- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Rent at Fair Rental Price

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rent at Fair Rental Price

I have a investment home and I rented it out by rooms. During 2024, I decided to switch to renting out the entire house instead of renting by rooms, for some reason. Most tenants moved out within a two months period but the last tenant refused to move out before his lease ended. He stayed in the house for three more months. For that three months the rental income was just several hundred dollars per month, but the fair rental price in that area is around $2,500. How do I answer the question:" did the property always rent at fair rental price?" and can I deduct depreciation and expenses for the three months as usual? Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rent at Fair Rental Price

I don't see an issue as far as fair rent is concerned, since the tenant was only renting one room, so the rent for that room was probably fair. As far as deducting depreciation and expenses for the whole year, you should just consider the house rented for the number of months it was fully occupied. So you will only deduct depreciation and expenses for a portion of the year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rent at Fair Rental Price

Hi Thomas,

Thank you for replying. As to the depreciation and expense, I am wondering if I can deduct a percentage of that. It is a three bed room house. Let's say the depreciation and expense is $1,000 per month. Can I deduct 30% of the $1,000 for the months that he occupied the room? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rent at Fair Rental Price

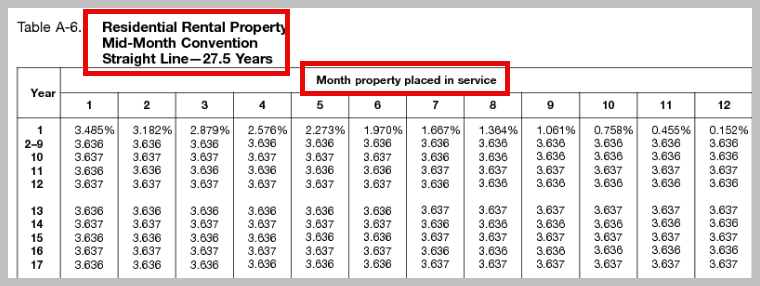

Yes, you can use the square feet of the rooms against the whole house to arrive at the correct percentage of depreciation. This can get complicated for tax software so my suggestion is to enter the information yourself and keep track of any depreciation you use on your tax return. See the chart below used for 27.5 year depreciation.

Once the whole house is converted to rental you will enter it as an asset with a date placed in service. TurboTax will handle the math for depreciation on this asset. Be sure to separate the land cost and enter it when asked. You can use the tax assessment to arrive at the percentage of cost that applies to the land.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rent at Fair Rental Price

Thank you for your response. It is becoming a little tricky now. I read Publication 527 and found "If you hold property for rental purposes, you may be able to deduct your ordinary and necessary expenses (including depreciation) for managing, conserving, or maintaining the property while the property is vacant". My understanding is even if the house is not occupied by tenant, as long as it is a rental property, I can deduct depreciations and expenses. But in my case, even if I still have a tenant there, I cannot deduct 100% depreciations and expenses. This doesn't make sense. I know sometimes it subjects to IRS's interpretation, were there any cases on this kind of situation? Or is it because based on your experience, it is safer to not deductible 100%? Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rent at Fair Rental Price

Yes, if the rental property is available for rent, marketed as such and you are trying to obtain a fair rental value (FRV) in rents you can continue to deduct your ordinary and necessary expenses as well as depreciation.

I'm not sure why you think you cannot deduct 100% from the date you converted it completely to a rental. Please provide more details if you need further assistance.

As indicated in my earlier answer:

- Once the whole house is converted to rental you will enter it as an asset with a date placed in service. TurboTax will handle the math for depreciation on this asset. Be sure to separate the land cost and enter it when asked. You can use the tax assessment to arrive at the percentage of cost that applies to the land.

Note: Any asset placed in service and removed from service in the same tax year is not allowed to be depreciated. This is not referring to the partial rental and then the conversion to the full house as a rental.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

howverytaxing

Returning Member

AndrewA87

Level 4

gangleboots

Returning Member

lasq90

Returning Member

howverytaxing

Returning Member