return amount went up by the amount within Box4 (Fed. income tax witheld), does this make sense or did I enter something wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting excess Roth IRA Contribution

1. Enter the amount that actually ended up in your account (the net).

2. No, that makes sense.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting excess Roth IRA Contribution

Thanks @RobertB4444 .

I think I may confused myself here, so just want to make sure I understand what TurboTax is asking for in my situation.

Again, here the history of my Roth Contributions:

- March 2020 -- Contributed $6000 each to RothIRA for 2020 year (12k total)

- Feb 2021 -- Contributed $6000 each to to RothIRA for 2021 year (12k total)

- Late March 2021 -- realized overcontributed for the 2020 year.

- Late March 2021 -- To prevent 6% fee, took a $800 distribution each wife and myself, plus some fed. witholding

- Feb 2022 - Received a 2021 1099-R form that accounted for the March 2021 Distribution (w/ Box4 Witholding)

Here's my question: When it comes to the early distribution I took in 2021, does that deduct from my 2020 total contribution, or my 2021 total contribution?

In 2020's TurboTax appended filing, when it asks : "Enter your total Roth IRA contributions for 2020"... do I put $6000 here?

In 2021's TurboTax filing, when it asks : "Enter your total Roth IRA contributions for 2021"... do I put the $6000 minus the early distribution and fed witholding amount?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

PhilWineinger

New Member

sgt-loudmouth

Level 3

mscheidler

New Member

Herrings2026

New Member

Donor_bayshore

New Member