- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hi @DanaB27 :

Thank you for your detailed responses!

I am in the same situation as the opening poster (CRL), except my situation is where both myself and my wife overcontributed in 2020; we took distributions to correct it before the 2021 filing deadline. I opted for the first option you provided, and am now looking to amend my 2020 Return. I recently received the 2021 1099-R from my brokerage institution, and it does have the "P" and "J" distribution codes on it.

Brief History:

March 2020 -- Contributed $6000 each to RothIRA for 2020 year (12k total)

Feb 2021 -- Contributed $6000 each to to RothIRA for 2021 year (12k total)

Late March 2021 -- realized overcontributed

Late March 2021 -- ~$800 distribution each wife and myself, plus some fed. witholding (box4)

- I had originally used TurboTax 2020 to do my 2020 return, and now returning back to it so that I can do the Amendment. Within the 1099-R form process, when I select "P" in Box7, it says "Return of Contribution Taxable in 2019". I'm assuming that this is ok, and I should continue to select "P"?

- Within TT 2020 Amendment process, it also asks for the value of my RothIRA as of December 31, 2020. Do I enter the exact value as shown on my 2020's 5498 I received from the Brokerage Firm? Or should I subtract out the distribution I took in March 2021?

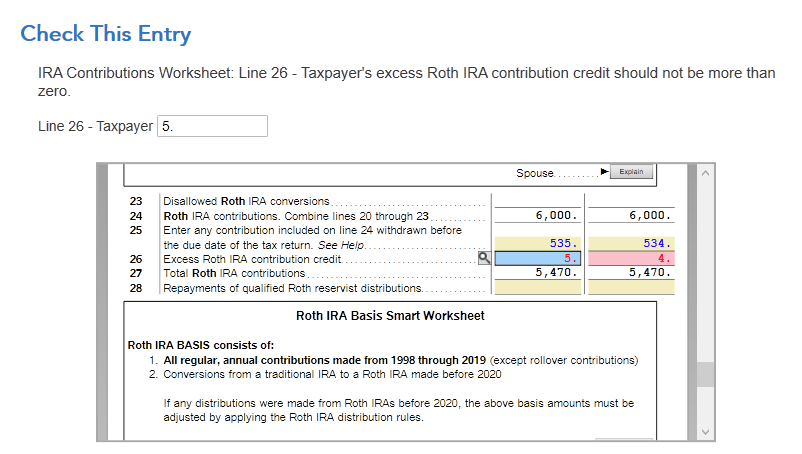

- After finalizing the TT2020 Amendment, I get an error on line26 of IRA Contribution Worksheet. @dmertz on another post said this was some sort of bug in TT2020. Can I simply delete the $5/$4 entries below?

- In filling out my 2021 Return within TT 2021 software, TT asks me "Enter your total Roth IRA contributions for 2021, even if you transferred, or "recharacterized" some or all of it to a traditional IRA" --- Do I enter $6000 here, or do I enter $6000 minus $800? Or $6000 minus 800 minus Fed Withholding?

Thanks for all the help!